Canada’s Job Numbers Mystify

Canada’s job numbers continue to mystify economists as the swings from month-to-month make it impossible to get an accurate picture of the health of the labor market. The last two months of 2017 combined to produce 145,000 jobs--- the equivalent of staggering 1.4 million jobs in the United States for the same time period. Many economists looked at the Canadian job performance with incredulity, since economic growth has not been adequate to generate these job numbers. Nonetheless, analysts expect the Bank of Canada to respond with a series of rate hikes through 2018. The bond market also took its cue from the job numbers as the short end of the market surged, reflecting the anticipated rate increases from the central bank. It seemed that Canada was off to the races.

Then the January job number, released today, not only slammed the brakes on job creation but actually put the economy in reverse. The unemployment rate increased by 0.1% to 5.9%. No wonder Canadian economists are baffled by Statistics Canada when it reported that a total of 88,000 jobs were lost in January. Adding to the confusion is the mixed performance, whereby 49,000 full-time jobs were added and 137,000 part-time jobs were lost. (One of the problems with Statistics Canada sampling is that the standard error is 30,000, hence the difficulty in determining what actually took place each month)

Is the employment cup half full or half empty?

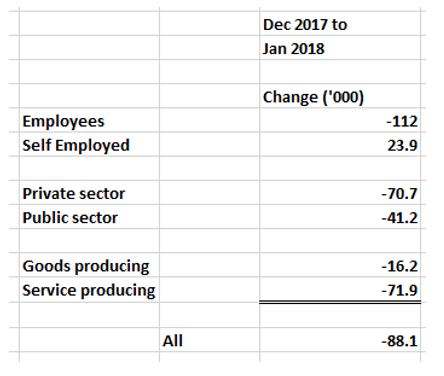

The accompanying table summarizes the main features of the January job report and offers up some key issues in the Canadian labor market. As the number of employees fell by 112,000, the number of self-employed individuals increased by 23,000. This category comprises a group of workers, some of whom had recently lost full-time work and now are working for themselves but whose income is less secure. In fact, on a 12-month basis Canada generated as many self-employed workers as employees.

Private sector employment fell dramatically by 71,000, while the public sector shed an additional 41,000. Employment in Ontario dropped by 51,000 in January, entirely due to losses in part-time work. This was not unexpected considering that the province introduced a 21% increase in the minimum wage.

So, where does this leave the Bank of Canada? The Bank has been very careful to stress that it is “data dependent”. That is, it has not adopted a firm path for future rate increases. And, wisely so, since it now looks as if the Canadian economy is no longer expanding at a rate sufficient to achieve full employment. When the turmoil in the equity and credit markets is added to the employment picture, the Bank has a lot to digest prior to its next policy meeting.

Seems like an abrupt slowing, Prof.