Canada's Housing Market Is In Bubble Territory

Image Source: Unsplash

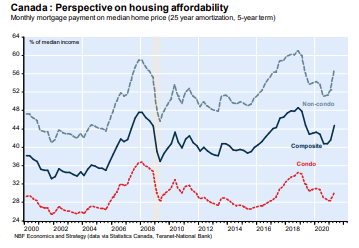

“Housing affordability in Canada worsened by 3.2 points in Q2’21, marking the sharpest deterioration since 1994Q2. Mortgage payments now engulf 45% of income for a representative (Canadian) household, above the average since 1980 (43%). Income growth and lower interest rates were conducive to improving affordability for most of the past two years. That is no longer the case in 2021, as income growth is being easily outpaced by home price increases, while mortgage interest rates also rose on a quarterly basis...On a sliding scale of markets from worst deterioration to least: Toronto, Victoria, Vancouver, Hamilton, Ottawa Gatineau, Montreal, Winnipeg, Quebec, Calgary and Edmonton” (Kyle Dahms & Alexandra Ducharme, National Bank, August 2021)

The recent experience of soaring house prices in the pandemic recession has also correlated with a troubling decline in housing affordability in Canadian large cities.

Affordable housing is a commonly used term that applies to all types of house purchases, including standard market-based housing.

As already noted, the chief culprit behind deteriorating affordability are the high prices of both multiple units as well as single-family homes. Indeed, during the pandemic house price increases have rapidly outpaced the growth in family incomes.

According to the CMHC, (a Canadian government crown corporation), housing in Canada is regarded as affordable if the annual maintenance costs are less that 30% of a households pre-tax income.

In other words, housing is affordable when a household spends less than 30% of its gross (before-tax) income on shelter costs. In turn, shelter costs obviously differs between renters and homeowners.

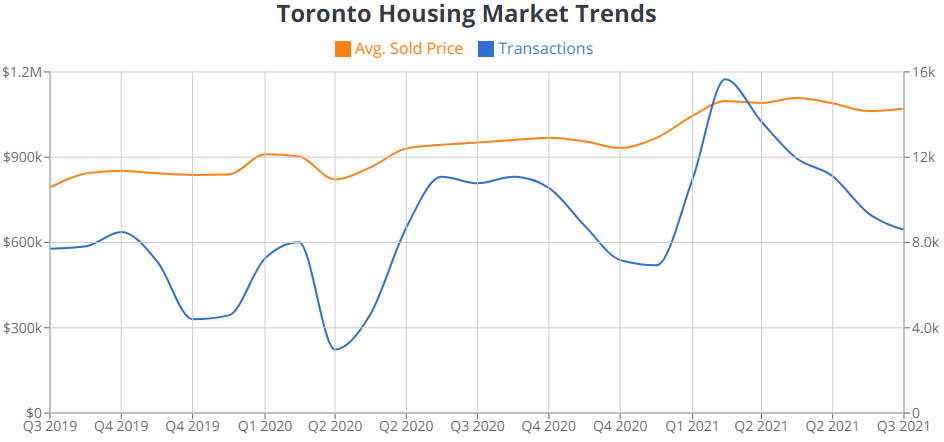

Thus, as of August 2021, the year-over-year increases in house prices in Toronto was quite staggering. Twelve-month increases range from 21% for detached houses, 32% for townhouses, 9% for condos, and 14% for semi-detached houses.

Of course, the current level of affordability is so low that it seems obvious that something must happen to bring family incomes and house prices better in line. In other words, what goes up so quickly, can also fall very quickly. That is, the massive 12-month spike in Canada’s home prices on its own seems to foreshadow a major housing correction in the future.

As well, the Bank of Canada is worried about the housing bubble and has warned the markets that interest rates will soon have to increase.

Consequently, the Canadian central bank recently introduced a new plan which makes it more difficult for homebuyers to secure mortgage financing. That is, despite extremely low mortgage interest rates, under the latest qualification rules, Canadian house buyers will have to demonstrate that they can afford to service a minimum interest rate of 5.25%.

The Bank of Canada’s minimum qualifying rate was raised in June 2021 to 5.25%. This means that as a borrower your income needs to be high enough, and the existing debt low enough, to be able to pay down your mortgage at that higher rate.

Thus, even when the current low mortgage rate in Canada is below 2%, the borrower must qualify to receive a loan on the 5.25% figure. That is, the lending institutions will have to run affordability calculations for two different mortgage rates- the contracted rate and the qualifying rate.

In effect, this harsh new mortgage financing rule suggests that the Bank not only wants to deter house purchases, but that it plans to eventually raise its benchmark rate to affect a mortgage rate closer to 5.25%.

Finally, in a recent monetary policy decision, the Canada’s central bank chose to maintain its benchmark policy rate at the lower bound of 0.25% and left its pace of government bond purchases at $2 billion per week. This low-rate benchmark policy cannot be countered on for much longer.