Canada’s Economic Recovery: Waiting For Godot

Ever since the collapse of world oil prices in 2014, Canadians have been watching and waiting for the economy to recover. Cautiously optimistic, the Bank of Canada has placed its bets that the recovery will be led by the non-resource sector exports. The Canadian monetary and government authorities have adopted a number of policy measures designed to help the economy adjust to a world of lower commodity prices.These adjustments include:

- The decline in the Canadian/US dollar from roughly parity in 2014 to 75-77 US cents; although this devaluation was market driven, the Bank of Canada’s easing of monetary conditions led the way to a lower Canadian dollar;

- Since January 2015, there have been two reductions in the bank rate as a means of easing business loan conditions and as well encouraging a depreciation of the Canadian dollar;

- The Federal government, in its March 2016 budget, introduced deficit spending to spur economic recovery, particularly by promising to fund infrastructure projects at the federal, provincial and even municipal level; and,

- Providing as much accommodation as possible to encourage non-resource exports, especially manufacturing and high-tech products.

How have these adjustments performed so far?

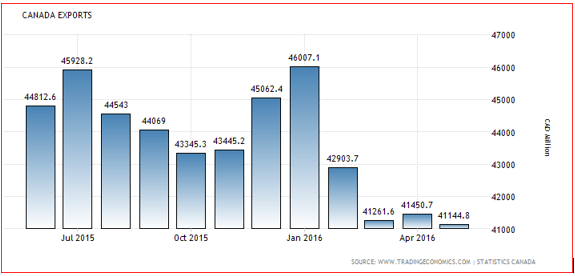

Beginning with the overall trade picture (Chart 1), we see that exports held up particularly well up to January 2016, but then fell sharply and remained weak. Much of the weakness is due to the fall in oil exports, and in Q2, the loss of additional oil exports due to the devastating forest fires in northern Alberta .

Chart 1 Canada Exports, 2015-2016 (May)

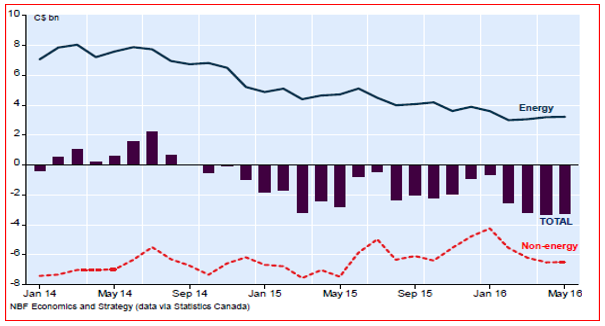

However, Canada`s merchandise trade balance continues record deficits (Chart 2). Of special note is the weakness in non-energy exports, much to the dismay of export industry. Peter Hall, chief economist at Export Development Canada, lamented that it is counterintuitive. It is not what we were expecting to see at all. Recall that the Bank of Canada has pinned its recovery strategy on non-energy exports picking up most of the slack due to falling energy exports.

Chart 2 Canada’s Merchandise Trade Deficit

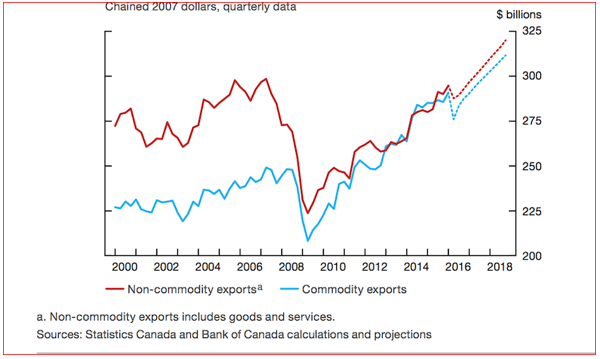

In a recent press conference, the Bank of Canada officials stress their optimism that export volumes --- commodity and non-commodity products-- will increase markedly through to 2018 (Chart 3). The recent reversal in the performance of exports is viewed as only a hiccup, in an otherwise steady growth path. Governor Poloz remains quite adamant that the recent developments do not change his optimistic view. He argues that there are “complex adjustments”, currently underway, which will result in the economy becoming less dependent on natural resources. As these adjustments work themselves out, he believes we will see a more robust trade performance.

Chart 3 Volume of Exports, 2016-2018 Forecast by Bank of Canada

While Canadians wait for a turnaround in their trade sector, there are some basic conditions that are delaying, indefinitely, the desired improvement:

- The US economy is clearly slowing down; in the first six months,GDP has averaged 1 percent, annualized, and the forecast calls for much of the same in the remaining two quarters; given that over 75 percent of Canada’s total export are headed for the US, this mediocre US performance will dominate the outcome of our export flows;

- The prospect for higher oil prices is receding as the price seems to hover around the $40/ bbl as supply pressures continue to weigh on the market;

- The Canadian dollar is now trading within its long term equilibrium price range – there has been a reversion to the mean; it is not realistic to expect that a further significant drop in Loonie; the Bank of Canada admits as much in its recent reports; and, finally,

- Business investment has been declining and remains one of the most important reasons that overall GDP growth is anemic; growth in the non-resource industry depends heavily on increased capital formation and until that takes place, the trade sector will continue to underperform.

Literally, Canadians are not really enacting the Samuel Beckett play Waiting for Godot (who never actually arrives). It just seems so.

Disclosure: None.

Thanks for sharing

Good information. Thanks sir for sharing