Canada Will Be Caught In The Rise In US Trade Protection Measures

Image source: Pixabay

At this juncture in the US election, it is necessary to take considerable care not to attach too much weight to the prospects for a radical change in policy. The campaign is full of popular slogans and promises. That aside, there are some clear signs that protectionism is the soup du jour. The US is taking issue with its persistent trade deficits, going back decades. Tariffs and non-tariff barriers seem to be the preferred strategy by both presidential candidates to deal with trade balances.

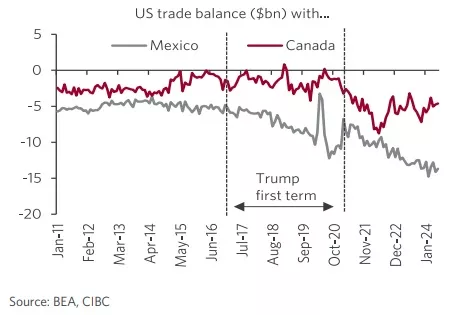

A recent CIBC trade study focuses on the likely impact on Canada of US protectionist policies. Canada and Mexico both have run trade surpluses for more than a decade. These surpluses widen under the Trump years and continue to widen, especially with respect to Mexico. Canada and Mexico were not given any exemption from “baseline tariffs”. The Republicans are toying with tariffs from 10% to 20% with its two neighbors, despite the existence of the North American free trade pact, known as the USMCA.

It is no secret that Americans, especially Republicans, are simply lashing out at China under various guises, from the extreme MAGA of the Trumpian crowd to various regions and industrial sectors arguing for protection to offset Chinese competitive advantages. Trump started the ball rolling and now Harris has joined in, albeit not in such an extreme manner.

Trade specialists know that a shift in trade balances with China is not going to take place any time soon, let alone at all. As the dominant manufacturing entity in the world, its products will continue to be exported and its trade strength will not likely diminish. Tariffs have never been a successful trade instrument historically and there is no reason to expect it to be any more effective today. China is moving its production to other Asian countries to jump specific tariff walls. The US will likely play the game of “whack-a-mole “in protecting its industries, whether it is from China directly or its investments in other Asian nations.

Harris has a checkered performance in the field of trade. She opposed the USMCA and Trans-Pacific trade deals, citing inadequate environmental protections. Alternatively, she knows full well that tariffs are going to induce inflation, often taxing the very income groups she is courting in the election.

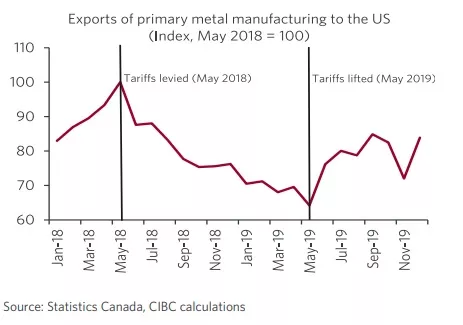

Canada has suffered from the US tariffs on its steel exports. US imports of Canadian steel products have been cut by more than 35% in 2018. Fortunately, the tariffs were dropped quickly, but the experience is an ideal example of how impactful US tariffs will be to Canada should they be put into long-term use. It does not take much imagination to grasp the impact of a 20% tariff on all Canadian exports destined for the US to realize that Canada stands to experience a loss of manufacturing jobs throughout from an aggressive US restrictive policy. Equally so, Canada would be forced to retaliate on similar products coming from the US.

The CIBC trade study argues that:

What gives us some comfort is that the most hawkish versions of Trump’s trade agenda would entail enough self-inflicted wounds that we suspect, as noted above, that these are threats aimed at leverage with trading partners, rather than a realistic depiction of where policy would head, and a populist pitch designed to appeal to voters in America’s industrial heartland.

Nonetheless, a Trump administration is always at risk of going dangerously too far on trade matters and Canadians need to be keenly aware of this.

A final word from the CIBC trade study concerns the negative effect of US protectionist policy on the US itself. It could not be clearer, to wit:

- domestic US inflation increases, as the burden of higher tariffs falls on the consumer

- the US dollar strengthens as imports decline which encourages more imports, leaving the trade balance unchanged

- US would face retaliatory tariffs, resulting in a decline in its exports.

The latter two developments, simply, wipe out any advantages from tariffs.

More By This Author:

The Canadian Banks Find Reasons Not To Give Out LoansFaced With Declining Employment Levels The Bank Of Canada Needs To Act Quickly

Central Bankers Are Always On Their Back Foot