Brazil Boils

It’s been a hot time for stocks in Brazil over the last several days. The country’s benchmark Ibovespa index broke out above its highs from early this year completing a cup and handle formation and hasn’t looked back since. Yesterday was the index’s eighth straight day of gains during which the index has rallied more than 6%. This morning, the country is in the spotlight again as Berkshire Hathaway (BRK-B) has agreed to buy a $500 million stake in Nu Pagamentos SA, valuing the company at $30 billion. You may have never heard of Nu Pagamentos, but it is a privately held company that does business under the name Nubank, which is the largest fintech company in Latin America.

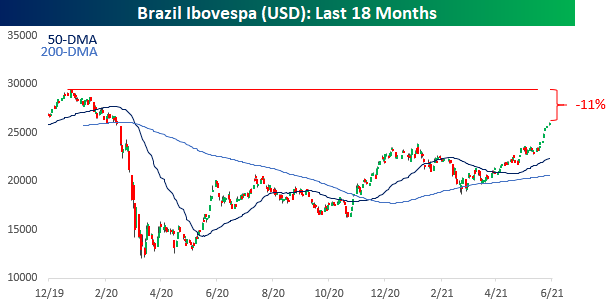

With the recent weakness in the dollar, the rally in Brazilian equities has been even stronger for US-based investors. During the same eight-day winning streak, the Ibovespa is up over 12% is USD. As shown in the chart below, though, while dollar weakness has flattered returns for Brazilian equities from a US-based investor’s perspective in the short-term, it’s been the opposite pattern over the longer term. While the Ibovespa is well above its early 2020 highs in local currency terms, on a dollar-adjusted basis, it’s still down 11%.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more