Belgium: Core Inflation Rises, But The Peak Is Near

Image source: Pixabay

In March, inflation in Belgium rose slightly from 6.6% to 6.7%. Indeed, the sharp decrease in the energy component of inflation is offset by the acceleration in prices of other components. We believe that this situation will not last, as the acceleration in prices is becoming less intense. However, it will take time to fully normalize the situation.

The impact of an energy price shock on the economy mostly happens in two inflation waves. The first reflects the direct impact of higher energy prices on household spending. The second takes longer to show itself: it represents the impact of energy prices on the production costs of businesses. Since Belgium is also characterized by automatic wage indexation, the second wave of inflation is also the consequence of rising wage costs. Where do we stand?

The first wave has passed...

It is well known that energy prices have made a huge contribution to inflation since the second half of 2021. At its peak, energy contributed half of the inflation (in October 2022, the contribution of energy to inflation reached 5.95 percentage points for inflation of 12.3%). Since then, this contribution has collapsed and was even negative in March (-1.49 pp). Due to a large base effect (energy prices were rising very fast a year ago), we expect the contribution of energy prices to inflation to become increasingly negative in the coming months.

These extreme variations are linked to the strong variations in gas and electricity prices in the European market. Indeed, the evolution of the gas and electricity component of consumer prices is based on the price of the new contracts of energy suppliers. These contracts are based, with a certain time lag, on the wholesale market prices. With the price of the TTF day-ahead contract falling from an average of €240/Mwh in August 2022 to an average of almost €44/Mwh in March 2023, such a fall in the consumer price index is not surprising.

... but has been poorly measured

This being said, considering that the bill actually paid by consumers fluctuates at the same rate as the wholesale price is a very blunt assumption. Similar to the preliminary work carried out in the Netherlands by CBS, the statistical Bureau, researchers from Ghent University looked at the actual energy bill in 2022, based on data from more than 900,000 households in Belgium. It appears that, on the basis of actual payments, the expenditure on energy (gas and electricity) has been greatly overestimated in the inflation figures. Therefore, according to their calculations, the CPI has been overestimated by 3.3 percentage points in 2022. This is linked to several phenomena: on the one hand, most consumers do not change their energy contract every month. The evolution of wholesale prices is therefore strongly smoothed for an end consumer, even if he has a variable price contract (because this takes into account an average price over a reference period). On top of that, the CPI does not directly take into account the fact that consumers have adjusted their consumption due to the fear of too high a bill (the weight of a CPI component is stable throughout the year). However, the gas network operator reported a decrease in household consumption of around 20%. Finally, the government's support measures for households have been smoothed out over time in the CPI, whereas in reality households have benefited directly.

This means that the energy bill shock has not been as large as the CPI shows (although for some households it might have been the case), but it also means that the current fall in gas and electricity prices on the wholesale markets is not translating into much lower bills for consumers either. In short, the CPI is probably far from capturing the real price dynamics in the current context.

Second-round effects

Notwithstanding this divergence between the CPI and the reality experienced by households, the measurement of energy prices has pushed up the CPI and the health index which serves as the basis for the automatic indexation of pensions, social benefits, and wages. This has resulted in an unprecedented rise in nominal household incomes of 7.9% in 2022. But wage increases also mean higher labor costs for companies. This, together with the direct effects of rising prices for commodities, components, and energy, has led more and more companies, service providers, and retailers to raise their prices. So far, they have been able to largely pass on cost increases to selling prices. Indeed, National Bank data even show an increase in the gross margin of companies in 2022. This has led to an increase in the sources of inflation. Thus, in March 2023, 73% of the 240 components of the CPI had inflation above 5%, and this figure has been rising almost constantly for the past two years! It is therefore understandable that these very broad inflationary pressures offset the negative contribution of energy prices to inflation.

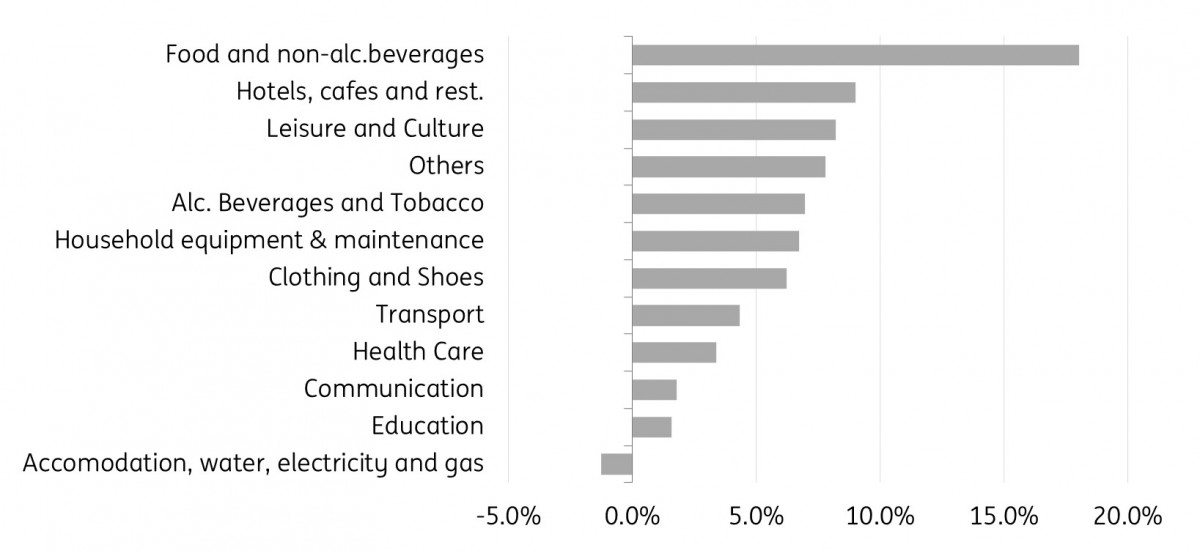

Gr. 1: CPI components show that inflation is widely spread

Image Source: Statbel, computation: ING

The second wave has passed its peak

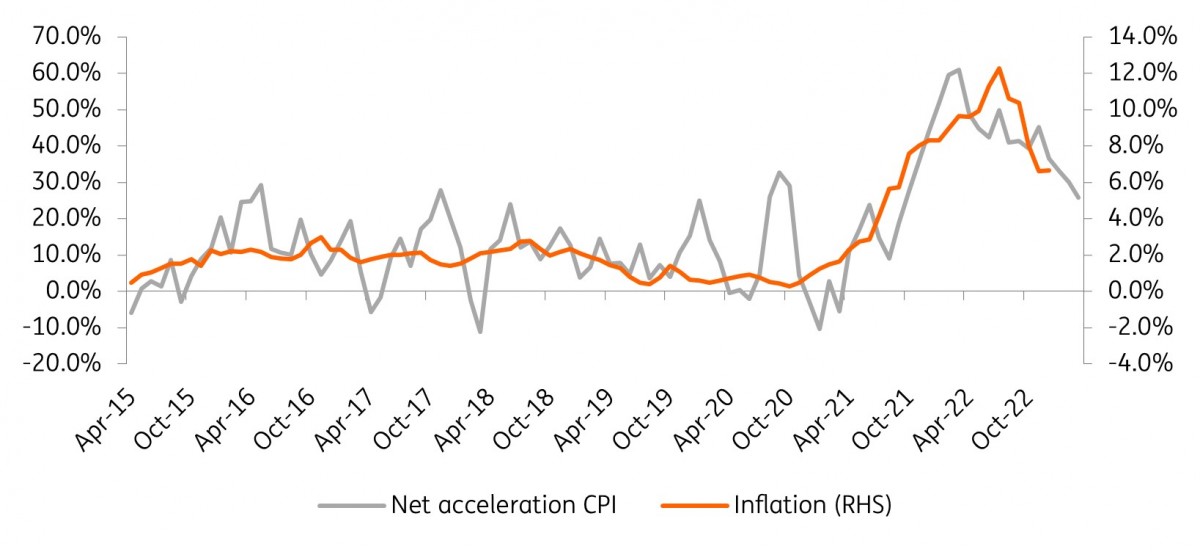

The question now is how core inflation will evolve in the coming months. The fact that inflation is now very widely disseminated makes forecasting more difficult: each component of inflation can be a potential source of additional CPI inflation each month. Nevertheless, in addition to the diffusion of inflation, we also measure the net acceleration of the CPI (% of CPI whose price is accelerating – % of CPI whose price is decelerating, smoothed over 3 months), which is a 3-month leading indicator of inflation. Interestingly, this indicator has been declining in recent months: in March, the net acceleration of the CPI was only 25.8% and down for the fourth consecutive month. In other words, although core inflation is still rising, the detailed data tend to indicate that it should peak in the second quarter.

The fall in core inflation and the more negative contribution of energy to inflation should then allow inflation to gradually decline for the rest of the year. But the movement will remain slow, and inflation could still hover around 3.5% by the end of 2023.

Gr. 2 The CPI net acceleration index argues for a near reversal in core inflation

Image Source: Statbel, computation: ING

More By This Author:

Following The Collapse Of Silicon Valley Bank, Where Do The Risks Lie For Small Banks?Fx Daily: Is Gold Telling Us Something About The Dollar?

The U.S. Braces For A Harder Landing

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more