Bank Of Canada Weighs The Risks Of Doing Too Little

The Bank of Canada has raised its policy rate a cumulative 300bp since February and is set to hike a further 75bp next week as inflation pressures linger and domestic demand holds up better than expected. Any benefits to the Canadian dollar are still likely to be quite contained and short-lived, as external risks remain elevated.

75bp hike now the call

Up until the past couple of weeks, both the market and we ourselves had been favoring a 50bp move at the 26 October policy meeting, but the September inflation report and the Bank of Canada’s Business Outlook Survey have indicated a second consecutive 75bp hike is now the most likely outcome.

While headline inflation slowed on lower gasoline prices, the core measures rose more than expected, confirming that underlying price pressures continue to run hot. The BoC had cited the risk of ongoing CPI increases following its last policy meeting, warning that data indicated a “further broadening of price pressures” while also highlighting worries that high inflation expectations create a “greater risk that elevated inflation becomes entrenched”.

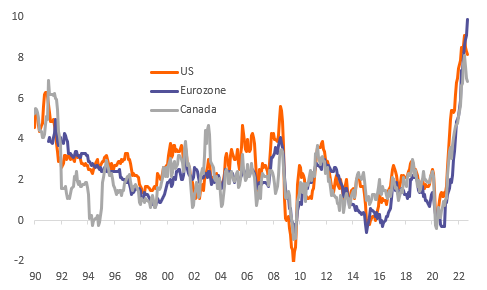

Annual inflation rates 1990-2022 (%)

Source: Macrobond, ING

In this regard, inflation expectations have subsequently hit a new record high while employment growth has resumed and business sales expectations have ticked higher. The combination of these reports and the BoC’s current stance makes it difficult to justify slowing the pace of hikes, particularly with the Federal Reserve and other central banks continuing to push ahead with 75bp hikes at forthcoming meetings. The belief that the risk of doing too little to tame inflation outweighs the cost of doing too much, is now widely held.

More hikes to come despite growing recession risks

Nonetheless, there is spreading economic pain and although inflation is likely to be sticky in the near term, we expect the BoC to slow to a 50bp hike in December with perhaps a final 25bp hike in early 2023. As with other central banks in major economies, the mindset is focused on defeating inflation with an acceptance that the risk of a resulting recession is high. Given this situation, once the core CPI starts recording month-on-month readings of 0.2% or 0.3%, down from the current 0.4%/0.5% monthly increases, we think the BoC will pause with a strong likelihood that it starts to unwind rate hikes in the second half of 2023 as recessionary pressures mount.

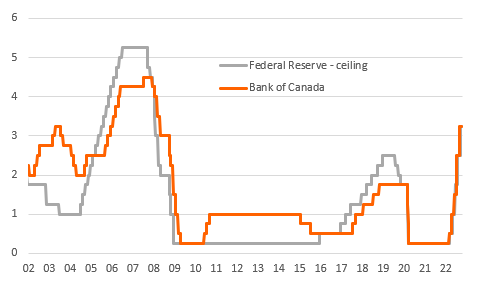

Bank of Canada & Federal Reserve policy interest rates 2002-2022

Source: Macrobond, ING

CAD: Still limited benefits from BoC hawkishness

USD/CAD has remained close to the highs recently, as USD strength has combined with still-unstable risk sentiment and recently, a contraction in oil prices. As highlighted above, there has been evidence that the Canadian economy is slowing, although we don't see this as having played a major role in driving CAD lower, as external factors continue to be the central drivers.

Equally, the FX benefits from the repricing higher in BoC rate expectations after the latest CPI report have been quite limited. The OIS curve currently embeds 70bp of tightening at the October meeting, meaning that a 75bp hike should not be enough to drive CAD higher by itself.

It’s possible however that a hawkish tone by Governor Tiff Macklem will trigger a repricing higher in peak rate expectations, pushing them closer to the Fed’s 5.0% (currently at 4.6% in Canada). This scenario could see CAD trade moderately stronger after the meeting, but the adverse risk environment continues to point to a higher USD/CAD from the current levels, with risks skewed to 1.40 being tested. A return to 1.30 is still in our forecast for 2023 as CAD should benefit from low exposure to Russia and China, and may emerge as a market favourite to play pro-cyclical bets.

More By This Author:

FX Daily: Falling Gas Prices Fuel Optimism

Rates Spark: Relentless And Potentially Dangerous

Turkey’s Central Bank Surprises With 150bp Rate Cut

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more