Australia’s Reserve Bank Lifts Cash Rate Again

This latest hike was not totally surprising given the backward steps from inflation according to the monthly data. Further tightening is not ruled out, but we think this may well be the peak for rates as we expect inflation to ease more substantially in the coming months.

Governor of the Reserve Bank of Australia, Philip Lowe

Recent guidance has not been helpful

We went into this meeting with very low conviction on our call for a further 25bp rate hike, taking the cash rate to 4.1%. This was in contrast to the consensus view, which was about 3:2 in favour of no hike at this meeting.

The Reserve Bank of Australia (RBA) had already delivered a 25bp rate hike at its May meeting, and that was against a backdrop of much better inflation data and came after the bank had hinted that rates may already have peaked. So with their reaction function muddied by recent actions, it was not at all clear whether the RBA would indeed respond to the increase in April inflation from 6.3% to 6.8% year-on-year, or wait for the full quarterly inflation figures to come out - and give more time for the effects of previous tightening to become apparent.

As it turns out, that April inflation increase was too much for the RBA to ignore, and policymakers did raise rates again. The recent increase in the unemployment rate also doesn't yet look like a convincing turn in the labour market, and indeed, disappears completely with just a little smoothing (three-month moving average) of the recent data, though a few more months may provide some more confidence that labour developments are moving in an encouraging direction. Labour data remains a key input into the RBA's rate-setting decision, at least that is what its statement suggests. Though we suspect it will cease to be as instrumental for policy decisions as inflation eases.

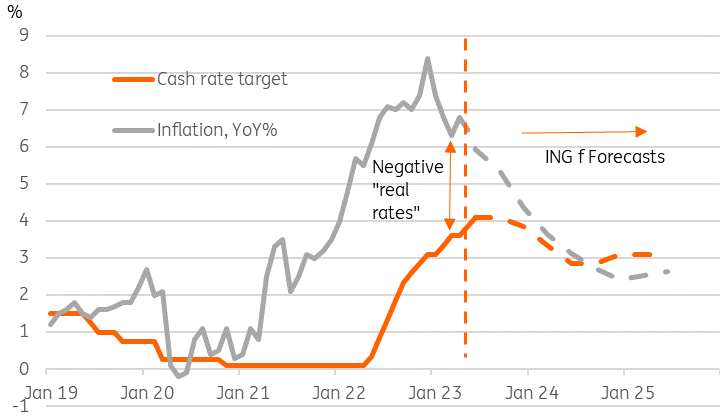

Cash rates and inflation

CEIC, ING, RBA

Any more? Never say never, but we think not

As for whether this marks the peak in rates, we suspect the answer may be "yes". The statement accompanying the decision notes "Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve." It feels like the RBA is hedging its bets on whether it will need to hike again, but we believe that inflation will fall more rapidly in the coming months (see chart), and that this will narrow the gap between inflation and policy rates, making real policy rates less negative. Real policy rates at zero tend to be a fairly basic benchmark for the point at which policy shifts from being accommodative to restrictive.

Risks to this view remain firmly on the upside, however. It would only take some acceleration in wage costs, some climate or other supply shock or more notable increases in house prices to shift the balance to one further (and probably final) hike. But as things stand, we believe this latest hike from the RBA should be enough, and still leaves a chance for the RBA to pull off the soft landing that it is clearly aiming for.

More By This Author:

National Bank Of Poland Leaves Rates Unchanged, Focus On Tomorrow’s Press Conference

FX Daily: Surprise RBA Hike Gives The Dollar Food For Thought

ISM Reports Add To U.S. Recession Fears

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more