ISM Reports Add To U.S. Recession Fears

The US may be adding jobs in huge numbers but the key ISM business surveys cast serious doubt on how long this can last. The manufacturing ISM index is already indicating recession and the service sector will soon join it unless order books turn around dramatically.

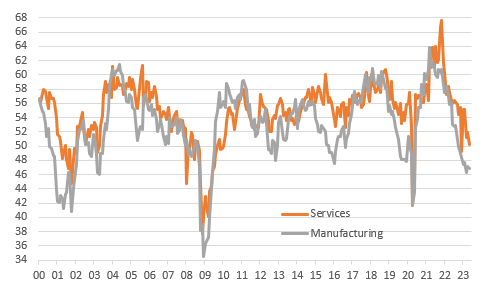

ISM reports indicate a rapid softening in business activity

Last week’s ISM manufacturing index dropped to 46.9, the seventh consecutive sub-50 reading with order books, aside from two months of pandemic stress, looking in their worst shape since the 2009. Today’s ISM services report for May, while not quite as grim, only adds to worries about the outlook for the economy.

The headline balance fell to 50.3 from 51.9 (consensus 52.4). As with many of the manufacturing ISM components, the only time the service sector report has been weaker in the past 14 years was in April and May 2020 at the peak of Covid containment and the December 2022 blip caused by the huge winter storm that was so disruptive for the travel, entertainment and service sectors. The details are poor throughout with business activity having similar metrics to the headline. New orders fell 3.2 points to 52.9, but the backlog of orders plummeted to 40.9 from 49.7. The backlog of orders are not seasonally-adjusted so comparisons are tricky, but for what it is worth, this is the worst reading since 2009. This is something that we also saw in the manufacturing report, dropping from 43.1 to 37.5.

ISM reports are heading in the wrong directions

Macrobond, ING

Order books need to turn around quickly to avert recession

Now at least in the manufacturing report we saw the employment component rise to 51.4 from 50.5, yet the payrolls report said manufacturing employment fell 2000. We saw private sector employment rise 257,000 in that same report, yet the ISM has service sector employment in contraction territory at 49.2! The data contradictions underscore the challenge for the Federal Reserve and only support the argument that they leave policy on hold in June to try and get a better gauge of what is happening in the economy. The decline in price pressure is a welcome development though with the manufacturing prices paid below the break-even 50 level at 44.2 and service sector prices falling to 56.2 from 59.6. This leaves the service sector price index at its lowest level since March 2020 and slap bang in the middle of its long run range.

It looks likely that the manufacturing sector is already in recession (seven consecutive sub-50 readings for ISM manufacturing). The service sectors order books are weak and will need to turn around rapidly to prevent the service sector joining it. Given this situation it is difficult to imagine that employment will continue to make such large gains. Then with price measures rapidly weakening it is understandable that markets doubt that if we do get a pause at the June Federal Open Market Committee meeting that the Fed will be able justifying a restart on rate hikes later in the year.

More By This Author:

OPEC+ Meeting Brings Deeper Saudi CutsTurkey: Headline Inflation Down, But Services Remain Sticky

FX Daily: Trading The 50-50 Risk

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more