Australian Dollar Gains Ground As China’s COFCO Purchases US Soybean Cargoes

Image Source: Unsplash

The Australian Dollar (AUD) extends its gains against the US Dollar (USD) on Wednesday after China made a goodwill gesture ahead of the upcoming meeting between Presidents Donald Trump and Xi Jinping. China’s state-owned COFCO purchased three soybean cargoes from the United States, according to two trade sources cited by Reuters.

President Trump also expressed optimism in South Korea that the upcoming meeting with Chinese President Xi will result in a “great deal” for both the US and China. Any shift in China’s economic conditions could also affect the Australian dollar (AUD), given the close trade ties between China and Australia.

The AUD also gained ground following the release of Australia’s Consumer Price Index (CPI) data. Consumer Price Index rose 1.3% quarter-over-quarter (QoQ) in the third quarter (Q3), compared with the 0.7% increase seen in the second quarter. The market consensus was for a growth of 1.1% in the reported period. CPI inflation climbed to 3.2% year-over-year (YoY) in Q3, versus 2.1% prior and above the market consensus of 3.0%.

The RBA Trimmed Mean CPI for Q3 rose 1.0% and 3.0% on a quarterly and annual basis, respectively. Markets estimated an increase of 0.8% QoQ and 2.7% YoY in the quarter to September. The monthly Consumer Price Index jumped by 3.5% YoY in August, compared to the previous reading of a 3.0% increase. This figure came in hotter than the expectation of 3.1%.

The AUD/USD pair received support from decreasing bets on rate cuts by the Reserve Bank of Australia (RBA). RBA Governor Bullock reiterated that the labor market remains a little tight, despite the unemployment rate jump being a surprise.

US Dollar advances ahead of Fed policy decision

- The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is gaining ground after two days of losses and trading around 98.90 during the Asian hours on Wednesday. The Greenback could face challenges as traders expect the Federal Reserve (Fed) to deliver a rate cut later in the North American session.

- The Fed is widely expected to lower interest rates by another quarter point, bringing the benchmark rate to 3.75-4.00%, at its October meeting. The CME FedWatch Tool indicates that markets are now pricing in nearly a 97% chance of a Fed rate cut in October and a 96% possibility of another reduction in December.

- Traders will be looking forward to any signals from Fed Chair Jerome Powell’s speech at the post-meeting conference regarding the pace of future easing. The October CNBC Fed Survey also indicates that the Fed could implement additional rate reductions over the next two meetings.

- President Trump stated in South Korea on Wednesday that the Federal Reserve will not raise interest rates. Trump projected that investments totaling around $21–$22 trillion would flow into the United States (US) by the end of his second term and forecast 4% GDP growth in the next quarter, noting that factories across the country are booming.

- The ongoing US government shutdown has entered its fifth week, delaying the release of key economic data crucial for guiding monetary policy decisions and shaping market expectations.

- The US Bureau of Labor Statistics (BLS) reported on Friday that the US Consumer Price Index (CPI) rose 3.0% year-over-year (YoY) in September, following a 2.9% increase in the prior month. This reading came in below the market expectation of 3.1%. Meanwhile, the monthly CPI increased 0.3%, against the 0.4% rise seen in August. The core CPI increased 0.2% month-over-month, compared to the market consensus of 0.3%, while the yearly core CPI was up 3.0% in September.

Australian Dollar tests 0.6600 barrier due to bullish shift

AUD/USD is trading around 0.6590 on Wednesday. Technical analysis of a daily chart suggests a bullish shift as the pair rises above the descending channel. The pair is also trading above the nine- and 50-day Exponential Moving Averages (EMAs), indicating that both short- and medium-term price momentum remain strong.

On the upside, the immediate barrier lies at the psychological level of 0.6600. A break above this level would support the AUD/USD pair to explore the region around the 12-month high of 0.6707, which was recorded on September 17.

The primary support lies at the 50-day EMA of 0.6546, aligned with the nine-day EMA at 0.6545. A break below these levels would revive the bearish bias and prompt the AUD/USD pair to navigate the area around the four-month low of 0.6414, followed by the lower boundary of the descending channel around 0.6370.

AUD/USD: Daily Chart

Australian Dollar Price Today

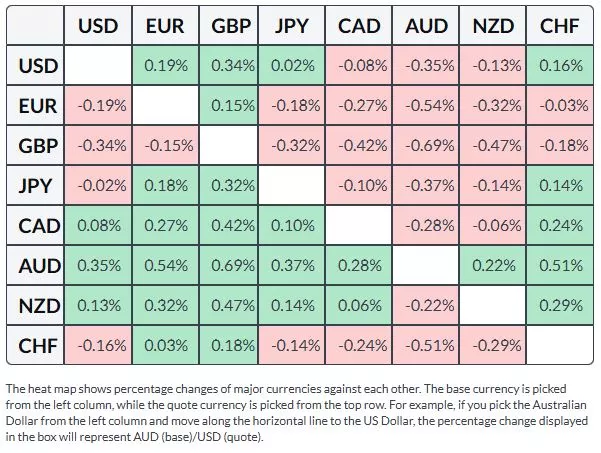

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the British Pound.

More By This Author:

EUR/JPY Price Forecast: Targets 177.00 Support Near Nine-Day EMA

Australian Dollar Holds Gains As US Dollar Declines On Fed Rate Cut Bets

UK Retail Sales Rise 0.5% MoM In September Vs. -0.2% Expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more