UK Retail Sales Rise 0.5% MoM In September Vs. -0.2% Expected

Image Source: Pexels

The United Kingdom (UK) Retail Sales climbed 0.5% month-over-month (MoM) in September after advancing 0.6% in August (revised from 0.5%), according to the latest data published by the Office for National Statistics (ONS) on Friday.

Markets projected a 0.2% decline in the reported month.

The core Retail Sales, stripping the auto motor fuel sales, increased 0.6% MoM in September, compared with the previous rise of 1.0% (revised from 0.8%).

The annual Retail Sales in the UK climbed 1.5% in September versus 0.7% prior, above the consensus of 0.6%. The annual core Retail Sales jumps 2.3% in the same month versus a 1.3% rise prior (revised from 1.2%). This reading came in better than the market expectations of 0.7%.

Market reaction to the UK Retail Sales report

The Pound Sterling attracts some buyers following the upbeat UK Retail Sales report. The GBP/USD pair is trading 0.03% lower on the day at 1.3318 as of writing.

Pound Sterling Price This week

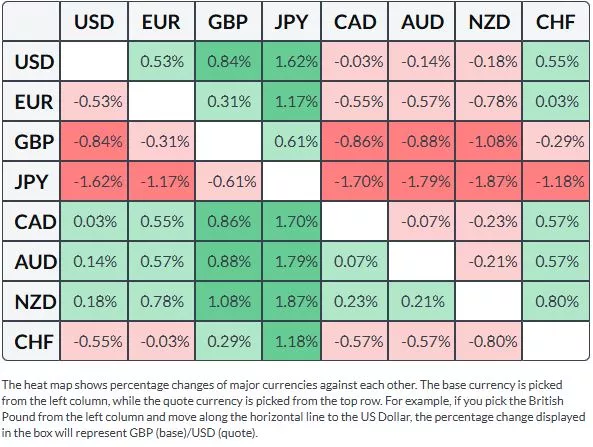

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

The UK Retail Sales Overview

The United Kingdom (UK) docket has the Retail Sales data for September to be released by the Office for National Statistics (ONS) on Friday, later this session at 06:00 GMT.

UK Retail Sales are expected to decline by 0.2% month-over-month (MoM) in September, swinging from a 0.5% increase seen in August. On an annualized basis, Retail Sales are seen rising 0.6% during the reported month, inching lower from 0.7% prior.

Core Retail Sales, stripping the basket of motor fuel sales, are anticipated to have climbed by 0.7% year-over-year (YoY), lower than the previous reading of 1.2%.

How could the UK Retail Sales affect GBP/USD?

UK Retail Sales data for September could contribute to the downward pressure on the GBP/USD pair amid signs of softer consumer spending. Even the surprise uptick may struggle to help the pair hold ground amid rising bets of more interest rate cuts by the Bank of England (BoE) in the remaining year.

The Pound Sterling (GBP) faced challenges after BoE Monetary Policy Committee (MPC) member Swati Dhingra signaled on Thursday that United States (US) tariffs could put downward pressure on prices in the medium term. The preliminary United Kingdom (UK) Purchasing Managers’ Index (PMI) data by S&P Global will be eyed later in the day. Attention will be shifted toward the US Consumer Price Index figures due on Friday.

Technically, the GBP/USD pair remains steady after five days of losses, trading around 1.3320 at the time of writing. The pair may target the two-month low of 1.3248, recorded on October 14, followed by the six-month low of 1.3141. On the upside, the initial barrier lies at the nine-day Exponential Moving Average (EMA) of 1.3365, followed by the 50-day EMA at 1.3433. A break above these levels would improve the short- and medium-term price momentum and open the doors for the pair to test the monthly high of 1.3527.

More By This Author:

EUR/JPY Price Forecast: Could Target Record Highs On A Successful Break Above 177.00Australian Dollar Recovers Losses On Optimism Surrounding US-China Trade Deal

USD/CAD Falls To Near 1.4000 As Oil Prices Extend Gains On Falling Stockpiles

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more