AUD/USD Forecast: Dollar Retreats Ahead Of Powell Testimony

Today’s AUD/USD forecast leans bullish as the dollar weakens ahead of Powell’s testimony to Congress. This weakness extended from the previous session when the US released downbeat economic data.

Market participants eagerly await Powell’s speech before Congress, which might contain clues on the outlook for Fed policy. Powell will likely reiterate the view that the Fed is in no hurry to cut interest rates. However, any dovish inclination could further weaken the dollar, allowing the AUD/USD to rise.

Dollar weakness started on Tuesday when the US released data revealing weaker growth in the US services sector. Consequently, markets gained confidence that higher interest rates were slowing the economy. Therefore, the Fed might be more inclined to start cutting interest rates in June.

Similarly, rate-cut bets increased in Australia after data on Wednesday showed slower economic growth in Q4. Higher interest rates in Australia are starting to weaken economic growth. At the same time, inflation in the country is slowing, prompting the RBA to start thinking about the first rate cut. GDP rose 0.2% in Q4 missing forecasts of 0.3% growth. The report indicated a rising cost of living for Australian consumers.

Notably, the RBA remains relatively hawkish despite the drop in headline inflation. According to the central bank, services inflation remains persistent, needing higher interest rates. As a result, markets expect the first RBA rate cut to come in August.

AUD/USD key events today

- US ADP Non-Farm Employment Change

- Fed Chair Powell Testifies

- JOLTS Job Openings

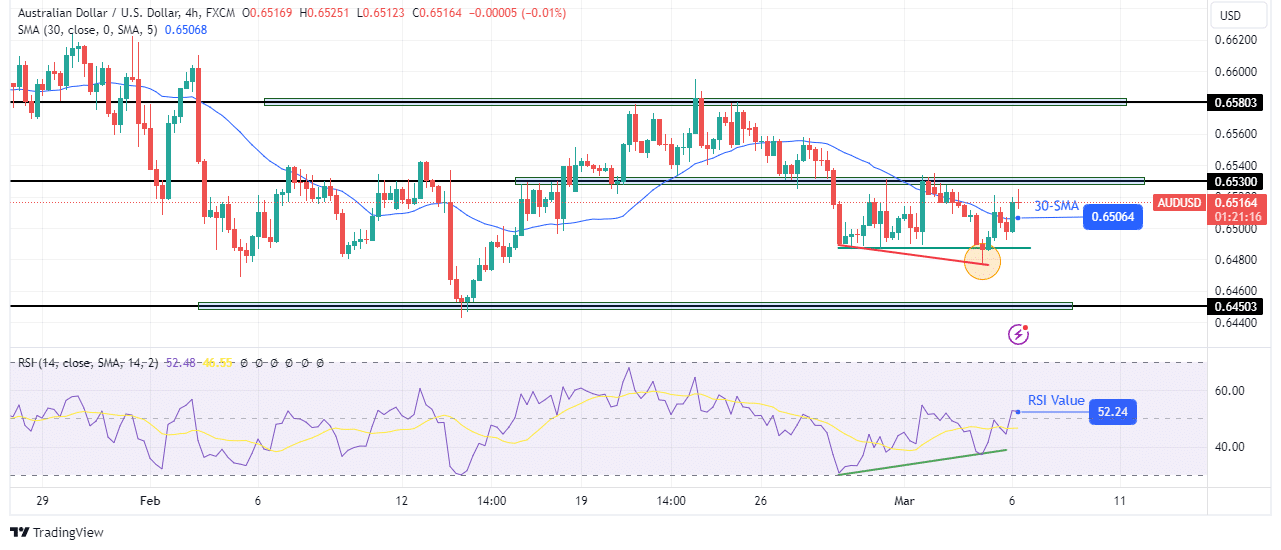

AUD/USD technical forecast: Bulls take the lead after bullish divergence.

AUD/USD 4-hour chart

On the technical side, there has been a shift in sentiment to bullish as the price has broken above the 30-SMA. At the same time, the RSI has broken above the 50 mark and now trades in bullish territory. The shift in sentiment comes after the price failed to make a new low and the RSI made a bullish divergence.

In the previous downtrend, although the price broke below the previous low, it failed to close below. Therefore, it made a big wick showing bulls were challenging further declines. Soon after, bulls gained momentum and broke above the 30-SMA resistance. However, to confirm this new direction, the price must make a higher high above the 0.6530 key resistance level.

More By This Author:

Gold Price Soars As Dollar Weakens, Eyes On US Data

USD/JPY Forecast: Yen Retreats Following Ueda’s Remarks

EUR/USD Price Wobbling Near Resistance, All Eyes on Core PCE

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more