Gold Price Soars As Dollar Weakens, Eyes On US Data

The gold price is trading in the green zone at $2,126 at the time of writing. The metal maintains a strong bullish trend and is looking to hit fresh highs. The US dollar dropped again in the last few hours, weakening the greenback.

Gold price jumped higher even though the Switzerland Consumer Price Index reported a 0.6% growth versus the 0.5% growth estimated after the 0.2% growth in the previous reporting period.

Today, the US ISM Services PMI represents a high-impact event and could bring more action. It is expected to drop from 53.4 points to 53.0 points, while the Factory Orders may report a 3.1% drop.

Tomorrow, the fundamentals remain in the driving seat. The Australian GDP may announce a 0.2% growth, the US ADP Non-Farm Employment Change could jump to 149K from 107K, while the JOLTS Job Openings indicator may drop from 9.03M to 8.80M.

Furthermore, the BoC is expected to keep the Overnight Rate at 5.00%, while Fed Chair Powell Testifies could change the sentiment.

Gold Price Technical Analysis: Strongly Bullish

(Click on image to enlarge)

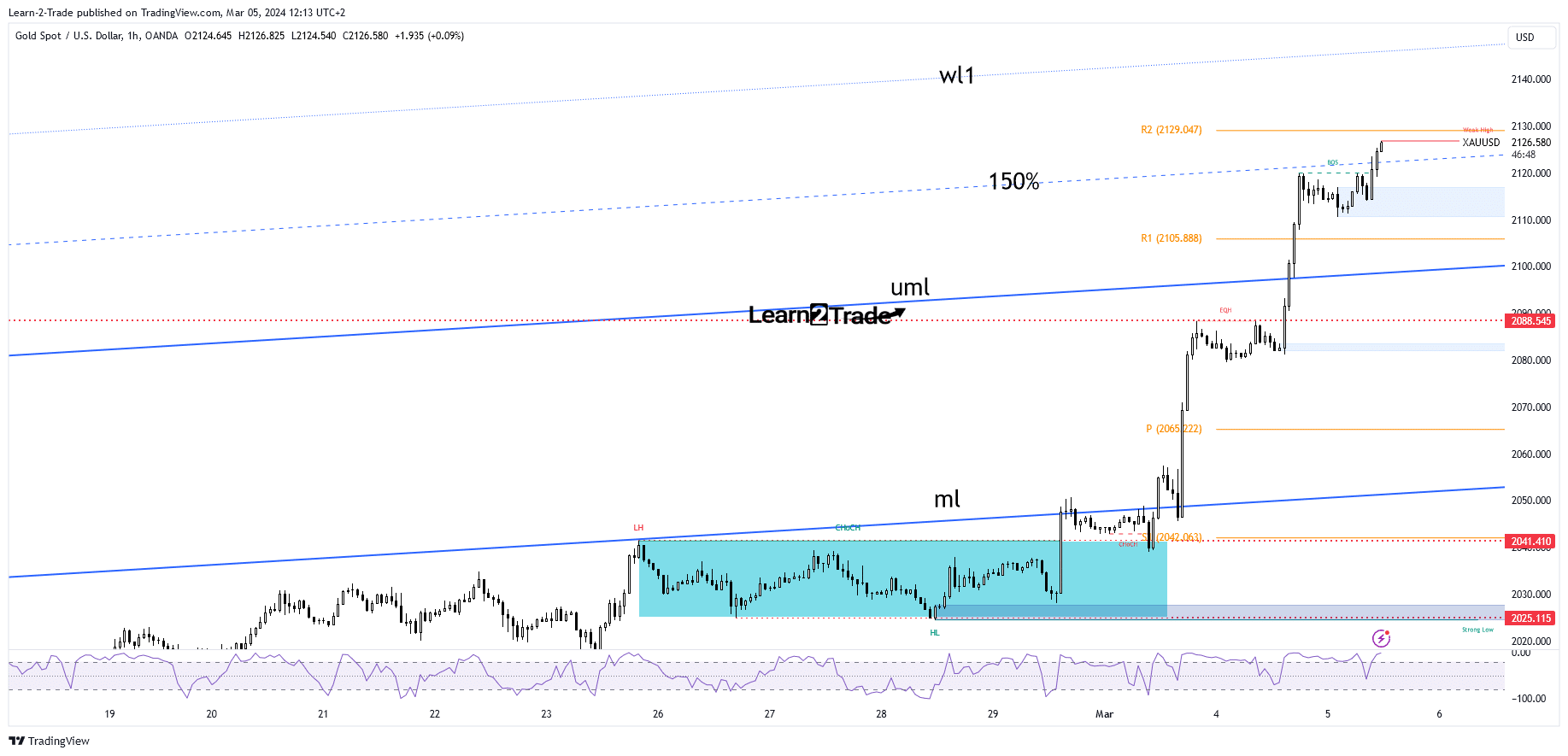

Gold 1-hour chart

The XAU/USD ignored the upper median line (uml) and the weekly R1 of $2,105. Now it challenges the 150% Fibonacci line. This represents a dynamic resistance, so a valid breakout may announce further growth. The weekly R2 of 2129 stands as a static resistance.

The price needs to take out this obstacle as well to approach the first warning line (wl1) of the major ascending pitchfork. Gold is strongly bullish, despite minor retreats.

Short-term drops could bring us new long opportunities. The upper median line (uml) represents dynamic support, so XAU/USD remains bullish as long as it stays above it.

More By This Author:

USD/JPY Forecast: Yen Retreats Following Ueda’s RemarksEUR/USD Price Wobbling Near Resistance, All Eyes on Core PCE

AUD/USD Outlook: Aussie Neutral Amid Mixed Economic Signals

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more