Asia Week Ahead: Slowing Global Trade Likely Weighing On Asia’s Export Momentum

Image Source: Pixabay

Global trade may be slowing and it's hitting both China and Taiwan’s export sectors.

Slowing global trade weighing on China and Taiwan

Export data for China and Taiwan should show a deeper yearly contraction, which reflects high inflation in the US and Europe. As domestic demand and export demand have been weak, PPI in China continues to shrink year-on-year, with CPI stabilizing just slightly above 2%.

Singapore retail sales supported by tourist arrivals?

Singapore retail sales will be out next week. We had expected a slowdown in retail sales due to elevated inflation, but retail sales managed to hold relatively firm, possibly supported by the influx of foreign visitors. We expect October retail sales to remain in expansion although the pace of growth may slow somewhat as higher prices finally bite.

Philippine inflation could hit 8%

Meanwhile, Philippine inflation is scheduled for release on 6 December. Headline inflation could hit 8.2%YoY, driven largely by higher food prices resulting from extensive crop damage due to typhoons. Bangko Sentral ng Pilipinas is likely to retain its hawkish bias to close out the year although governor Felipe Medalla has recently hinted that a pause may be in the cards as early as the first quarter of 2023.

Other data releases next week

Japan’s third-quarter GDP reading will be out next week but we expect no change from its initial forecast. We expect the -0.3% quarter-on-quarter seasonally-adjusted preliminary forecast to hold.

Australia also releases GDP data for 3Q22, this time an initial forecast. We think it will slow a little from the 0.9%QoQ growth rate shown in 2Q22 but is likely to come in at around 0.7%QoQ, which still represents a very decent rate of growth.

A little before the GDP release, the Reserve Bank of Australia meets to decide on monetary policy. We have decided that the central bank is no longer particularly concerned with the flow of data, and will hike rates another 25bp despite recent softer-than-expected inflation.

And Reserve Bank of India also meets next week. Inflation remains higher than it would like but is showing some signs of peaking, while rates have already been raised a lot. It is not inconceivable that it will hike by only 25bp, less than the 35bp expected by the market.

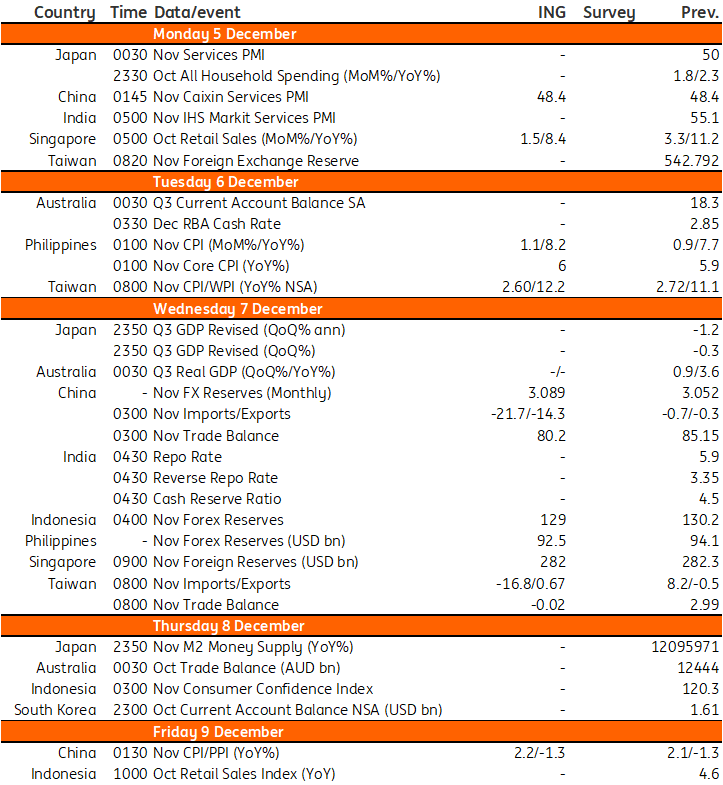

Asia Economic Calendar

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Payrolls May Not Be Dollar’s Lifeline

Fed In A Flutter As U.S. Inflation Softens

FX Daily: Dollar Correction Extends

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more