Fed In A Flutter As U.S. Inflation Softens

With CPI, PPI, import prices, and now, most significantly, the core PCE deflator pointing to weakening price pressures, the Federal Reserve's hawkish messaging is being questioned by the market. Admittedly the consumer is still spending, but it appears that pricing power is moderating and there may not be the need for a prolonged period of high rates.

US inflation surprises on the downside again

Federal Reserve Chair, Jerome Powell, tried his best to talk up the prospect of a higher-for-longer interest rate policy story, but the market didn’t believe him yesterday and will be even less inclined to do so after today’s personal income and spending report.

The 0.2% month-on-month core Personal Consumer Expenditure deflator outcome (consensus 0.3%) is another inflation surprise with the year-on-year rate slowing to 5% from 5.2%. This is significant as it is the Fed’s favored measure of inflation and with pipeline price pressures, such as import prices and PPI, also continuing to soften after we got the soft core CPI print, it poses real challenges to the Fed’s narrative on inflation.

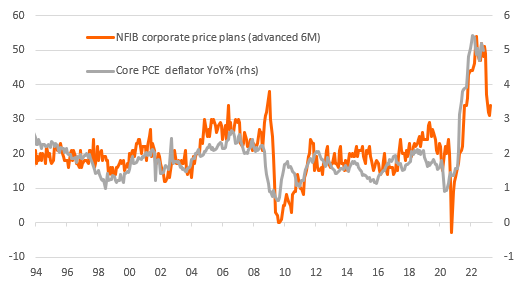

In fact, the situation could get even trickier for the Fed with the chart below plotting the core PCE deflator against the National Federation of Independent Businesses price plans survey. It shows that the proportion of companies looking to raise their prices over the next three months has dropped sharply very recently, presumably reflecting some evidence of softening demand and rising inventory levels. This relationship suggests the core PCE deflator could head down to 3% by the end of 1Q, which would argue that we are getting close to the top for the Fed funds target rate.

Moreover, if the economy does fall into recession as many fear, that corporate pricing power story will weaken much further and could contribute to inflation getting close to the 2% target by the end of 2023.

Weakening corporate pricing power points to a sharp fall in inflation

Source: Macrobond, ING

Activity still holding up for now

For now, though, the activity side is holding up well with real consumer spending rising 0.5% MoM in October, the strongest gain since January. The news on the Black Friday/Cyber Monday retail sales has also been good and means that real consumer spending is on track to rise at a 4% annualized rate in the current quarter. We also expect to see a strong jobs number tomorrow given that job vacancies exceed the total number of unemployed Americans by a factor of almost two. The Fed will likely point to these factors as justifying an ongoing hawkish position insofar as demand exceeding supply will keep the inflation threat alive.

A 50bp interest rate hike for December still looks a certainty and we continue to expect a final 50bp hike in February. For any more hikes we are going to need to see strong demand continue, but with US CEO confidence at the lowest level since the Global Financial Crisis and the housing market deteriorating rapidly, it is not our base case.

More By This Author:

FX Daily: Dollar Correction ExtendsEurozone Inflation Comes Down In November, Paving Way For 50bp ECB Hike

Italian Inflation Stabilizes In November

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more