Asia Week Ahead: Key Economic Data For China Next Week

Image Source: Pixabay

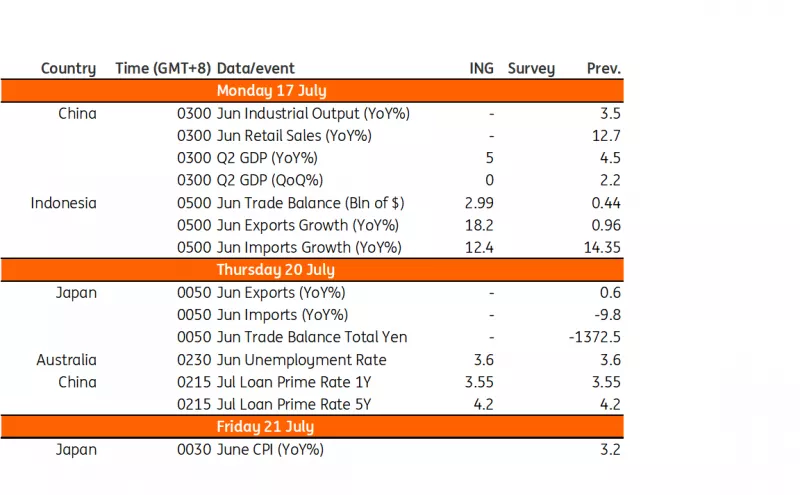

China releases a raft of data next week and the main focus will be on second quarter GDP figures. Elsewhere, we'll also see unemployment data from Australia and June's CPI inflation for Japan.

China to release second quarter GDP Figures

The highlight of the main data dump for June will be the second quarter GDP print. In our view, GDP will come in at the lower end of the 5.8%-8.0% year-on-year range. Industrial production is likely to weaken further from the 3.5% growth rate shown in May and retail sales – which had benefitted from both base effects and re-opening pent-up demand – will fall from a 12.7% rate to about 3%. The drag from construction, which is contracting at more than a 7% YoY rate, should continue. There will also probably be little sign of any boost from fixed asset investment or infrastructure spending. Trade figures already released which round out the second quarter indicate that net exports won’t be playing much of a role in second quarter GDP either. The third quarter has all the potential to be even softer.

1Y and 5Y loan prime rates due at the end of the month will not likely change (currently at 3.55% and 4.20% respectively), although we would expect these to come down over the coming months after further reductions in PBoC policy rates.

Australia’s unemployment rate is unlikely to go lower

The June labor market report follows an unexpectedly strong report for May (+75.9K), and we think there may be some statistical pullback from that figure. It is not clear that this will have any meaningful impact on the unemployment rate, which at 3.6% is still close to the all-time low rate of 3.4% reached last October. We are tempted to run with a small contraction in the total employment figure, driven by a correction in the full-time employment numbers and limited offset from a smaller positive figure for part-time workers. However, given the volatility of this release, we assign a low conviction to these forecasts.

Japan CPI inflation to rise modestly

The Japanese government has issued a heat stroke warning for Tokyo and surrounding areas as outdoor temperatures rise sharply. Tokyo’s Hachioji has hit the record for this year at 39.1C. With more people staying indoors, the increasing cooling demand has resulted in a rapid increase in the spot power rate, which is likely to cause the consumer price to rise modestly in June.

Indonesia's trade surplus to recover

May was a bit of an anomaly, with a spike in energy imports resulting in a stark narrowing of the trade surplus. The surplus slipped to a mere $400 million, down from the average of $4bn for the year. We expect imports to contract by 12.4% YoY as energy imports translate to a widening of the trade surplus to roughly $3bn, even after exports slip by 18% YoY. A wider trade surplus should help shore up the IDR, which has come under some pressure recently.

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

UK Economy More Resilient Than Expected In May

The Commodities Feed: Brent Breaks Above $80

Eurozone Industrial Production Confirms No Strong GDP Bounce Back For 2Q

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more