Asia Week Ahead: Key Central Bank Meetings In Japan And Indonesia

Image Source: Unsplash

The Bank of Japan meeting could be a close call, while Bank Indonesia is likely to extend its pause. Meanwhile, Korea reports GDP figures and Singapore reports inflation.

Australia's second-quarter CPI data are a key variable for the Central bank

The highlight for the week will be the second quarter CPI release in Australia on Wednesday. The inflation outlook will help determine whether the Reserve Bank of Australia (RBA) hikes rates again in the second half of the year. The unemployment data released earlier today showed that the unemployment in June stood at 3.5%, slightly lower than the consensus of 3.6%. The improvement in the labor market could point to solid economic activity despite the recent string of tightening. As such, CPI for the second quarter is likely to remain elevated but lower compared to the first quarter.

Taiwan's industrial output to continue decline

Given the poor performance of China’s second-quarter data, industrial output in export-reliant Taiwan is likely to have remained in contraction last month. Semiconductor production plays an integral role in Taiwan’s industrial output. A report released by TrendForce recently showed that global foundry sales will decrease by 4% year-on-year in 2023, with many major firms suggesting no significant rebound in orders.

Korea’s GDP to pickup

Korea’s GDP growth in the second quarter is expected to accelerate to 0.5% quarter-on-quarter seasonally-adjusted compared to the first quarter’s 0.3%. The improvement in net export contributions is likely to have driven overall growth on the back of a sharp decline in imports, while private consumption growth will probably remain flat. Monthly activity data should stay soft with construction and service activity declining in June.

BoJ meeting to be a close call?

The Bank of Japan (BoJ) will meet on Friday and we believe that recent swings in the FX and Japanese government bond markets reflect market expectations for policy adjustment. It is a close call, but we still think yield curve control (YCC) tweaks are possible, given that recent data support steady inflation growth and a sustained economic recovery.

BI expected to pause

Bank Indonesia (BI) is set to extend its pause, keeping policy rates at 5.75%. Inflation has returned to target but pressure on the Indonesian rupiah (IDR) of late may give Governor Perry Warjiyo reason to keep rates steady. We expect BI to stay on hold for a couple more meetings and only consider a potential rate cut once the IDR stabilizes.

Singapore inflation to slow

Favorable base effects and moderating commodity prices could help both headline and core inflation dip in Singapore. Headline inflation may edge lower to 4.6% YoY with core inflation also expected to slow. The Monetary Authority of Singapore will be weighing the upside GDP growth surprise alongside the improving price outlook for its meeting later this year.

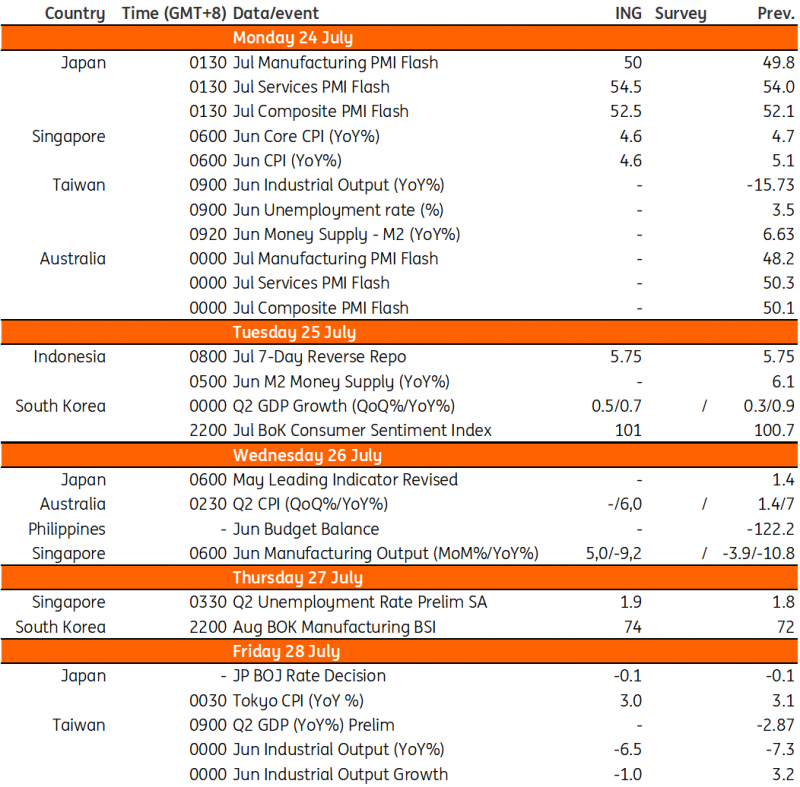

Key events in Asia next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Dollar Bears Being Asked For Patience

Continued Disinflation In Poland Supports Prompt Central Bank Easing

Gold Shines Again With An End To The Fed’s Tightening Cycle In Sight

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more