Asia Week Ahead: China’s Trade Data And An Upcoming RBA Decision Take The Spotlight

Image Source: Unsplash

RBA meeting to be closely watched

The 7 May Reserve Bank of Australia (RBA) meeting is worth watching closely. Recent inflation data in Australia looks to have stalled on a monthly basis and has even started to nose higher. That said, Australian inflation has actually performed better than we had been expecting. We had looked for it to rise sooner and by more. On that basis, inflation isn’t causing us any undue concern. This looks to us like it will be another no-change meeting. Compared to the US, Australia’s economy has slowed more and the labour market softened more significantly.

Time is probably all that is needed for monetary policy to do its work. But at least one analyst has already gone out with a 25bp hike call for this meeting – and we have to admit that this is where the risks to RBA policy lie over the next few meetings. Progress has been slow, but the target rate was not expected to be reached until next year anyway.

China’s trade data out next week

The key data release in China next week will be the trade data next Friday. We're expecting data to come in relatively sluggish, with export growth expected to be flat at around 0% year-on-year and import growth faring better at 6.4% YoY. China also publishes its Caixin services and composite PMI on Monday, which the market expects to cool slightly from March. Foreign reserves data will also be released sometime on Tuesday.

Robust industrial output report likely from India

We expect a robust March industrial production release in India. The recent manufacturing PMI data has been running strong consistently and isn't showing any signs of a pullback. There may be some election-related disruption in May/June, but we anticipate the growth rate to rise from 5.7% in February to 6.2% in March.

Trade and inflation numbers out from Taiwan

Taiwan publishes its CPI and PPI inflation on Tuesday, where we will see the first month of impact from the 11% electricity price hike. We expect CPI to pick up in sequential terms but to remain little changed in YoY terms around 2.1% YoY. PPI inflation may see a larger impact from the price hike in the early stages. Taiwan also publishes its trade data on Wednesday, where we are expecting both export and import growth to moderate after a strong March to 10.3% YoY and 4.2% YoY respectively.

Indonesia and Philippines report growth numbers

The coming week also features first quarter GDP reports from Indonesia and the Philippines. We expect Indonesia’s first quarter GDP to expand by 5.2% YoY.Robust economic growth was supported by election-related spending after nationwide elections were held in February. Meanwhile, the Philippine economy likely grew by 6.0% YoY in the first quarter. Growth possibly received a boost from a favourable net exports contribution given the stark narrowing of the trade deficit in 2024.

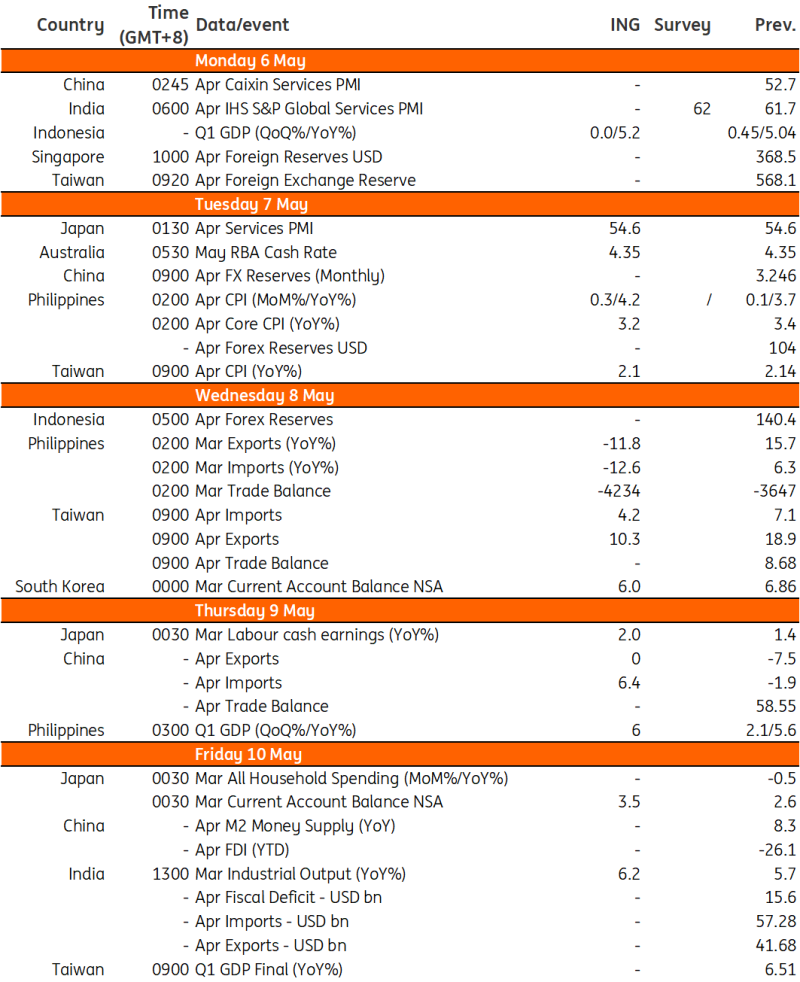

Key events in Asia next week

Refinitiv, ING

More By This Author:

Asia Morning Bites For Thursday, May 2

Fed Holds Policy Steady: Rate Hikes Remain “Unlikely” Despite Lack Of Inflation Progress

Softer US Activity Numbers Will Do Little To Temper The Fed’s Hawkishness