Softer US Activity Numbers Will Do Little To Temper The Fed’s Hawkishness

Image Source: Pixabay

There are a few more tentative signs of economic softness coming through in the US data, but inflation continues to run far too hot for comfort. Today’s Federal Reserve FOMC meeting is likely to see the Fed adopt more hawkish language than at the March FOMC meeting, but they certainly won’t close the door to potential rate cuts later in the year.

Manufacturing and construction activity remain subdued

Ahead of today’s Federal Reserve FOMC meeting we have had some fairly subdued US activity numbers. The ISM manufacturing index dropped back into contraction territory in April at 49.2 from 50.3 (consensus 50.0). Production held just above the break-even 50 level at 51.3, but new orders are contracting again at 49.1, the lowest level since December, while the employment component came in at 48.6, the 7th consecutive sub-50 print and the 13th sub-50 reading in the past 15 months. Prices paid jumped to 60.9 from 55.8, but this is a reflection of the run up in oil prices (which has subsequently reversed) and ongoing strength in some commodity prices. Overall, it paints a picture whereby the sector is largely stagnating with businesses looking to trim costs where they can.

Construction spending fell 0.2% month-on-month versus expectations of a 0.3% increase, that said, February's growth rate was revised up to 0% versus the initially reported 0.3% contraction. Nonetheless, this is the third consecutive month of flat or negative output. Details showed private construction fell 0.5% leaving it up 7.3% year-on-year in dollar terms, while public construction rose 0.8% MoM and is up 17.9% YoY.

Job vacancies are shrinking

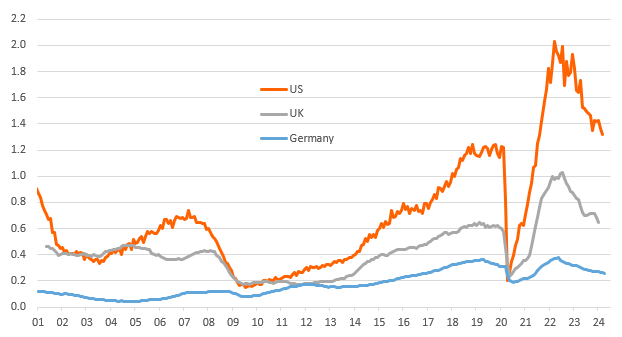

Meanwhile job openings dropped from 8.813mn to 8.488mn, exactly in line with what the Indeed job posting website data had suggested, but below the consensus 8.68mn forecast. This means that as of March there were 1.32 job vacancies per unemployed American. This indicates a jobs market that remains very tight, but there has been a cooling, as the chart below shows, given we had more than two vacancies for every unemployed person in 2022 and we are converging on the pre-pandemic levels of 2018 and 2019. Europe continues to have much greater slack in its jobs market.

Ratio of job vacancies to the number of unemployed people

Source: Macrobond, ING

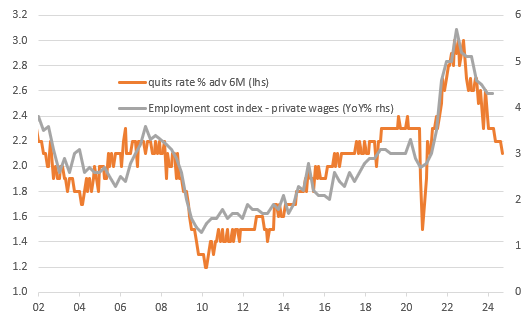

Slowing quits rate points to cooling wage pressures

Within the report we focus on the quits rate as that has been the single best guide for the path of labour costs, which are so important for the inflation outlook. It slowed to 2.1% of all workers quitting their jobs to move to a new employer from 2.2% in February, which suggests that the jobs on offer are not particularly enticing, either because of the role or the rate of pay and workers are choosing to stick with what they’ve currently got. It hit 3% in April 2022 at the peak of the job frenzy.

As the chart below shows, it points to a further slowing in the employment cost index (ECI), which was surprisingly strong yesterday. Less turnover in workers means the incentive to pay staff more to retain them is weakening. Consequently, the ECI should soon resume a softening trend given today’s quit rate plus pay rate numbers for jobs website Indeed, the Atlanta Fed wage tracker and today's ADP wage series which all point to a clear cooling in pay pressures.

Slowing quits rate points to cooling wage pressures

Source: Macrobond, ING

Given the US is largely a service sector economy, labour costs are key to gauging how persistent inflation will likely be. The quit number and its relationship with costs should offer the Fed a little bit of comfort that inflation should subside, but that won’t stop them sounding hawkish this afternoon in the wake of core inflation prints that have been running hotter than expected through the first three months of the year.

More By This Author:

FX Daily: DXY Closing In On Year’s High Ahead Of FedEurozone Inflation Stable As The Outlook On Prices Gets Increasingly Muddied

U.S. Employment Costs Reacceleration Incentivises The Fed To Be More Hawkish