Asia Week Ahead: Central Bank Meetings And Critical Inflation Data

Image Source: Unsplash

It’s set to be a big week ahead for the Asia Pacific region. The Bank of Japan gets ready to normalize policy further against the backdrop of a stronger JPY, and it’s make or break time for the Reserve Bank of Australia as June inflation data determines what its 6 August meeting brings.

Japan: Labor report and BoJ meeting

Next week’s highlight will be the Bank of Japan (BoJ) meeting. It is a close call, but we maintain our view that the BoJ will hike rates by 15bp and reduce its bond-buying program simultaneously. We believe that the economy is back on a recovery track after an unexpected contraction in the first quarter of 2024, and solid wage growth for May should the central bank give more confidence.

In addition, the BoJ has also expressed concern that a weaker yen could lead to higher inflation. This could dampen household spending. Markets will also be watching closely for the BoJ's plans to taper its government bond purchases and the pace and scale of those purchases. The market consensus seems to be that it will start with a cut from JPY6tr to JPY5tr and reduce it to JPY3tr over the next two years.

Australia: June CPI

The June CPI inflation reading is critical for the outlook for the 6 August Reserve Bank of Australia (RBA) meeting. We expect the monthly inflation rate to be 3.8% year-on-year, which would stem from a 0.5% month-on-month increase in the price level. While 3.8% would be lower than the 4.0% rate recorded for May, 0.5% MoM leaves the run-rate of inflation way higher than it needs to be to bring inflation back to target. It would also lift this year's second quarter inflation rate to 3.8% from 3.6% in the first quarter. Recent comments from RBA Governor Michele Bullock seem to support the notion that domestic demand is too strong to allow inflation to fall at an acceptable rate, and we see the only logical response being a rate hike.

China: July PMIs

China publishes its PMI data next week. The official CFLP manufacturing and non-manufacturing PMI will be released on Wednesday. The manufacturing PMI may remain in contraction for a third consecutive month after two straight months at 49.5; we are looking for a slight pullback to 49.3. The Caixin manufacturing PMI will be released on Thursday. The Caixin PMI has fared better than the official PMI in recent months, partly due to support from export demand; the Caixin PMI sample is more heavily weighted toward private enterprises and exporters than the official PMI. If we begin to see the two PMI readings converge, this could be an early sign of export demand softening.

Taiwan: Advance GDP and PMIs

Taiwan also releases its second quarter GDP data on Wednesday. Growth is expected to moderate from the first quarter’s 6.56% but to continue rising rapidly at around 4.2% YoY. Strong exports and industrial production should support growth in the second quarter. Taiwan will also publish its June manufacturing PMI data on Thursday, where we will see if its manufacturing can remain in expansion for a fourth consecutive month.

Korea: July Trade, CPI and Industrial Production

According to the second quarter GDP data released this week, manufacturing industrial production is expected to rebound in June after falling in May. Growth will be driven by semiconductor and auto production, but retail sales, construction, and capex are expected to be weak and drag down overall economic activity. Solid gains in manufacturing are likely to be confirmed by July export data. Meanwhile, consumer inflation is likely to accelerate due to recent hikes in gasoline and city gas prices.

India: June fiscal deficit

India's public finances for 2024/2025 have gotten off to a very good start as the May figure registered a surplus after the April deficit. That leaves the year-to-date budget for the first two months of the fiscal well down on where a theoretical value for an on-target 4.9% GDP deficit for the full year would be by now.

Of course, these deficit figures are very volatile, but having a cushion at the beginning of the year provides some scope for later slippage without missing the target for the year. The June 2023 deficit was INR451,370 crore (crore = 10 million) and so any figure there or thereabouts for June this year would leave the YTD figure well on track to achieve or undershoot the deficit target. The latest budget at a glance produced last week can be found here.

Indonesia: July CPI

June inflation may edge up to 2.6% after moderating in the last few months and recording just 2.5% in May. The IDR has been a direct beneficiary of lower inflation and any drift upwards may put the currency back under weakening pressure.

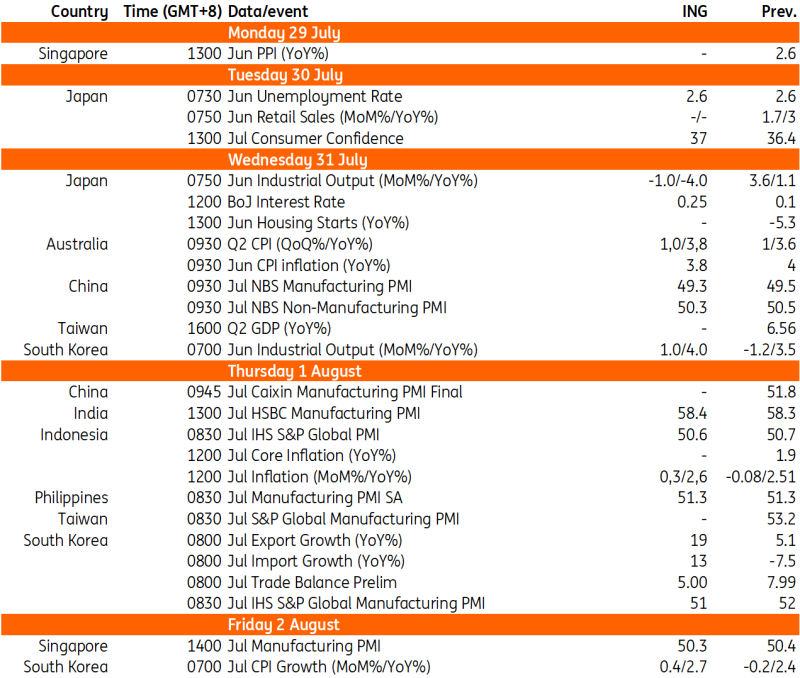

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Italian Confidence Data Confirms Divergence Between Consumers And BusinessesHungarian Employment And Participation Rates Reach New Highs

The Commodities Feed: Gold Slumps To Two-Week Low

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more