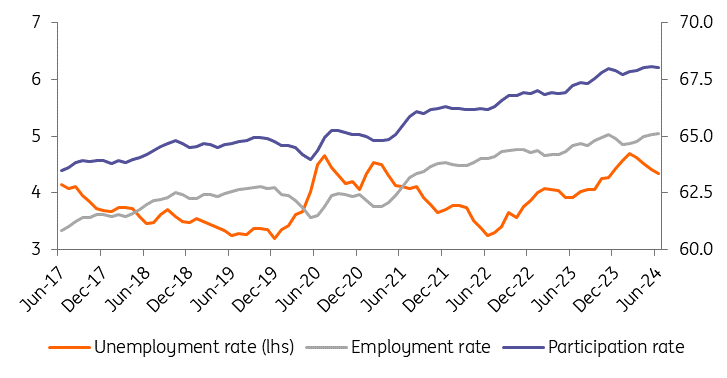

Hungarian Employment And Participation Rates Reach New Highs

Both the participation rate and the employment rate reached new highs in June. This makes it hard to argue that labour market tightness in Hungary is still easing. We expect the positive momentum to continue, which could keep wage growth elevated and pose an inflationary risk.

| 4.3% |

Unemployment rate (Apr-Jun)ING Forecast 4.4% / Previous 4.4% |

| Better than expected | |

According to the latest unemployment statistics of the Hungarian Central Statistical Office (HCSO), the slow but trend-like positive change in the labour market observed since the beginning of the year has not been broken. The model estimate shows a decline in the monthly unemployment rate to 4.2% in June 2024. Meanwhile, the official three-month moving average rate (based on survey data) also improved by 0.1ppt to 4.3% in April-June. The data received is broadly in line with our expectations. As for the number of those unemployed, both statistics show a decline and the unemployment figure sits around 210-215,000.

Historical trends in the Hungarian labour market (%, 3-m moving average)

(Click on image to enlarge)

Source: HCSO, ING

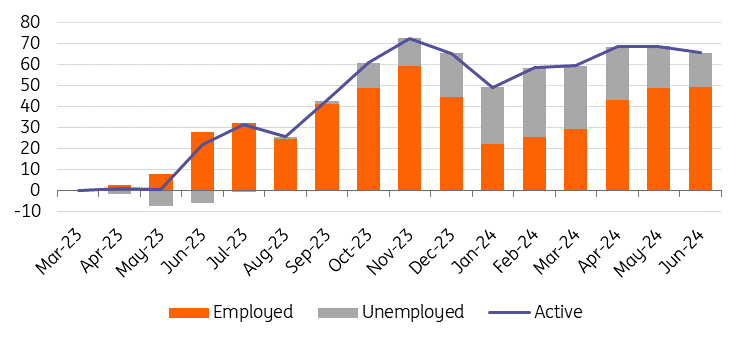

Looking at the detailed data, we see that the number of economically active people (i.e., labour market participants) increased significantly in June, parallel with the decrease in the inactive group. Meanwhile, the unemployment figure fell only marginally (by less than 2,000 persons). As a result, there was essentially a leap from inactivity straight to employment status for those returning to work.

The most obvious explanation for this is the seasonal increase in demand for labour, especially in agriculture. Seasonal workers continue to return to work in the following months, and we therefore see a similar outcome in the details in the summer. As a result, the number of those employed has risen to record levels again – at least according to the monthly statistics. The same can be said for both employment and participation rates. So, while the labour market story over the past year or so has been one of easing tightness, this narrative now seems to be unravelling.

Recent cumulative changes in the Hungarian labour market (‘000 persons, 1Q23=0)

(Click on image to enlarge)

Source: HCSO, ING

In light of the latest labour market data, it is getting easier to understand why wages in the private sector are still rising so dynamically (13.5% year-on-year in May) even though surveys had predicted only a 5-10% increase in wages this year. The labour market has recovered faster than expected, while new production capacity via foreign direct investment (FDI) set to come in soon is encouraging firms to retain workers with higher salaries. To cope with rising labour costs, companies have built up considerable liquidity in a seemingly uncertain economic environment and are now investing these resources in labour rather than capital. The biggest open question, however, is how long this process can continue without internal pressure to raise the prices of goods and services provided. We suspect that as soon as domestic demand growth shifts into higher gear (by the first quarter of 2025 at the latest), companies will respond with higher prices, even pre-emptively, based purely on the expectation of growing demand in the future.

Two forces will shape the labour market in the coming months. On the one hand, seasonal employment may continue to rise in the remaining months of the summer. This could contribute to further gradual improvements in the main labour market indicators. It could also work in this direction if the nascent recovery in the construction sector is indeed sustained. However, this stands in contrast to industry's weak performance, where there is increasing evidence of a rationalisation of working hours and staffing levels in response to the fall in order books, as confirmed by institutional labour statistics.

All in all, these factors point to a slight improvement in the coming months, provided that the favourable developments in domestic demand continue. By the end of 2024 and after some fluctuations in the middle of the year, the unemployment rate could be close to its current level of 4.2%.

More By This Author:

The Commodities Feed: Gold Slumps To Two-Week LowFX Daily: Multiple Factors Still At Play In FX

Asia Morning Bites For Friday, July 26

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more