Airline Stocks Surged To All-Time Highs When Oil Was Trading Above $100/Barrel

Brent crude oil came close to $114 per barrel on Wednesday, its highest level since June 2014, as the conflict in Ukraine intensified and sweeping economic sanctions were imposed on Russia, the world’s third largest oil producer.

As a result of geopolitical uncertainty, stocks have largely sold off, with the MSCI World Index dropping more than 2.6% in the month of February.

Global airline stocks, though, finished the month slightly ahead with a gain of about 0.6%, a possible sign that investors were sensing a return to normalcy from the pandemic before the Kremlin began rattling its saber.

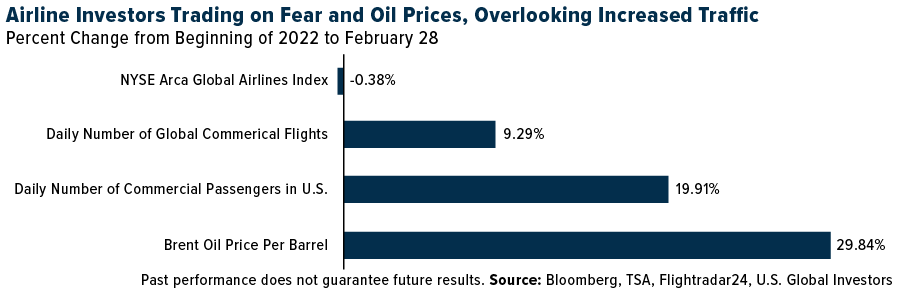

But now airlines face a new challenge with higher fuel costs—or so the market seems to believe. Even though demand for commercial air travel increased nicely in the first two months of 2022, with the number of global flights growing 9.3% and number of U.S.-based passengers growing 20%, an index of global airline stocks dipped a moderate 0.4%.

This has created what I think could be an attractive buying opportunity.

Operating Efficiently In A High Fuel Cost Environment

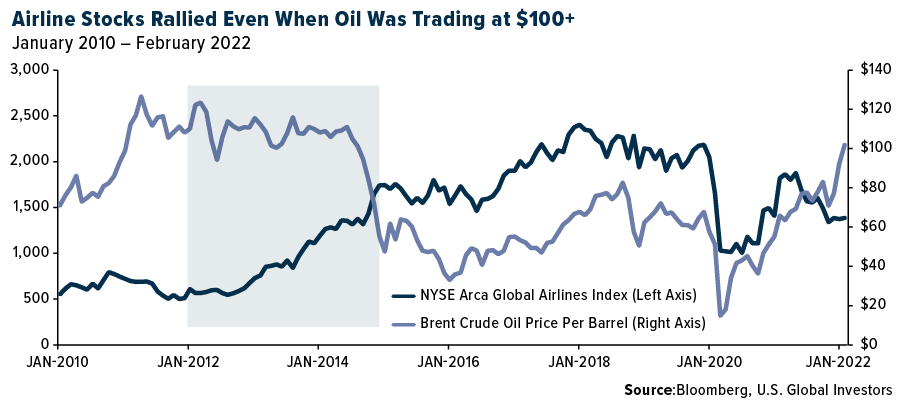

The price of crude has advanced a lot so far this year, and fuel is one of the biggest expenses airlines have. That alone may seem like a major headwind. But higher fuel costs have not necessarily stopped shares from rising.

Take a look below. Oil prices were highly elevated from 2011 to mid-2014, and yet global airline stocks surged to new all-time highs.

They continued to soar over the next few years, not just because the oil market collapsed, but because carriers had become leaner and more efficient. They learned to pack more people on every flight, they practiced capacity discipline by getting rid of unprofitable routes, and they started charging extra for perks and services that used to be included in the price of a ticket.

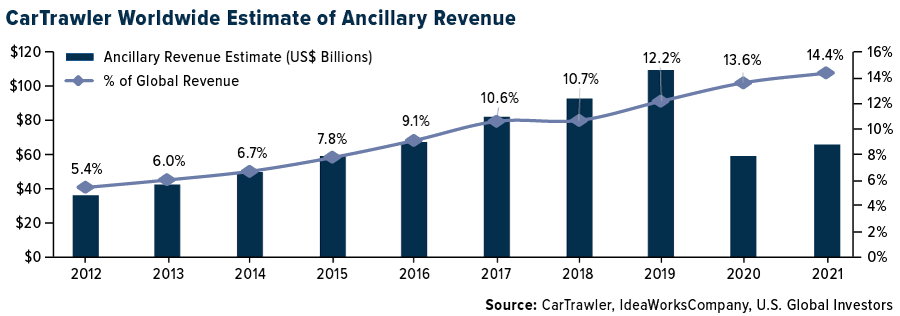

In 2012, these ancillary fees generated under $40 billion for global carriers, and by 2019, they were responsible for bringing in close to $110 billion, according to IdeaWorks. Even though the fees fell in dollar terms due to the pandemic, they continue to represent a larger share of global airline revenue, which should help companies offset the rising cost of fuel.

Capacity Discipline Is Also Key

In addition, some analysts have shown that airline stock performance is driven not by oil prices or even earnings but by the perception of pricing power. Back in 2016, Wolfe Research’s Hunter Keay told CNBC that, in certain environments, high fuel costs could actually be good for carriers because they encourage capacity discipline, which in turn makes the group more attractive to investors.

“Capacity discipline and fundamental behaviors are far more important than the amount of money [carriers] earn,” Keay explains. “It’s got nothing to do with estimates; it’s got nothing to do with margins; it’s got nothing to do with how much money or cash flow you’re making, even. It’s how you make it. Is it sustainable? High oil prices create that dynamic.”

Granted, airlines are facing challenges at the moment that didn’t exist when Keay made these comments, including the ongoing pandemic and Russia’s aggression against its neighbor. And yet his fundamental point remains intact.

How much do you know about oil? Take our quiz and find out by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to ...

more

What about Boeing? $BA