A Huge Decline In French Economic Confidence, But Sector Differences Remain

In France, the main business climate indicator posted an unsurprising decline. However, the details of the survey reveal significant differences between sectors and show the effectiveness of safeguarding measures, while confirming some pitfalls.

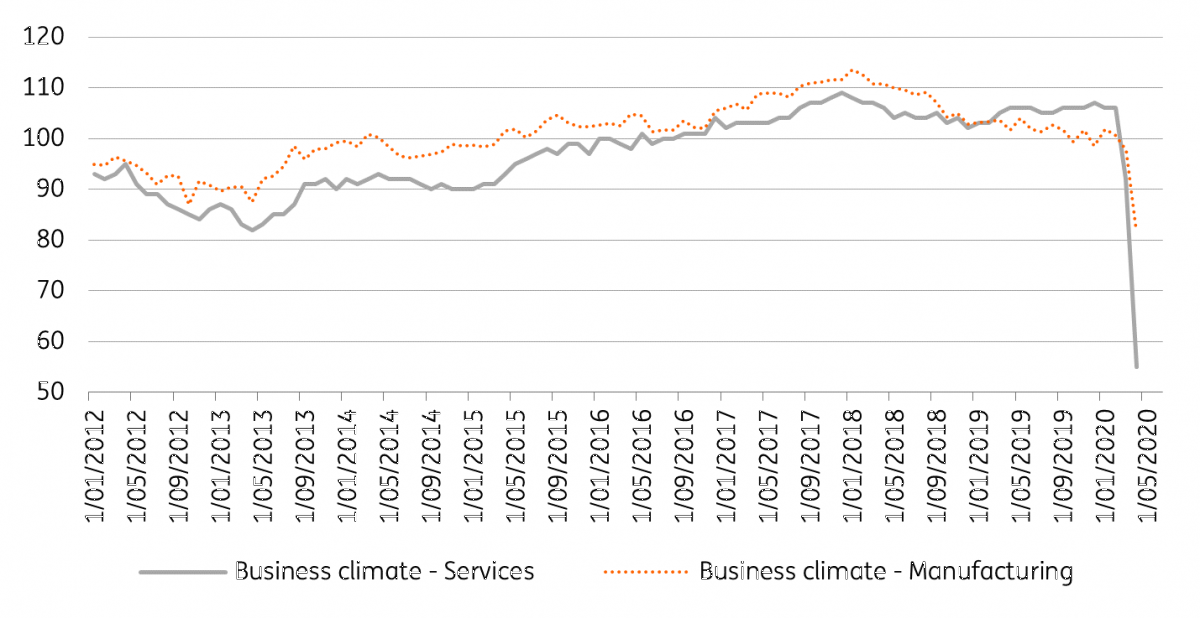

Service confidence is at an all-time low

Confidence in the French service sector fell to an all-time low in April, plunging from 92 to 55, a figure that PMI indicators (at 29 in March and 27.4 in April) had previously suggested. At the height of the 2009 crisis, the indicator had fallen to 67. Note that the survey's components relating to recent activity declined less than at that time, reflecting the suddenness of the current shock. These figures, at least for now, suggest that firms are more positive about their situation than in 2009 perhaps due to the measures introduced by the government.

It is noticeable that the employment trend, as measured by recent hirings as well as intentions, has deteriorated more sharply for temporary workers than for employees who benefit more easily from partial unemployment measures. More than one employee in three is currently benefiting from the schemes. These figures show that the policies in place have made it possible to limit the fall in entrepreneurs' confidence in the state of their own business and to limit the damage to employees. On the other hand, they illustrate the fact that temporary workers, who are generally already less protected, are more likely to end up unemployed this time once again.

Confidence indicators for the retail sector continue to illustrate the atypical consumption behaviors of this period, for example through the continued high level of expected sales of food products (and the continuing fall in most other categories).

Sharp drop in confidence in April

Source: Refinitiv Datastream

Industrial confidence is faring better

The industry confidence indicator fell much less than expected to 81.9 after 97.7 in March; the April figure is still well above the 2009 low of 66.1. This is all the more astonishing given that capacity utilization had fallen from 78% to 56% in March, compared to a 70% low during the financial crisis. Indeed, despite this drop in capacity utilization, the survey shows recent output decreasing but it's not in freefall. This probably means that the figure for May will be even worse. In contrast to service companies, manufacturing companies are as negative today as at the worst point of the 2009 crisis about their own situation; their confidence in the general economic outlook is at an all-time low.

A positive element of the survey, which partly explains why the decline in confidence is not as large as expected and illustrates the importance of the supply shock (in the sense of an inability to produce), is the relatively good performance of order books. Of course, they are not well filled, but are comparable to those of 2013, far from the low point reached in 2009.

Strong recovery measures are needed

The April confidence indicators confirm that only 65% of the French economy is functioning during the lockdown. The lengthening of this period until May 11, therefore, means that the GDP contraction in 2Q20 could reach unprecedented proportions and that a strong recovery plan will be needed if we're to avoid a worse recession the government's currently expecting, that of an 8% contraction in 2020.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more