Find Out How Robo-Advisors Diversify Your Investments

It all started several years ago when I met Invesco's early-stage robo-advisor, Jemstep. As a former portfolio manager who morphed from a value-oriented contrarian stock picker to a lazy passive index fund investor, I was intrigued. Could a digital investment platform carry out the careful index fund asset allocation that I work tirelessly to perfect? In order to find out, I took a spin on the Jemstep platform and found that after a quick risk tolerance questionnaire, the robo-advisor-suggested asset allocation was remarkably similar to the one that I had so carefully crafted.

Jemstep, now marketing directly to the financial advisory community, previously allowed investors to maintain their investments with their existing custodians. This legacy robo-advisor provided asset allocation recommendations for the investor to carry out on her own. Thus, my interest was piqued: Could a robo-advisor really provide all that a sophisticated investor needed?

The Robo-Advisor Diversification Conundrum

I continued to study the robo-advisors, their similarities and differences. Simultaneously, I wrote many articles about the industry for Investopedia. I was curious to discover if there was a robo-advisor that offered a platform diverse enough, with various asset classes, to meet the needs of the investor seeking a level of diversification that went beyond the traditional, U.S. and international stock ETFs and broad total bond market and government bond ETFs. What I found was a tremendous amount of distinction within the investment asset classes offered by the various ETFs.

Tony Ash, Seeking Alpha contributor, wrote about the divergence in asset allocation recommendations among the robo-advisors in "Are All Robos the Same?" He also touched upon the various number of asset classes offered by Betterment and Wealthfront. Ultimately, there's tremendous heterogeneity within the robo-advisory industry, as each digital investment advisor offers distinct asset classes and ETF selections.

While the decision about whether to invest with a robo-advisor is a personal one, it's useful for the investor to understand the vast diversification models within the broad automated investment advisor offerings.

When looking at the diversification of individual robo platforms, I discovered that although the majority of robo-advisors trade in exchange traded funds, there are a few that incorporate individual stocks as well. Additionally, several robo-advisors offer funds that recognize the well-researched market anomalies such as the long term outperformance of small caps and value stocks. A recent CFA blog article, "Generating Alpha by Exploiting Market Anomalies," by David Larrabee, CFA, claims that since 1926, US small cap stocks outperformed large caps by an average of 2.7% annually.

Ultimately, if you're searching for the diversification opportunities behind various robo-advisory platforms, take a look at how several companies diversify their clients' assets.

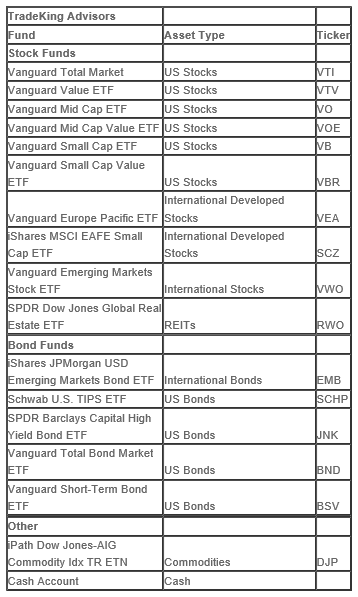

TradeKing Advisors Assets

TradeKing Advisors (TKA) takes the diversification lead with 17 funds included within their investment options. The availability of market-cap-related ETFs include a mid and small cap ETF that captures the market anomaly that small caps outperform larger cap stocks. TradeKing Advisors also nods to the value investor with a mid cap value and small cap value ETF. Other specialty TKA ETFs include several unique international funds, the iShares MSCI EAFE Small Cap (NYSEARCA:SCZ) ETF and the SPDR Dow Jones Global Real Estate (NYSEARCA:RWO) ETF. TKA tackles the bond asset class with high yield corporate and international emerging markets bond funds. Finally, this robo-advisor expands the traditional asset classes with a commodity index fund offering, iPath Dow Jones-AIG Commodity Idx TR (NYSEARCA:DJP) ETN.

Personal Capital

Personal Capital is quite unique in both its offerings, holdings and diversification orientation. At first glance, the diversification for their stock allocation is in line with many others: U.S. stocks, developed market international stocks and emerging market stocks. Yet, their methods of capturing distinct asset classes is unlike the competition. Personal Capital buys individual stocks for their client portfolios instead of choosing from existing ETFs. The firm also subscribes to a tactical sector-weighted asset allocation instead of a market capitalization-weighted approach.

In the bond asset classes, Personal Capital includes the typical corporate and inflation-protected bonds. They also offer international bonds as do several other automated investment platforms.

Personal Capital deviates from the commonplace by offering an alternatives asset class that includes the following sectors:

- Real Estate

- Gold

- International Real Estate

- Energy

- Food

- Metals

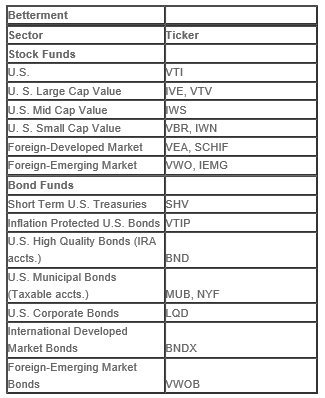

Betterment

Betterment, a goals-based robo-advisor sticks to the more typical financial assets. The company recently launched a tax smart asset location option for their investors to accompany their internationally diversified investment options.

The Betterment investment choices span diversified U.S. stock and bond ETFs without any "alternative" asset classes. The stock asset choices include broadly diversified U.S., developed and emerging markets international funds. Seeking to exploit the value market anomaly, Betterment includes U.S. large, mid and small cap value ETFs.

Betterment offers broader diversification in the bond sector than many of its competitors with munis, Treasuries and corporate bonds along with several international bond funds. The international bond ETFs include both developed and emerging market international bond ETFs, a unique addition to the typical robo-advisory ETF offerings.

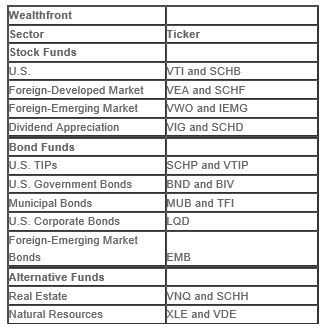

Wealthfront

Wealthfront, another low-fee robo-advisor with a wide slate of ETF options differs somewhat from its competitors by adding sector real estate and natural resources ETFs. Their vanilla stock ETFs are flavored with a dividend appreciation ETF, unlike many of the company's peers. The Wealthfront bond diversification options include typical government, corporate and munis along with a foreign emerging market bond fund.

In the final analysis, although the robo-advisory landscape is frequently discussed as if it were uniform, it isn’t. From various definitions of conservative, moderate and aggressive investors to opportunities for diversification, the robo-advisor field is diverse. Before turning your investing over to a digital algorithm, understand whether the robo-advisor’s underlying individual investment choices are in line with your diversification preferences.

Disclaimer: I am a portfolio manager, former ...

more

Thanks Danielle, I'll check it out. I've thought about that topic myself.

Interesting piece, thanks. You'd probably like the recent post by @[Cullen Roche](user:18262), "Have We Reached Peak Robo Advisor?" www.talkmarkets.com/.../have-we-reached-peak-robo-advisor