Will The Fed Bankrupt The Tooth Fairy?

Imagine for a moment that we become a cashless society.

That payments are done by a Central Bank Digital Currency (CBDC).

No more dollar bills… no more quarters, nickels, or dimes. All… on your phone.

Forget the government tracking… the invasion of privacy… the central bank’s ability to see everything you buy… and the possibility of bans on certain products (the latter was embraced in a recent panel at the World Economic Forum.)

Instead, let me ask a question…

What would the Tooth Fairy then leave under a pillow?

A QR code?

A cold wallet with Bitcoin in it?

Candy?

This morning, my daughter turned and wiggled a tooth.

Another one is coming loose.

She’s expecting a payday.

She lost her first two teeth during our trip to Switzerland. Before the trip, we’d discussed that the Tooth Fairy would leave money under her pillow.

But we thought it would happen before takeoff…

So, we had to improvise.

My wife explained that there’s a different tooth fairy in Switzerland – who uses local currency.

But I went overboard.

Since Switzerland is a wealthy nation with a very free economy and enviable tax system, I later justified, my daughter received five Francs per tooth…

Yes, I say these things to a five-year-old.

That was roughly $5.60 per tooth based on the currency exchange rate.

The truth was we didn’t have any dollars… and we only had “5 Franc” coins on us…

So, that’s what we gave her, much to the chagrin of my friend’s daughter, who only received one franc per tooth for several years…

Now… what about the U.S. tooth fairy’s upcoming visit?

Well, the U.S. fairy is subject to different business conditions… a worse economy… higher taxes… and economic rot…

State and Federal governments take a giant bite out of her ass.

She pays a lot for licensing to local state agencies and must be certified to handle teeth properly…

I also assume she had to bribe Senator Bob Menendez just to operate in New Jersey.

Sure, she’s still magical…

But she operates under the strain of an economic system that’s dropped from 5th overall on the Heritage Economic Freedom Index to 25th in a little over a decade.

I also imagine the U.S. tooth fairy looks somewhat similar to the late-comedian Chris Farley (Midjourney)

So, based on this analysis, my daughter should only get $2 per tooth on this side of the Atlantic.

Now, I thought it was fair pay, until I looked it up.

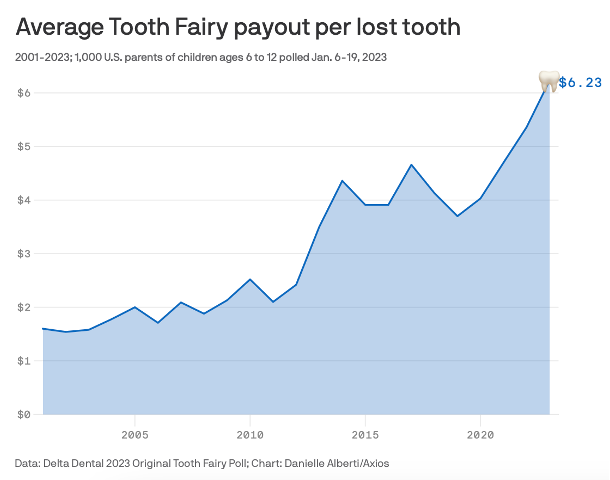

But look at this chart.

In February, Axios said the average Tooth Fairy payment has surged from $2.00 in 2005… to $6.23 this year.

Talk about inflation!

I’d better go to the bank today…

Tooth fairy payments naturally started to explode in 2012 when the Federal Reserve effectively made Quantitative Easing a permanent fixture.

So, thanks a lot to Federal Reserve chairs Ben Bernanke, Janet Yellen, and Jerome Powell…

A CBDC advocate would say that it would reduce that inflation over time.

But it’d probably just put the tooth fairy out of business.

Inflation and the Liquidity Cycle

If Wednesday’s press conference by Fed Chair Jerome Powell taught us anything, it’s that the chances of a Fed rate cut in 2024 are approaching the odds that the Tooth Fairy is real.

“Higher for longer” on interest rates is the path forward.

And we expect that more pain is coming.

As I noted yesterday, duration risk in the bond markets will remain a credible problem in the next two years.

Who will buy a 10-year bond at 4.4% when they can get 5% on a two-year bond? The Treasury Department will need to get more investors into longer-duration bonds… it can’t just keep rolling over debt every two years at higher rates in larger quantities.

The coming rollover and an explosion in domestic bond issuance are massive problems. We have about $8.7 trillion in short-term debt that needs refinancing and another $2 trillion in deficit spending locked in for next year… all while the Fed reduces its balance sheet by roughly $500 billion.

So… the 10-year must go higher – upwards of 5.25% - which will weigh heavily on risk assets.

But – the bigger picture emerges when discussing the liquidity cycle itself. As Michael Howell at CrossBorder Capital noted this week, liquidity cycles operate on five-to-six-year cycles, and we likely bottomed out in October 2022.

Howell projects that global liquidity (directly impacting risk assets) is in a rebound stage today.

And this will benefit two sectors with compelling (read: low) valuations.

That’s energy and financials.

I find this argument compelling… if only because both have had VASTLY different performances this year.

Share Florida Republic Capital

Value and Momentum in Energy and Financials

Let’s start with the financials…

Who wants to own a bank stock right now?

Our equity readings suggest… VERY few buyers right now.

It’s hard to get people excited about banking in general. But the recent downturn in March, coupled with questions about banks' duration risk on bonds and higher deposit costs… has punished the financial sector.

Financials were in a negative momentum quadrant for 70 days from March through May. They’ve been negative since selling accelerated on August 14.

What’s fascinating about the current situation is that buying pressure was worse today than on March 15, at the peak of the March banking spasm.

Back then, insiders loaded up on their stocks – especially the banks that weren’t effective by duration risk.

There has been a lot of insider buying in the financials over the last ten days, but it hasn’t happened in the banking sector… properly. There were plenty of deals back in March. We’re watching to see if we get buyers very soon.

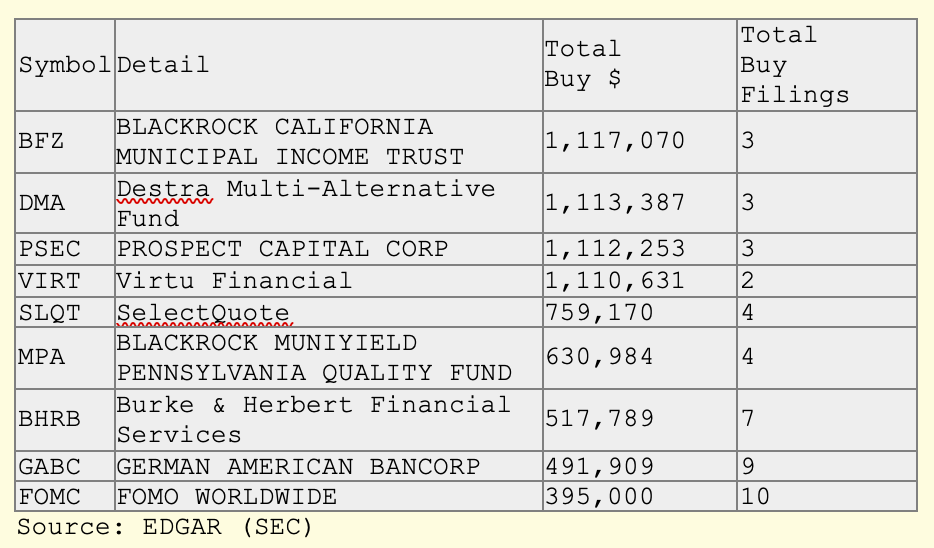

Here are the ten largest buys in the financial industry in the previous ten days.

It feels like we’re not quite there yet on the latest cycle.

We’ll see how this plays out in the next week. I’m keeping a close eye on the S&P 500 SPDR Financials (XLF), which are again moving toward oversold territory.

Energy is Red Hot

Energy, meanwhile, is the ONLY thing working in this market. Energy has been red hot since June, and it's been in positive momentum conditions for 64 straight trading days.

Naturally, I’m worried about a risk selloff in this sector very soon, as I explained in my “Counternarrative” piece last week.

But – energy – from a “fundamental” perspective is still incredibly cheap. The S&P 500 P/E ratio sits at 23.5x right now.

The S&P 500 Energy Select Sector SPDR ETF (XLE)’s weighted P/E average is 9.24x.

Companies in the space have engaged in incredible capital discipline for years.

Energy producers learned the lesson of the 2014 oil boom when crude surged above $100. They overproduced, flooding the market. Crude fell under $40 within two years.

They won’t be doing that again.

Within the energy space, 20 oil-and-gas names have Piotroski scores over 7, no credit problems, and low buyout multiples. There’s a lot of great names there.

Looking ahead, we must play the inflation playbook, combined with expanding liquidity on a global scale. I'll let you know when the financials start to turn the corner.

For now, we’re happy to trade in the short term on positive momentum for energy stocks and invest in energy for the long term.

More By This Author:

Postcards from the Florida Republic - October 23, 2022

Postcards From The Florida Republic - Labor Day Edition

Three Overvalued Tech Stocks To Sell Right Now

Disclosure: None.