Tiny Tech Bank Defies US "Massacre Of The Minnows"

It’s a truism that the United States has too many banks, and even after the collapse of four lenders this year the country could stand to lose a few more. But while the latest count of nearly 4,100 institutions may be excessive, it’s not always true that bigger is better. One example is $1 billion Live Oak Bancshares (LOB), which flouts many preconceptions about what it means to be a tiny U.S. bank.

Founded in 2008 by former Wachovia banker Chip Mahan, Live Oak was until recently spoken of in the same sentence as Silicon Valley Bank – the lender that rocketed to greatness and then imploded in March. While SVB was much bigger, both were niche groups that grew rapidly: between 2017 and 2022, each quintupled its assets, with Mahan’s bank recently hitting $10 billion. The market rewarded them lavishly. Of the over-140 lenders that make up the S&P U.S. Regional Banks index, Live Oak was the most richly priced at its 2021 peak, at more than 5 times book value. The next on the list, crypto-specialist Silvergate Capital, flamed out one day before SVB.

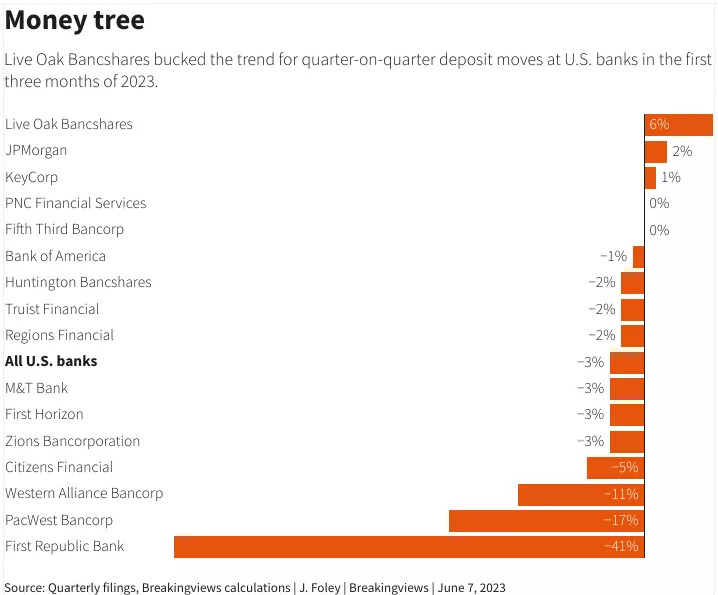

But if those failures demonstrated that rapid growth brings escalating risk, Live Oak is a counterexample. Take funding. SVB and Silvergate loaded up on large, uninsured deposits to fuel their expansion, leaving them vulnerable to bank runs. At the end of 2022, around 90% of SVB’s customer savings were uninsured. At Live Oak, by contrast, just 15% of deposits are above the government guarantee limit, based on its latest regulatory filing. And those potentially flighty funds are more than three times covered by cash and rapidly available credit lines. That makes the North Carolina-based firm about as run-proof as a small bank can be.

In lending and investing, too, Live Oak has zigged where others zagged. Investors in U.S. regional banks have zoomed in on risky real-estate lending, sagging bond portfolios and exposure to struggling tech firms. Mahan’s assets, by contrast, are positively prosaic. Live Oak has spent the last 15 years cornering the market in small-ticket lending backed by the U.S. government’s Small Business Administration (SBA). Think dentists, veterinarians and chicken farms – industries with historically low levels of default. It’s now the biggest SBA lender. Because of the way that programme is structured, around 40% of Live Oak’s lending carries a government guarantee.

Despite its low-tech clientele, Live Oak most punches above its weight in digital innovation. Mahan’s bank has no traditional branches, instead gathering deposits online. The company spun out its cloud-based banking software division nCino in 2014; that firm is now worth $2.8 billion, more than twice Live Oak’s value. Gains from venture-style investments have produced a quarter of the bank’s pre-tax profit since it went public in 2016, according to Refinitiv data.

The question is whether Live Oak, for all its advantages, is doomed to relative smallness. Huntley Garriott, the ex-Goldman Sachs banker who runs it, reckons he can grow assets by 15% a year, and command a 15% return on equity – comparable with JPMorgan’s targeted returns. At that rate, Live Oak could double its balance sheet in five years. But even then, it would only be the country’s 85th biggest lender, based on Federal Reserve data. Rising interest rates have taken the shine off the bank’s valuation too. Where it once traded at 5 times book value, it’s now closer to 1.5 times, according to Refinitiv. The focus on small businesses may not be so great in a recession – analysts at Truist expect its bad-loan loss rate could look worse than its community-and-regional-bank peers’ next year.

That more earthly valuation might reflect Live Oak’s biggest risk: that it starts to look more like the rest of the pack. Since 2016 the bank has quadrupled the number of industries it lends to under the SBA’s classification, including some sectors like self-storage that have experienced rapid, sometimes-speculative growth. Where once it sold the bulk of its loans to other investors, it now keeps most on its balance sheet, and increasingly makes conventional, non-guaranteed loans too. And to keep growing, Live Oak will need deposits. Those no longer come cheap, especially for a bank without branches or decades-long customer relationships.

An impatient owner might spy an easy answer: sell to a bigger rival. A larger group – say, Truist Financial, PNC Financial Services or Citizens Financial – could turbocharge Live Oak’s loan book by funding it with cheap retail deposits. Still, analysts at Keefe, Bruyette & Woods reckon that the bank’s standalone net interest income will soar by a fifth next year, implying it can grow even without such help. And Mahan, with 15% of Live Oak’s stock, shows no signs of being a seller. If he didn’t cash out when the shares were close to $100, it’s hard to see him doing so now they’re a quarter of that level. Live Oak may therefore remain a sapling surrounded by redwoods. There’s room for both.

More By This Author:

S&P 500 Earnings Dashboard 23Q1 - Friday, June 9

U.S. Weekly FundFlows: Conventional Investment Grade Funds Attract Largest Weekly Inflow Of 2023

TSX Earnings Scorecard 23Q1 - Thursday, June 8