Does The Fed Have To Shrink Its Balance Sheet?

In March, the FOMC majority opinion held that it was time to start to shrink the Fed’s balance sheet and that the reduction should be carried out in a “predictable manner”. Various Fed members want to halt the program of reinvesting principal payments from maturing securities, starting as soon as this year, according to the minutes of the March meeting. The FOMC has been clear that a tightening program would eventually involve shrinking the central bank’s balance sheet. However, it said that it will not start unloading securities until the federal funds rate is ``normalized``. Yet, recently, a number of Fed officials have come out in favor of shrinking the balance sheet starting this year.

The financial markets have been expecting this kind of statement for some time, yet scant discussion has taken place on the basic question: is it necessary to do shrink the balance sheet?

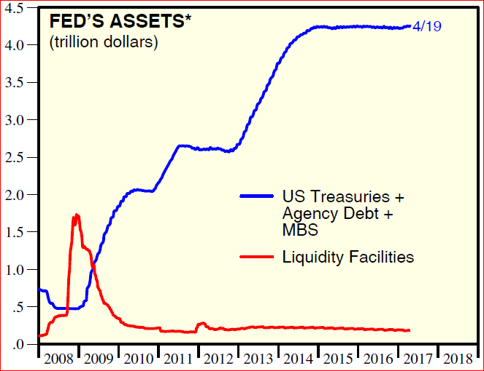

Conventional thinking is that, since quantitative easing is an “unconventional” policy, it is high time to return to more traditional Fed policy. Expanding the balance sheet from $800 billion to $4.5 trillion (see accompanying chart) in a short time is highly unconventional and a return to normalcy is required. Former Chairman Ben Bernanke has gone on record saying that ``the prudent approach to shrinking the balance sheet is ... to delay the beginning of that process until the short-term rate is well away from zero``[1]. He seems to be in no hurry to start that process given the current interest rate levels.

Source: Yardeni Research Inc.

A recent article in the Financial Times by Alexandra Scaggs makes several interesting points in favor of retaining a large balance sheet.[2] :

- A large balance sheet gives the Fed lots of leeway in setting short-term interest rates; the rate paid on bank reserves deposited with the Fed creates a rate ceiling and the rate charged on reverse repos maintains a floor

- Academic studies have made the case that the balance sheet provides the private sector with a large pool of safe assets to satisfy its need for short-term liquidity; the private sector would not be forced to buy risky assets such as those that were featured in the 2008 crisis.

- Reducing the balance sheet would deprive overseas banks from accessing dollar funding as part of an effort to stabilize their economies; and,

- A large balance sheet will provide the Fed with a strong backstop of solid assets to use in the event of a financial crisis.

So far, investors have yet to receive a cogent argument from the Fed as to why the current level is unacceptable and what is an acceptable level of securities to hold, post 2008. The Bank of Japan has a much longer history of quantitative easing and relatively a much larger balance sheet. There is no talk about reducing the BoJ holdings. It appears that this policy is no longer so ``unconventional`` in Japan. Before the Fed gets this program underway, we need a fuller explanation on why moving forward is necessary now.

[1] Shrinking the Fed’s balance sheet

[2] FT Weekend, April 23,2017 `On Wall Street`

Disclosure: None.

One would want to infrastructure spending not to be offset by sterilization because stimulus is badly needed today.

Exactly, Norman! Trouble is, the Fed doesn't do anything unsterilized. I don't why that is, other than it fears inflation in an irrational way.

The only reason that makes sense is that the Fed wants to sterilize some other stimulus, like infrastructure stimulus. But so far that is not even happening. Also, the Fed could return the money gained to the treasury, and maybe there is a big shortage of bonds. Bond demand is still massive, despite bank efforts to pretend like it isn't.