Citigroup To Layoff 20,000 Employees To Boost Profits

(Click on image to enlarge)

Citigroup to Cut 20,000 Jobs Following Disappointing Quarter

Bloomberg reports Citi to Cut 20,000 Roles in Fraser’s Bid to Boost Returns

Citigroup Inc. said it will eliminate 20,000 roles in a move that will save it as much as $2.5 billion as part of Chief Executive Officer Jane Fraser’s quest to boost the Wall Street giant’s lagging returns.

Firmwide expenses are expected to drop to a range of $51 billion to $53 billion over the medium-term, Citigroup said. In the meantime, though, the firm expects to incur as much as $1 billion in expenses tied to severance payments and Fraser’s broader overhaul of the bank.

“The fourth quarter was very disappointing,” Fraser said in the statement. “Given how far we are down the path of our simplification and divestitures, 2024 will be a turning point.”

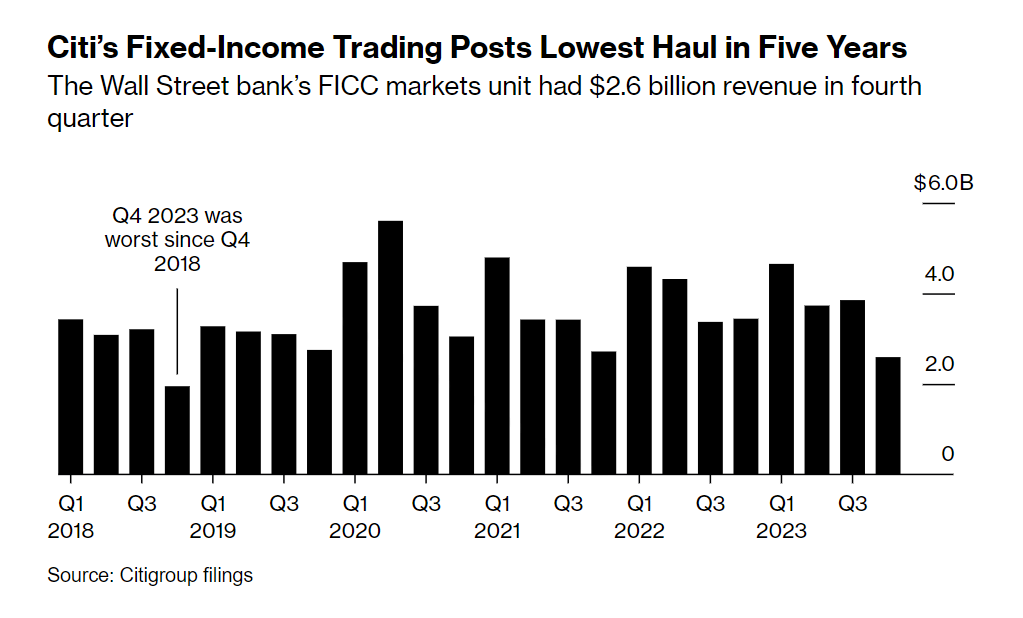

The outlook for cost savings helped mask a disappointing fourth quarter, when Citigroup’s fixed-income traders turned in their worst performance in five years as the rates and currencies business was stung by a slump in client activity in the final weeks of the year. Revenue from the business slumped 25% to $2.6 billion.

As it has sought to increase those returns, Citigroup decided to shutter its municipal business and distressed-debt trading unit, just as rival JPMorgan Chase & Co. invests further in the latter area. The bank is prepared to exit additional businesses within its markets division if they “don’t make sense for the go-forward strategy,” Chief Financial Officer Mark Mason said on a call with reporters.

Ultimately, firmwide headcount will decline by 60,000 jobs to 180,000 by the end of 2026, Mason said. That includes the 20,000 roles that will be eliminated as part of Fraser’s broader overhaul as well as 40,000 staffers that will depart when Citigroup lists its consumer, small business and middle-market banking businesses in Mexico in an initial public offering.

Ten Percent of Workforce

The Wall Street Journal notes the 20,000 layoffs are about ten percent of the workforce.

The cuts will trim about 10% of Citi’s head count, which totaled 200,000 in December excluding the staff employed by a Mexico business that is being spun off. Citi detailed its cost-cutting plans on Friday, when it also announced a fourth-quarter loss.

The third-biggest U.S. bank threw a kitchen sink of charges and expenses into its final 2023 earnings report, previewing them in a late Wednesday regulatory filing. The items, including some that exceeded what Citi had forecast as recently as last month, clouded underlying results that showed improvements in several key businesses.

Overall, Citi reported a net loss of $1.8 billion, or $1.16 a share, compared with net income of $2.51 billion, or $1.16 a share, in the same period a year earlier.

Revenue fell 3% to $17.4 billion from $18 billion. Citi said the recent devaluation of the Argentine peso had wiped out $880 million of the most-recent quarter’s revenue.

More By This Author:

Is Inflation Down? That’s What President Biden Says

Hertz Is Selling 20,000 EVs Due To Lack Of Customer Demand

Hotter Than Expected CPI Led By Rent, Up Another 0.4 Percent

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more