Is Inflation Down? That’s What President Biden Says

Let’s tune into a White House Statement on inflation to discuss what’s real and what is imaginary.

(Click on image to enlarge)

Statement from President Joe Biden

Please consider a Statement from President Joe Biden on the December Consumer Price Index

Today’s report shows that we ended 2023 with inflation down nearly two-thirds from its peak and core inflation at its lowest level since May 2021. We saw prices go down over the course of the year for goods and services that are important for American households like a gallon of gas, a gallon of milk, a dozen eggs, toys, appliances, car rentals, and airline fares. Despite what many forecasters were predicting a year ago, inflation is down while growth and the job market have remained strong. The economy has created more than 14 million jobs since I took office, and wealth, wages, and employment are higher now than under my predecessor.

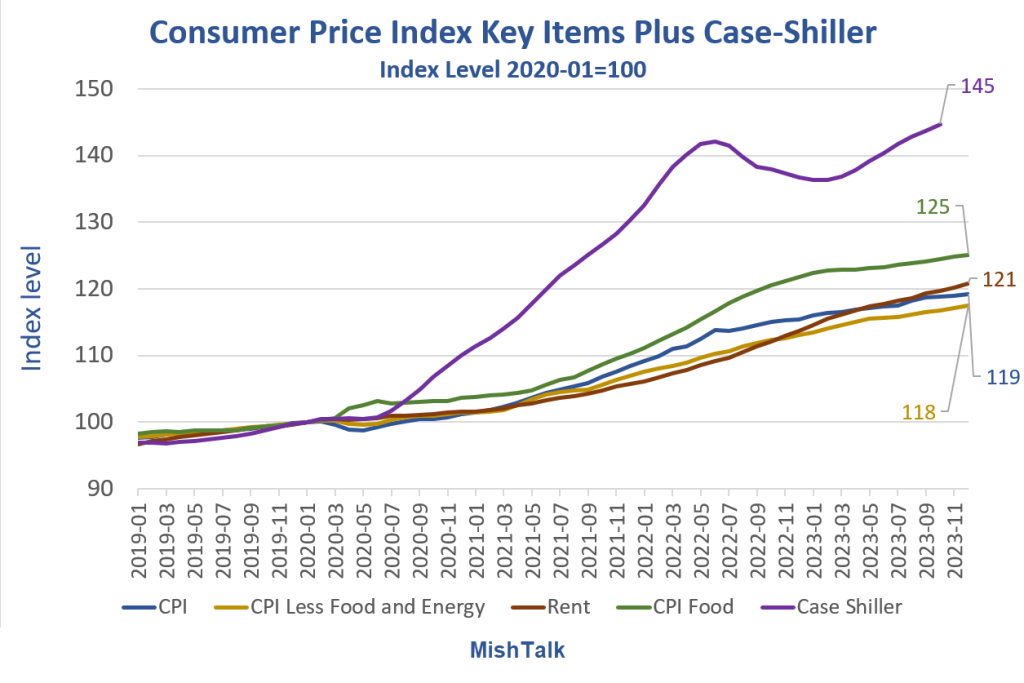

Consumer Price Index Change Since January 2020 Key Items

- Home Prices (Through October): +45 Percent

- CPI: +19 Percent

- CPI Excluding Food and Energy: +18 Percent

- Rent of Primary Residence: +21 Percent

- Food: +25 Percent

Inflation is not down. The CPI is not down. Some cherry-picked items are down from cherry-picked highs.

Consumer Price Index Biden Mentioned Items

(Click on image to enlarge)

Consumer Price Index Change Since January 2020 Biden Mentioned Items

- Energy: +28 percent

- Meat, Fish, Poultry, Eggs: +27 Percent

- Dairy: +21 percent

- Airline Fares: -5 Percent, Hooray!

If you cherry pick a top the declines look better, especially energy.

A comment on Twitter inspired this post.

Word Police

The Tweets generated a whole slew of comments. But conflating year-over-year change with actual price levels (purposely as team Biden does), or accidentally by others, is a major mistake.

Words matter.

Hotter Than Expected CPI Led by Rent, Up Another 0.4 Percent

(Click on image to enlarge)

For well over two years, economists and analysts said rent was declining or soon would be. But for the 28th consecutive month rent and OER were up at least 0.4 percent.

For discussion, please see Hotter Than Expected CPI Led by Rent, Up Another 0.4 Percent

I repeat my core key theme for over two years now. People keep telling me rents are falling, I keep saying they aren’t. I thought this may finally be the month the rent trend breaks but it wasn’t.

Rent of primary residence, the cost that best equates to the rent people pay, jumped another 0.5 percent in December. Rent of primary residence has gone up at least 0.4 percent for 28 consecutive months! [Note: somewhere along the way I got off by a month. Last month I said 28 months but it is 28 months this month].

The Housing Elephant Matters

Lost in the debate over the CPI index itself vs rate of change of the index and year-over-year changes is the housing elephant.

The price of a house is up a whopping 45 percent and rising. Rent is up 21 percent.

The 36 percent of the people who do rent have been royally screwed by Fed policy that inflated assets, especially home prices, in turn causing rents to soar.

The price of a house is not in the CPI. Instead, Owner’s Equivalent Rent (OER) is in the CPI.

The CPI is totally screwed up as a measure of inflation. Removing OER from the CPI does not address the issue, it understates inflation even more.

Inflation Matters, Not Just Consumer Inflation

Ignoring housing prices is what got the Fed into trouble in 2006 and again recently.

The price of eggs and airline tickets are down. La-de-da. How does that feel to someone renting and wanting to buy a home?

I can tell you by looking at polls.

Why Are Americans in Such a Rotten Mood?

Those who do rent, especially the lower economic groups, have been royally screwed by the combination of Fed policy and Bidenomics.

This idea addresses the question Why Are Americans in Such a Rotten Mood? Biden Blames the Media

People can cut back on some things but rent and food are not in that list.

For the 36 percent of the nation that rents, Bidenomics on top of Fed asset bubbles boosting home prices and rent has been a complete disaster.

It should be no wonder that people say they were better off economically under Trump.

Inflation Is Transitory to What?

The extra money home owners have in their pockets thanks to refinancing at 3 percent, coupled with Biden’s regulations, the end of just-in-time manufacturing, and totally inane energy policy all suggest the current easing of inflation is transitory.

My transitory position on inflation may be wrong. It’s just an opinion. There is a legitimate inflation/deflation debate, depending on what happens to asset prices and debt. I can argue both sides of that topic easily.

However, the CPI is up, inflation is up, and inflation is up even more if we properly account for asset bubbles. That’s not an opinion, it’s a fact.

More By This Author:

Hertz Is Selling 20,000 EVs Due To Lack Of Customer DemandHotter Than Expected CPI Led By Rent, Up Another 0.4 Percent

Consumer Credit Hits Record $5 Trillion, Credit Card Rates Also Record High

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more