Fetch.Ai - At The Intersection Of Blockchain And Artificial Intelligence

Two sectors that are vastly outperforming the markets, driving rapid growth and generating massive returns are cryptocurrency and artificial intelligence.

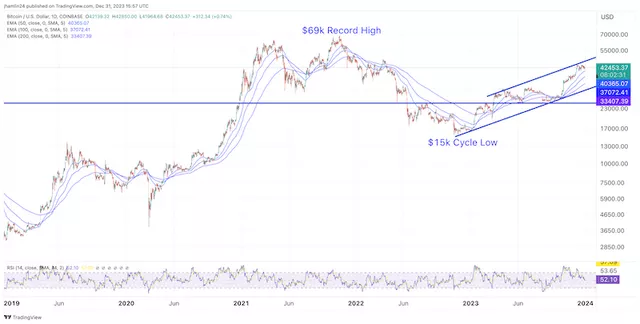

Bitcoin is up over 150% in 2023, while several of the altcoins that we track are up 10x or more in the same time period. This bounce is coming after a brutal 2-year bear market in the crypto sector that was exacerbated by the implosion of FTX and other crypto companies, a blanket ban on crypto by Chinese authorities, plus rapidly tightening monetary conditions.

Many believe that the past crypto bull cycle was cut short and the resulting bear cycle was more severe as a result of these events. If so, the sector has some catching up to do in the current bull cycle to return to the long-term trajectory. The Bitcoin price chart shows the bounce since the start of 2023, but the price still has significant upside to return to the 2021 highs.

Chart via TradingView

There are a host of bullish near-term catalysts on the horizon for the cryptocurrency sector. These include the likely approval of a spot Bitcoin ETF in the weeks ahead, with many analysts, including a former BlackRock Director, anticipating institutional capital inflows of $150 billion to $300 billion in the first few years. Bitcoin currently has a market capitalization of $820 billion, so these inflows would be significant at 18% to 36% of the total valuation.

The Bitcoin halving that occurs once every 4 years is also projected to take place in April of 2024. This event will see the daily output of new Bitcoin slashed in half fro around 900 to about 450. The inflation rate will drop from 1.79% to 0.88%, reducing Bitcoin's stock-to-flow ratio to less than gold for the first time. The halving will also reduce selling pressure from Bitcoin miners.

Speaking of gold, Bitcoin’s market value is frequently matched up against gold, which boasts a total market worth of around $13 trillion. Bitcoin's price would need to go up around 15x to match this market cap, a feat that many believe is possible following spot Bitcoin ETF approval in the U.S. That would put the Bitcoin price around $650,000, putting some perspective on the potential upside in the year ahead.

Additional bullish catalysts include the introduction of fair value accounting rules for Bitcoin on corporate balance sheets. The FASB has said this revision will take place in 2025, which is likely to attract many large corporations to the idea of holding some portion of their balance sheet in Bitcoin instead of rapidly-devaluing cash. The end of rate hikes and declining levels of trust in central banks could also lead to additional inflows into the crypto sector in 2024 and beyond.

That is the quick bullish case for Bitcoin and the wider cryptocurrency sector over the next few years. But what if you could complement this exposure with simultaneous exposure to another of the top growth sectors over the past year?

The global artificial intelligence market size was valued at around $150 billion in 2023 and is expected to grow at a CAGR of 36.8% from 2023 to 2030. The revenue forecast for 2030 is projected to reach $1.35 trillion according to Markets&Markets. Precedence Research has an even more bullish estimate for the market size of AI in 2030 at $1.81 trillion. PwC see the potential contribution to the global economy by 2030 from AI at $15.7 trillion with up to a 26% boost in GDP for local economies from AI.

Artificial Intelligence is expected to fundamentally transform the global economy and our way of life. It has the potential to revolutionize entire industries with huge increases in efficiency, safety, threat detection, medical diagnosis, education and more. There are legitimate concerns around the safety and impact the job market, but few will argue about the likely transformative impact we are going to witness over the coming years.

AI stocks have been top performers in 2023 with C3.ai (AI) up 160%, NVIDIA Corporation (NVDA) up 246% and Palantir Technologies Inc. (PLTR) up 169%.

Artificial intelligence is also rated as the top narrative in the cryptocurrency sector. How do the two concepts intersect, is there a multiplier effect and how can investors realize outsized gains from exposure to both crypto and AI?

Fetch.ai Facebook Page

At Nicoya Research, Fetch.ai (FET) has been one of our top crypto picks for 2023 and has been out top performer. The price has increased by 652% in the past year, but has pulled back from a high around $0.78 to $0.69 currently. There could be more near-term downside on profit taking, but I remain very bullish over the course of the next year.

So, what is so compelling about Fetch.ai that will drive the price higher in 2024?

Fetch.ai is An open platform for the new AI economy. It helps companies to transform legacy systems to be AI ready without changing existing APIs (Application Programming Interfaces). Fetch.ai has created AI platforms and services that let anyone build and deploy AI services at scale.

The Fetch.ai platform comprises four integral layers: the AI Agents, the Agentverse, the AI Engine, and the Fetch Network. Each layer plays a critical role, interlocking perfectly to form a robust ecosystem of Fetch.ai.

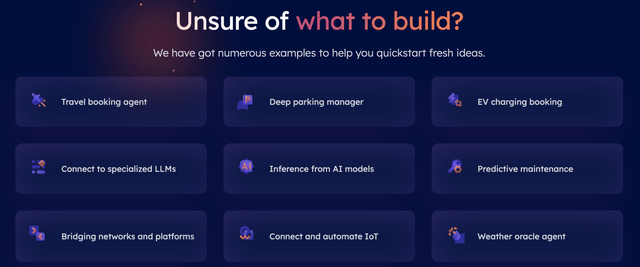

Fetch.ai is the first open network for AI Agents. Without getting too much into the weeds, AI Agents are modular building blocks that can be programmed with logic to perform specific tasks. They can even be set up to negotiate and transact on your behalf. Imagine having a digital personal assistant that understands your needs and makes smart decisions on your behalf - that's exactly what these AI Agents do. Using Fetch.ai, agents can be launched at the click of a button using Agentverse, a Software as a Service (SAAS) platform tailored for developing AI Agent solutions without complex coding.

Image Source: fetch.ai website

Fetch.ai is a platform where AI is not just a feature but the core driver, enabling AI Agents to execute a multitude of tasks for individuals, organizations, and devices. These agents, adept at decision-making and problem-solving, are reshaping the way we approach challenges in various sectors, from logistics to transactional operations. In essence, Fetch.ai is crafting an accessible, AI-powered world where technology adapts to meet our needs, simplifying and enhancing our digital interactions.

Fetch.ai’s technology has already been applied across various industries. For example, in the energy sector it enables energy grid optimization, peer-to-peer energy trading, and demand response management. In healthcare, Fetch.ai's autonomous agents are used to create intelligent healthcare systems that enable better patient care and resource allocation. In finance, autonomous agents can be used to create decentralized finance (DEFI) applications that enable secure, transparent, and efficient financial transactions. And in transportation, Fetch.ai's technology can enable intelligent transport systems that optimize traffic flow, reduce congestion, and improve safety.

Fetch.ai announced a partnership with Bosch earlier in 2023 to form a new Web3 foundation — Fetch.ai Foundation, that aims to research, develop and harness Web3 technology for real-world use cases that will span across mobility, industrial, and consumer domains. Bosch is a German multinational engineering and technology company that reported revenues of $88 billion Euros in 2022.

Developers have built and trialed several solutions using Fetch.ai’s platform that take advantage of the autonomous AI agent technology. These include a smart parking space management program in Germany that could autonomously negotiate the price of the parking spaces based on the availability and demand of the spaces and apply AI learning to provide the best possible experience.

Autonomous AI travel agents have also been trialed, capable of connecting people to over 770,000 hotels worldwide via the Amadeus global distribution system. The network of autonomous agents works to collect data on the behalf of users to book hotel rooms trained on user preferences and hotel room inventory, finding the best prices and overall matches. A video showing a Fetch.ai booking agent in action can be found below.

Put simply, Fetch.ai is applying artificial intelligence and utilizing blockchain to solve real-world use case problems.

Humayun Sheikh is the Founder and CEO of Fetch.ai. He is an entrepreneur, investor, and tech visionary passionate about AI, machine learning, autonomous agents, and blockchains. In the past, he was a founding investor in DeepMind where he supported commercialization for early-stage AI & deep neural network technology. DeepMind is one of the most important AI and neural network companies in existence and was acquired by Google/Alphabet (GOOG) in 2014. He also founded another machine learning/artificial intelligence company called itzMe.

An interview with the CEO can be found here and gives investors an idea of the man behind Fetch.ai. He comes across as a clear expert in this field with a vision for advancing and monetizing the technology. He inspires confidence that Fetch.ai is more than just another company claiming to be in the AI or crypto space, but is actually applying these technologies in a disruptive manner.

He highlights the importance of the intersection of AI and blockchain/crypto within the interview. "With the AI agents system, recommender engines will have to be paid somehow and the transactions will have to be recorded somehow. In an open system where you’re enabling everybody to deploy their models and everybody to deploy their services on this decentralized kind of platform, you need to have an open ledger."

Chief Executive Humayun Sheikh said the $40 million funding from DWF Labs will help advance the development of decentralized technology and autonomous agents and AI technology. “This investment will help us advance our mission to bring automation and AI capabilities to the forefront of the decentralized technology industry,” he said.

"So the first part of this whole puzzle is a mechanism to record all these transactions and blockchain has proven itself to be one of the best ways to do it. You can monitor transactions and create an audit trail that can adhere to regulations. This is an orchestration kind of layer which Blockchain can provide quite easily without being in the control of just one party."

The FET tokens are the lifeblood of Fetch.ai, fueling transactions and facilitating interactions within this decentralized world. They are the medium of exchange used to pay for services provided by Fetch.ai applications.

In early 2019, nearly 3000 investors bought FET through an initial exchange offering (IEO) hosted by Binance. Through this token sale, Fetch.ai raised $6 million in funding. The initial allocation of tokens saw 20% of all FET going to each the Fetch.ai Foundation and the founders, 17.6% to the token sale, 17.4% to future token releases, 15% to mining rewards, and 10% to advisors.

The FET token was originally released as an ERC-20 token on the Ethereum blockchain, but Fetch.ai now has its own blockchain which uses FET as its native cryptocurrency based on the Cosmos SDK.

The current market cap is $725 million with a fully diluted market cap of around $800 million. Over 1 billion of the 1.15 billion maximum supply of coins are already in circulation, meaning there will be little dilution ahead for token holders.

The price chart shows the FET token rocketing 644% higher in the past year from under $0.10 to roughly $0.77, before pulling back to $0.69 currently. Conservative investors can wait for a deeper pullback to the 50-day exponential moving average around $0.58, but with high odds of the spot Bitcoin ETF getting approved in the near-term, I think risk-tolerant investors can consider taking a small starter position on this 10%+ pullback.

Chart via TradingView

The Fetch.ai (FET) token trades on most major exchanges, including Coinbase, Binance and Kraken. The 24-hour trading volume on Binance alone was nearly $14 million, so there is significant liquidity. Users can also choose to stake FET to participate in securing the network via its Proof-of-Stake consensus mechanism and earn rewards in return for contributing to validator nodes.

While there is disruptive technology and real-world use cases behind Fetch.ai. I think the token could also see upside from being in right spaces (crypto and AI) at the right time. While more downside is possible in the near-term, I expect the Fetch.ai (FET) token and other AI-related cryptocurrencies that we track to continue outperforming the wider crypto sector over the next few years.

More By This Author:

3 Ways To Profit From China’s Dec 1st Graphite Export Ban

2 High-Risk/High-Return Mining Stock Picks

Top Silver Stock Pick For 2021

Nicoya Research LLC is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell ...

more