2 High-Risk/High-Return Mining Stock Picks

Image Source: Unsplash

Investors are always looking to move their capital to sectors that can offer the greatest returns. We believe a commodity super-cycle is underway that will generate massive returns for investors in key metals that are undervalued. For those looking for leveraged gains, mining stocks can often provide just that, as rising prices for the metals that they mine translate into profit margins rising faster than the prices for the metals themselves. For example, if gold goes from $2,000 to $3,000 per ounce, that is a 50% gain for those holding gold. But if a miner has a total cost of $1,000 per ounce, their gross profit margin goes from $1,000 to $2,000, an increase of 100% when the gold price went up just 50%. Rising input costs could make the true increase in profit margins somewhat lower, but it is still a leveraged gain versus holding the metal itself.

At Nicoya Research, we have exposure to a variety of different metals including gold, silver, copper, lithium, nickel, uranium, graphite, and rare earth or strategic metals. All of these metals are likely to increase in price over the next few years in my opinion, so it is good to have a diversified basket to capture gains from a wide range of catalysts.

The largest of those catalysts is the weakening dollar. As the value of the dollar continues to drop, the price of scarce commodities increases. The dollar index has been declining for the past year, from a high near 115 to under 100. A 13% decline in this index over the period of a year is a significant move. It rallied briefly in July but has once again put in a lower high on the chart, accompanied by several lower lows. The trend channel is clearly pointing to the downside, as de-dollarization heats up globally, US debts and deficits soar and reckless government spending continues unabated.

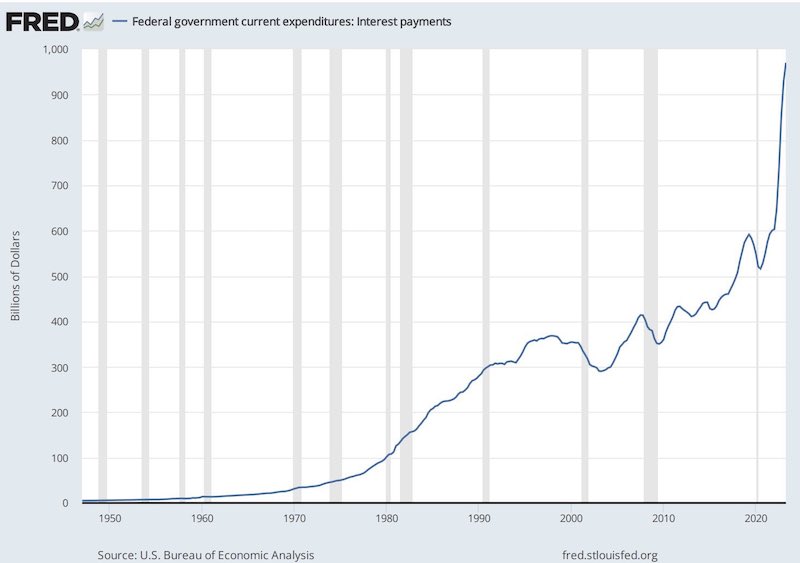

(Click on image to enlarge)

There are several reasons for the weakening dollar and rising inflation. Chief among them is the massive amount of new money creation in the past few years, along with rapidly rising debt (now at $33 Trillion!), deficits (up $1 trillion to $1.8 trillion this year), and exploding interest obligations on this debt (expected to hit $1 trillion this year). Adding pressure to the dollar is out-of-control government spending with no attempts at balancing the budget. The really concerning part of this picture is the rising interest cost on the debt, as interest rates have soared. To put it in perspective, the government is likely to spend more this year on interest expense on the debt than the entire defense department budget, which is already massively bloated at around $800 billion per year. This is not sustainable.

The weaker dollar has led to prices for commodities climbing sharply and quality mining stocks generating substantial gains. This has occurred in the face of the Federal Reserve raising interest rates at the fastest pace in history. Rising rates normally strengthen the dollar and we did see a USD rally in the first half of 2022 when the Fed began raising rates. But that rally fizzled and the dollar took a sharp turn lower in September of 2022, even with the Fed continuing to raise rates, doubling the Fed Funds rate from 2.5% to over 5%.

This can be explained by the markets being forward-looking and anticipating an end to rate hikes on the horizon. But this is also partially due to inflation remaining stubbornly high with no signs of fiscal responsibility from the current administration. And now that most of the rate hikes are behind us and we are at or near a terminal Fed Funds rate, we think the dollar decline will accelerate, which will translate into significantly higher commodity prices.

Conservative investors might want to opt for larger-cap names that are safer and less volatile or a diversified fund such as the VanEck Gold Miners ETF (GDX). For lithium exposure, there is the Global X Lithium & Battery Tech ETF (LIT), for copper exposure the Global X Copper Miners ETF (COPX), for rare earth exposure the VanEck Rare Earth/Strategic Metals ETF (REMX), and for uranium exposure the Global X Uranium ETF (URA). It is worth noting that these lithium, copper, rare earth, and uranium ETFs have outperformed gold and silver ETFs year-to-date in 2023.

Now that we have covered the safer and more diversified ways to invest in the mining sector, let’s examine a few speculative and unusual names that have a profile of higher risk, yet higher potential return.

TMC the metals company Inc. (TMC)

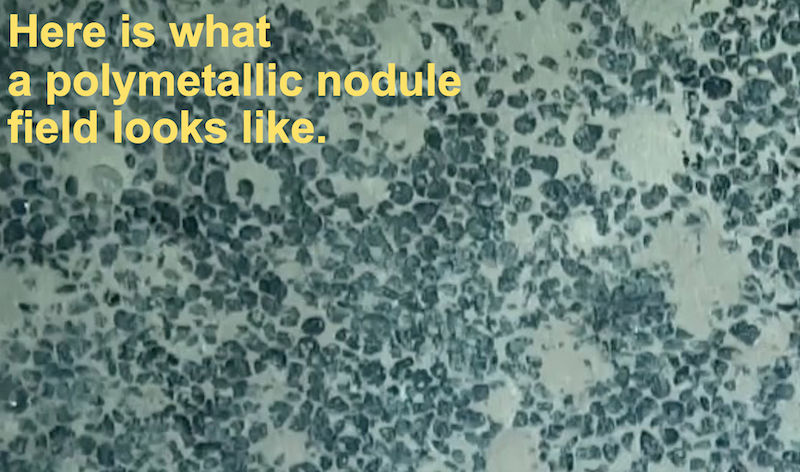

TMC the metals company Inc., a deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in the Clarion Clipperton Zone (CCZ) in the south-west of San Diego, California. It primarily explores nickel, cobalt, copper, and manganese products. This company is interesting because they are the first publicly-traded company to attempt mining valuable metals from the sea floor.

They claim to be developing the world’s largest estimated source of battery metals, with enough nickel, copper, cobalt, and manganese to electrify the entire U.S. passenger vehicle fleet. They estimate massive In situ quantities of nickel, copper, cobalt, and manganese with a total resource of 15,700,000 t Ni / 2,400,000 t Co / 13,300,000 t Cu / 350,000,000 t Mn. Some nickel projects have high grade, and some have a large resource, but TMC is an outlier among peers with the largest NiEq resource and highest NiEq grade.

The company estimates an NPV of over $10 billion at current nickel prices, based on just 22% of the NORI-D resource. Yet the company is trading at a market cap of around $300 million. This is a multiple of 10x to 20x less than their land-based peers, implying a huge upside should they be successful in obtaining permits and moving into production.

In just the past week, TMC said it plans to apply next year for a license to start mining in the Pacific Ocean, with production expected to start as early as late 2025. The company has signed a non-binding MoU with Pacific Metals Company (PAMCO) of Japan to evaluate the processing of 1.3 million tonnes per year of wet nodules But environmental campaigners say seabed mining could have a catastrophic impact on marine ecosystems, so it is still unclear if they will get the license needed to start mining. There are also questions about the costs to pull these nodules up from deep locations on the seafloor.

Here is a video to give you a better idea of what they are planning…

Video Length: 00:03:03

TMC is an interesting speculative mining play. Management believes it has rights to the globe’s largest undeveloped Nickel project. Nickel is one of the most widely used minerals for EV batteries and will see increased demand in the years ahead. A supply gap is likely to push prices for nickel much higher in the years ahead, potentially increasing the value of TMC as well. Much will hinge on getting final regulations from the International Seabed Authority, which seems to be in no hurry. But if this happens and TMC gets permits, I think this stock is going to be 5x to 10x for investors buying shares ahead of the news.

The share price spiked higher on increased media coverage lately but dropped back just as fast. I recommend this balanced article from CNBC for continued reading on TMC. The price went from 65 cents to $3.00, before falling back to $1.25 currently. Everyone will have to decide for themself if this is a good opportunity to buy the pullback or simply catch a falling knife. A small allocation as a lottery ticket could be of interest to risk-tolerant investors.

(Click on image to enlarge)

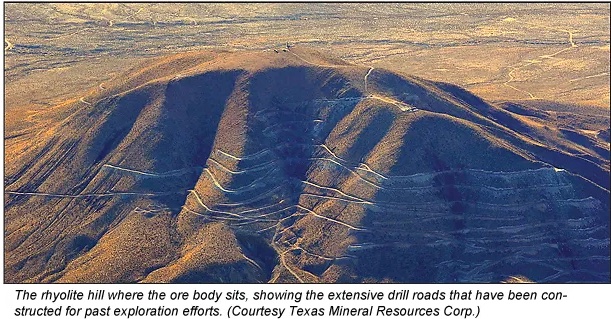

Texas Mineral Resources Corp. (TMRC)

Texas Mineral Resources Corp.’s primary focus is to develop and commercialize, along with its joint venture operating partner USA Rare Earth LLC, the Round Top heavy-rare earth, technology metals, and industrial minerals project located in Texas, in which TMRC owns an approximate 20% interest and USA Rare Earth owns an approximate 80% interest. Additionally, the company is exploring for silver in New Mexico.

The 2019 preliminary economic assessment (PEA) on Round Top was very encouraging with a pre-tax NPV of $1.5 billion and IRR of 79%. With a 20% interest, TMRC’s ownership of this NPV is approximately $300 million, yet they have a market cap of just $68 million. An IRR of anywhere above 20% is typically considered good in the mining industry, so this IRR of 79% is outstanding. The mine life is 20 years based on just 14% of the existing mineral resource estimate.

What I find particularly interesting about TMRC at the current time is that Round Top hosts the largest known gallium deposit in the United States at 36,500 metric tons.

What is gallium you might ask?

Gallium is a rare mineral that only occurs in trace amounts as a by-product of mining and processing other metals, such as aluminum, zinc, and copper. Gallium arsenide has a similar structure to silicon and is a useful silicon substitute for the electronics industry. It is an important component of many semiconductors. It is also used in red LEDs (light-emitting diodes) because of its ability to convert electricity to light. Solar panels on the Mars Exploration Rover contained gallium arsenide. Gallium nitride is also a semiconductor. It has particular properties that make it very versatile. It has important uses in Blu-ray technology, mobile phones, blue and green LEDs, and pressure sensors for touch switches. Gallium readily alloys with most metals. It is particularly used in low-melting alloys. It has a high boiling point, which makes it ideal for recording temperatures that would vaporize a standard thermometer. Gallium is on a short list of critical minerals published in the Federal Register.

China, the world’s top supplier of the two minor metals used to make semiconductors, announced restrictions on the exports of eight gallium and six germanium products in early July, citing national security reasons. This is a decision that many consider a retaliation for restrictions imposed on the Chinese semiconductor sector by the U.S., Japan, and the Netherlands in recent quarters. China’s export controls on gallium and germanium kicked in last week, with traders braced for a drop in international supply in August and September. Stockpiles outside China, which could last for two to three months, will need to be tapped while traders await Beijing’s export permit approvals.

Gallium is the more important of these two metals in my view, as the U.S. and Western governments have stockpiles of germanium but not gallium. Offer prices for gallium ingot at Rotterdam jumped 43.4% to $370 per kg last week, against $258 per kg in late June.

Again, TMRC’s Round Top project is estimated to have the largest known deposit of gallium in the U.S. Round Top has around 20 different rare earth metals, with a favorable composition toward the more valuable heavy rare earth metals such as Dysprosium, Lutetium, Terbium, Neodymium, etc. Round Top also contains lithium, uranium, and several industrial minerals. This deposit has key minerals that are used in several vital applications including Defense, Consumer Technology & Green Energy. With geopolitical tensions and economic warfare heating up between the U.S. and China/Russia, it is more important than ever that the U.S. secures domestic supplies of these metals. This is why I think the value of the Round Top project will increase dramatically and the government may even step in with grants and other incentives to move the project toward production.

TMRC has also signed a mineral exploration and option agreement with Santa Fe Gold with an initial target silver property within the Black Hawk Mining District in New Mexico. The geology is generally characterized by narrow ultra-high-grade silver veins. A bankable feasibility study is to be conducted in measured phases and TMRC has established a new Standard Silver subsidiary to hold these project assets. During July they reported the successful completion of a geophysical investigation using multiple variations of EM (electro-magnetic) geophysical surveying within the Black Hawk mining district, Grant County, New Mexico. They identified 16 potential drill targets. While this is still an early-stage exploration of historic mining areas, it nonetheless gives investors some exposure to silver, in addition to the rare earths at Round Top.

Lastly, the company’s management/board owns an estimated 20% of outstanding shares. aligning their interests with those of shareholders.

The project has been in the PEA phase for over 3 years now with no signs of progressing toward development. TMRC seems to be focusing on silver exploration in New Mexico and their partner seems focused on a rare earth metal and sintered neo-magnet plant in Oklahoma. This facility could have significant synergies with Round Top, but they don’t seem to be deploying capital toward Round Top itself. Another risk is that TMRC has very little cash on hand, which means shareholder dilution could be incoming. Yet a recent press release suggests they might reduce their equity position in Round Top in exchange for cash, rather than diluting shareholders.

The upshot for TMRC and shareholders would be government funding or a takeover or partnership with a larger mining company such as MP Materials. The financials look compelling and securing supplies of gallium is going to be of critical strategic importance with China banning exports. Insiders have bought shares in the open market recently, although a small amount and former Secretary of State Mike Pompeo has joined partner company USA Rare Earths. It is rumored that USA Rare Earth has been working diligently to complete the preliminary feasibility study (PFS). It seems likely that there is now increased interest in moving this project forward one way or another. It is a risky investment, but could also generate significant returns for investors willing to take a position while the share price is so low.

The share price for TMRC had a similar move to TMC, but less dramatic, over the past month. The share price bounced from $0.75 cents to over $1.00 in May and then bounced again from $0.80 cents to a brief high near $1.40 in July. Those were moves of 35% and 75% in just a few days. The price has since dropped back to $0.91 and could be offering an attractive entry price for investors that believe Round Top will move forward in the near future.

(Click on image to enlarge)

We advocate for holding both metals and mining stocks but stress the importance of stock selection in the sector, as well as understanding which point in the bull cycle you are entering or exiting positions.

More By This Author:

Top Silver Stock Pick For 2021

Gold Makes Record High and Targets $6,000 in New Bull Cycle

Gold And Silver Investors Should Be Wary Of Trade Talk Optimism And Buy The Dip