Ethereum Price: ETF Outflows Hit $796M In 5 Day Sell-Off. Key Levels To Watch

Image Source: Pixabay

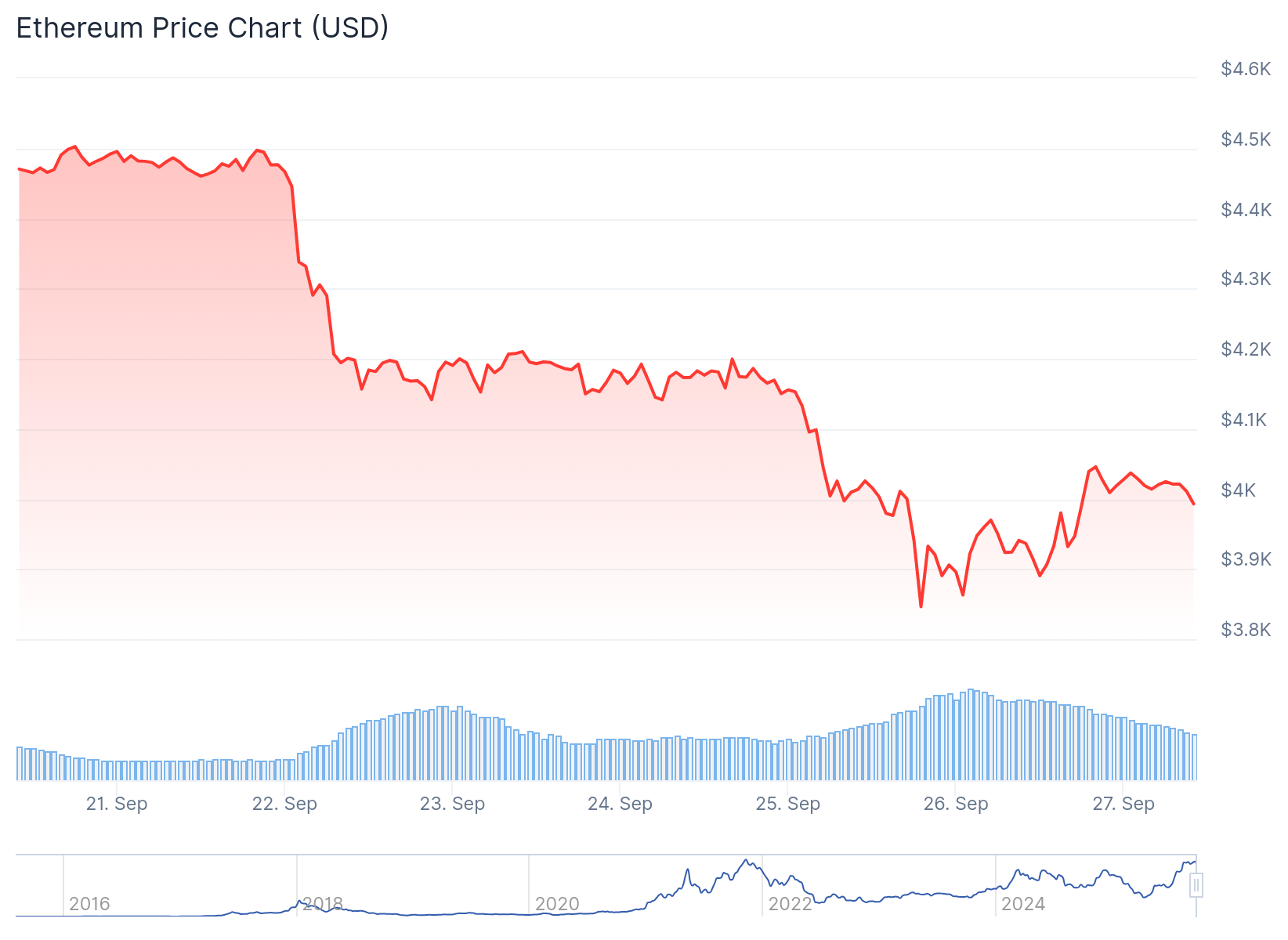

Ethereum faced pressure across multiple fronts this week as exchange-traded fund outflows reached concerning levels. US-based spot Ethereum ETFs posted five consecutive days of net outflows totaling $795.8 million.

(Click on image to enlarge)

Ethereum (ETH) Price

The selling pressure culminated on Friday with $248.4 million in daily outflows according to Farside data. This marks the first time spot Ethereum ETFs have recorded five straight outflow days since the week ending September 5.

Ethereum’s price declined 10.25% over the seven-day period, trading at $4,013 at the time of publication. The asset has fallen 12.24% over the past 30 days according to CoinMarketCap data.

The outflow streak comes as retail participation appears to be weakening for ETH. Net taker volume on Binance remained negative over the past month, indicating persistent sell-side pressure from retail traders.

Crypto analyst Bitbull characterized the ETF outflow streak as “a sign of capitulation as the panic selling has been so high.” The sustained selling pressure reflects broader market sentiment toward the second-largest cryptocurrency.

$ETH ETFs just recorded its biggest weekly outflow ever.

— BitBull (@AkaBull_) September 27, 2025

This is a sign of capitulation as the panic selling has been so high.

Do you think $3,750 was the bottom for ETH? pic.twitter.com/DRjlSSOKJC

Industry anticipation continues building over when the Securities and Exchange Commission will approve staking features for spot Ethereum ETFs. Grayscale prepared to stake part of its Ethereum holdings on September 19, potentially signaling confidence in regulatory approval.

Technical Analysis Points to Further Decline

Analyst Dan Gambardello identified a triangle pattern breakdown on Ethereum’s daily chart that could drive prices lower. The breakdown targets the mid-$3,000s range where the 20-week moving average converges with longer-term support.

Gambardello described the technical setup as a “throwback” he had been anticipating. The 20-week moving average is approaching the triangle trendline around $3,500-$3,600, creating what he calls “a very nice, healthy consolidation zone.”

The breakdown appears more overextended compared to other altcoins like Cardano, which remains closer to its moving average support. Ethereum’s 20-day moving average crossed below the 50-day average, showing weakening short-term momentum.

Gambardello emphasized the importance of monitoring whether ETH can break above $4,500 with strength to confirm a bullish reversal. Current market conditions include ETF dynamics, interest rate changes, and legislative developments creating additional volatility.

The analyst warned these factors lead to more fake breakouts and headline-driven price manipulation compared to previous cycles. Ethereum currently sits about halfway to the projected target, leaving room for either sideways consolidation or continued selling.

Critical Support Levels Define Recovery Path

Analyst Ted identified $4,060 as the support level that will determine Ethereum’s near-term trajectory. ETH tapped the $3,800 liquidity level as predicted before bouncing but remains trading below the key support region.

$ETH had a good bounce back from the $3,800 support level.

— Ted (@TedPillows) September 27, 2025

It's now approaching a crucial resistance level, and a reclaim of it will result in more upside.

In case Ethereum loses the $3,800 support level, a dump towards the $3,600 level is highly likely. pic.twitter.com/tbDrEnsLiI

A reclaim of $4,060 would signal potential rally continuation according to Ted’s analysis. However, failure to hold this level increases chances of decline toward $3,600.

The $3,800 test validated Ted’s previous technical analysis, showing buyers remain active at lower prices. Sustained recovery requires breaking back above meaningful resistance levels.

Michaël van de Poppe views current Ethereum price levels as presenting an accumulation opportunity for longer-term investors. The analyst characterizes this zone as a “higher timeframe support test” coinciding with the approach to the 20-week moving average.

I think that we'll see some more chop occur on $ETH.

— Michaël van de Poppe (@CryptoMichNL) September 23, 2025

I don't know whether we'll dip as deep as $3,550-3,750, but I'm sure that we'll start to see:

- 20-Week MA is getting closer.

- Compression is building up --> Big move to occur at a later time.

It's now down nearly 20% from… pic.twitter.com/MUvUEYY4Xv

Van de Poppe’s perspective focuses on multi-week and monthly chart structures rather than daily volatility. The 20-week moving average has historically provided strong support during previous cycles.

The higher timeframe support designation suggests this pullback represents healthy consolidation rather than major trend reversal. Van de Poppe’s analysis implies current weakness creates buying opportunities for investors with longer investment horizons.

Bitcoin ETFs posted net outflows of $897.6 million over the same five-day period as Bitcoin fell 5.28% to $109,551.

More By This Author:

Bitcoin Price: Fear & Greed Index Falls To April Lows As $3B In Leverage Wiped Out

XRP Price Could Drop Sharply: Analyst Highlights Critical Support Level

Tesla Inc. Stock: Europe Sales Slump Weighs On Tesla As Competition Intensifies