Bitcoin Price: Fear & Greed Index Falls To April Lows As $3B In Leverage Wiped Out

Image Source: Unsplash

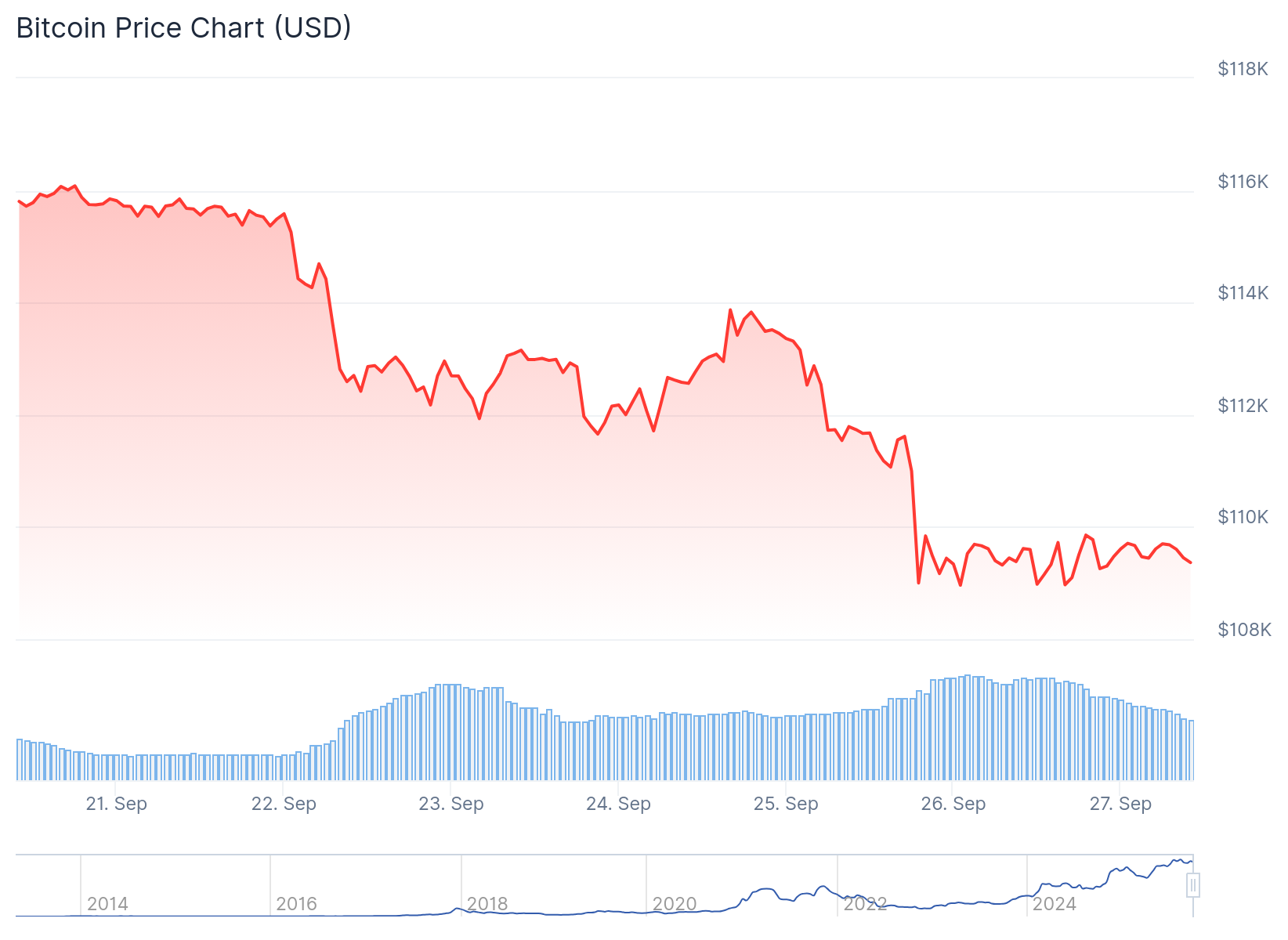

Bitcoin experienced a modest recovery Friday, climbing back above $110,000 after recent volatility. The world’s largest cryptocurrency has dropped over 12% from its record high above $124,500.

(Click on image to enlarge)

Bitcoin (BTC) Price

Ethereum outperformed with a 3.8% gain, crossing the $4,000 threshold. Dogecoin rose 3.4% while Solana added 2.5% as broader crypto markets showed signs of stabilization.

The recovery came as August PCE inflation data aligned with forecasts. The Federal Reserve’s preferred inflation measure rose 2.7% year-over-year, while core PCE excluding food and energy climbed 2.9%.

Fabian Dori, CIO at Sygnum Bank, said the data reinforced the Fed’s narrative of gradually easing price pressures. However, he noted policymakers must balance sticky inflation with a softer labor market backdrop.

Dori explained that if inflation trends lower, risk assets may find support from confidence in the Fed’s easing cycle. But upside surprises in coming data could push back rate cut expectations.

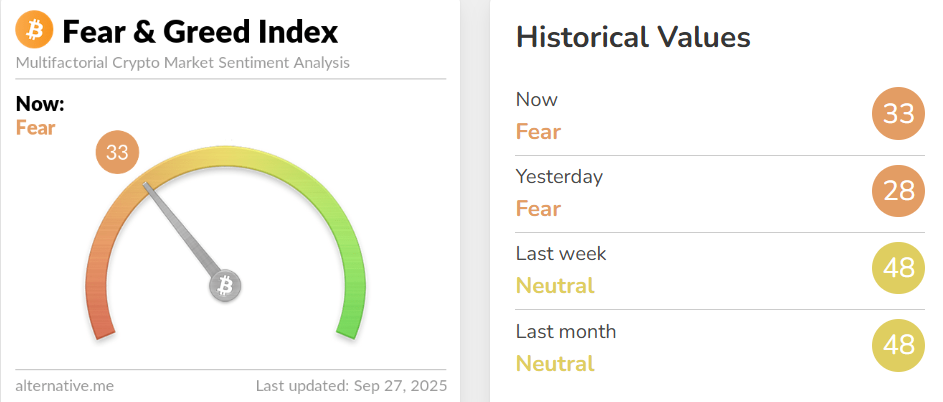

Fear Takes Hold of Crypto Markets

Market sentiment turned decidedly bearish as the Fear & Greed Index plummeted to 28 Friday. This marked the most depressed level since mid-April, signaling widespread fear among traders.

(Click on image to enlarge)

Alternative.me

The sentiment shift reflected recent volatility after Thursday’s $1.1 billion liquidation wave. This event wiped out numerous leveraged long positions across the market.

Matt Mena, strategist at digital asset manager 21Shares, noted that roughly $3 billion of leveraged longs have been liquidated in recent days. With excess leverage largely flushed out, positioning has swung to extreme bearish levels.

Popular tokens including Bitcoin, Solana, and Dogecoin now show a long-to-short ratio of just one-to-nine. Mena argued this extreme positioning, combined with the Fear & Greed Index at near-extreme lows, sets the stage for a potential short squeeze.

Analysts Split on Bitcoin’s Next Move

Technical analysts remain divided on Bitcoin’s future direction. Some see potential for a crash toward $60,000 if historical patterns repeat.

Crypto analyst Reflection points to similarities with Bitcoin’s 2021 price trajectory. In 2021, BTC staged a sharp rally to record highs, followed by a blow-off top and correction into mid-range support.

That sequence triggered a 50%-plus crash, sending Bitcoin from nearly $69,000 to around $32,000 within weeks. Bitcoin’s 2025 structure now echoes that same four-step process.

On the weekly chart, Bitcoin has broken below a rising wedge formation. This bearish pattern of higher highs and lows within narrowing trendlines raises the risk of a decline to $60,000-$62,000.

However, other analysts maintain a bullish outlook. Trader Jesse highlights Bitcoin’s 200-day moving averages serving as support during bull market dips.

(Click on image to enlarge)

Source: TradingView

This support cluster sits around $104,000-$106,000, where Jesse believes Bitcoin may form a mid-term bottom. Analyst Captain Faibik argues the current dip represents a healthy correction.

Faibik points to the emergence of a potential bull flag pattern. A decisive move above $113,000 resistance could confirm the breakout, opening the door for a rally toward $140,000.

Paul Howard from trading firm Wincent warned the market could drift lower before stabilizing. He pointed to Bitcoin dipping below its 100-day moving average and the total crypto market cap sliding under $4 trillion as signs of weakness.

More By This Author:

XRP Price Could Drop Sharply: Analyst Highlights Critical Support Level

Tesla Inc. Stock: Europe Sales Slump Weighs On Tesla As Competition Intensifies

Jabil Stock: Declines 6.5% Following Q4 Results, FY26 Outlook Raises Optimism