XLK: What "Hidden" Bullish Breadth Tells Us About Tech

Photo by Steve Johnson on Unsplash

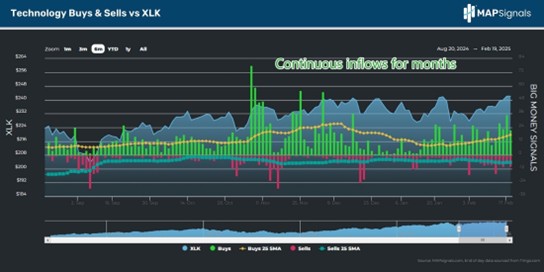

Trading should be simple. Follow trusty, time-tested indicators, and then call it a day. Recently, markets have been making new highs, stunning the crowd. One big reason for this is the hidden, bullish breadth in technology stocks – and in ETFs like the Technology Select Sector SPDR Fund (XLK), highlights Lucas Downey, co-founder of MapSignals.

Let’s rewind the tape. Just two short months ago, stocks were sold with abandon. Fedspeak caused many investors to second-guess the merry-go-round path of interest rates. But our data signaled a massive buy signal that rarely comes along. Capitulation is one of the best times to strap on the helmet and get in there. When the crowd is crying, start buying.

Today, we’ll size up the money flows picture and illustrate the powerful, hidden breadth in technology stocks. When the money flow backdrop is strong, dive below the surface. Unlock the hidden catalyst.

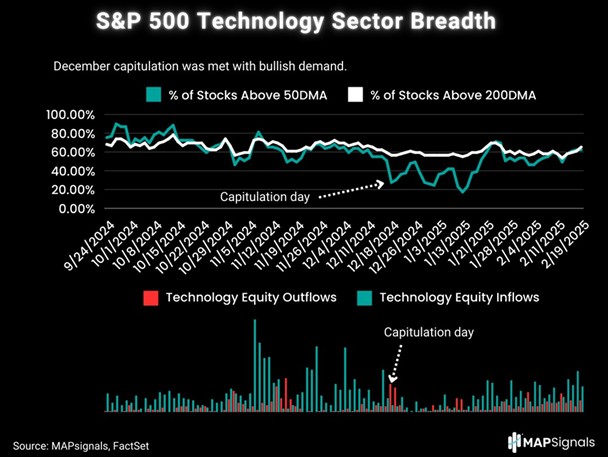

Below is a snapshot of our inflows and outflows in our technology stock universe. I want to draw your attention to two facts:

- First, note how mid-December saw red bars, indicating selling

- Second, and most importantly, see how those red bars vanished, indicating that buy demand swooped in to tame the sell-off

Money flows are important because they can often give a different picture than other popular breadth indicators. A case in point is the following graphic.

Here, I’ve plotted on top the 50-DMA and 200-DMA of the constituents of the S&P 500 technology sector. It reveals how the 50-DMA breadth was declining, and that it stayed muted for over a month starting near the capitulation event in December.

What the data on bottom spotlights is that capitulation came and then vanished days later. Buy pressure met the outflows, creating a bottoming signal.

The disappearance of selling is bullish. Looking back, it can be difficult to forecast the future. That said, we have been convinced the evidence painted a very constructive picture; one that rarely comes along.

About the Author

Lucas Downey is the co-founder of MAPsignals research, which focuses on finding outlier stocks by following the big money. He is the instructor for options with Investopedia Academy and also posts videos often on his YouTube Channel, www.youtube.com/c/mapsignals.

More By This Author:

Kinder Morgan: New Pipeline Shows The Attractiveness Of US Midstream Energy Plays

CVS: Stock Pops In A Tough Market...But Should You Buy It?

XLU: Why Calls On This Utilities ETF Could Pay Off

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more