XLU: Why Calls On This Utilities ETF Could Pay Off

Image Source: Pixabay

The brief ruckus around inflation forcing the Federal Reserve to pause earlier this week just didn’t last. Meanwhile, the utilities came rushing back – and my call option recommendation on the Utilities Select Sector SPDR ETF (XLU) returned back in the money, notes Hilary Kramer, editor of 2-Day Trader.

If resurgent inflation and the prospect of no rate cuts ahead can’t push volatility higher, then it’s time for volatility to recede. After all, there’s been no technical support for the S&P 500 VIX Short-Term Futures ETN (VXX) and no big pool of money demonstrating that there’s a will on Wall Street to make the world more frenetic and less stable.

That’s not how Wall Street operates. Things always calm down, usually within a matter of days.

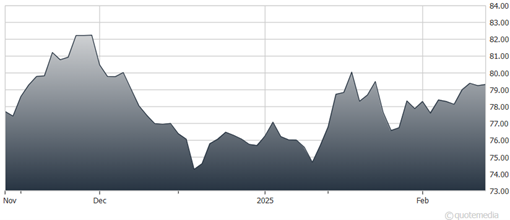

Utilities Select Sector SPDR Fund (XLU) Chart

As for XLU, barring a relapse, our calls will be worth something even if we hold them to expiration and then exercise. The only question is whether they’ll be worth more than we paid in the first place. For that to happen, the XLU ETF needs to at least test the $80.50 area in the next two weeks.

Can we get that? The XLU fund hit $80.44 just three weeks ago. That’s the only resistance left on the chart. If we hit it, we’ll get an easy shot at exiting at a wash at worst and ideally grab a win.

From there, resistance would emerge again at the $82.72 mark. It would be a big win in that scenario. That’s why we’re hanging on. Right or wrong, we keep trading. Money that isn’t working faster than cash is dead money. And while we don’t hit every pitch, the returns that we get when the risks go our way are big enough to keep swinging.

So, where is the market going? We’re still biased toward the long side, arguing that the XLU ETF will go up and volatility itself will go down.

About the Author

Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. The Financial Times describes her as "A one-woman financial investment powerhouse," and The Economist distinguishes her as "One of the best-known investors in America."

Ms. Kramer independently published newsletters including GameChangers, Value Authority, High Octane Trader, 2-Day Trader, IPO Edge, and Inner Circle. She is often quoted in publications such as the Wall Street Journal, New York Post, Bloomberg, and Reuters. Ms. Kramer is a frequent guest commentator on CNBC, CBS, Fox News, and Bloomberg, providing investment insight and economic analysis.

More By This Author:

Honeywell International: What Its Breakup Announcement Says About ConglomeratesFederal Agricultural Mortgage: A Dividend Play In The Agricultural Finance Sector

SPY: How A "Give Growth A Chance" Mantra Could Keep Markets Rising

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more