Image Source: Pexels

Kinder Morgan (KMI) reported earnings last week and announced that President Kim Dang will be taking over for Steve Kean as CEO. This prompted us to look back over KMI’s history, which reflects some of the best and worst of the MLP sector for the past ten years.

A decade ago, the shale revolution drove increased capex for upstream E&P companies as well as the midstream ones that service them. Prior to 2014, KMI operated as the General Partner (GP) to MLPs Kinder Morgan Partners (KMP) and El Paso Partners (EP). The GP-MLP structure always looked to us like the hedge fund manager-hedge fund relationship.

The GP (HF manager) calls the shots and the MLP (HF) does what it’s told with limited rights for the limited partners. The GP could and often did sell assets to its MLP (a “dropdown”), directing the MLP to issue equity and debt to pay for them.

Or the GP could direct the MLP to build new infrastructure. The GP had Incentive Distribution Rights (IDRs) which operated like the carried interest taken by HF or private equity managers. It gave them a share of the profits with minimum capital at risk.

Back then, we always invested in the GP rather than the MLP because, as with hedge fund managers, that’s where the big money gets made. Rich Kinder exploited his MLPs masterfully and became a billionaire in the process. However, by 2014 the increasing need of MLPs to raise evermore capital to finance infrastructure for the shale revolution was driving up yields, making raising equity capital more expensive.

Kinder was frustrated at KMP’s high cost of capital, so in August 2014, Kinder Morgan announced it was simplifying its structure and rolling its MLPs into KMI to create one single entity. In fact, we were moved to write enthusiastically about it.

Rich Kinder said at the time, “”We have vastly simplified the structure,” and promised “modest cost synergies.” He also promised a $2 annual dividend growing at 10% for the next five years. Less than two years later, it was slashed by 75% and still hasn’t recovered.

KMI began a trend to roll MLPs up into their GP parent, which was often a corporation. MLPs had attracted income-seeking, K-1 tolerant investors, but the model broke when midstream companies followed their upstream clients into over-investing. Increased leverage led to distribution cuts, alienating the traditional income-seeking investor.

The MLP structure has never recovered, and they now represent around a third of the sector. The Alerian MLP ETF (AMLP) remains as an anachronistic vehicle for those who only want MLP exposure and are content with a tax-inefficient structure.

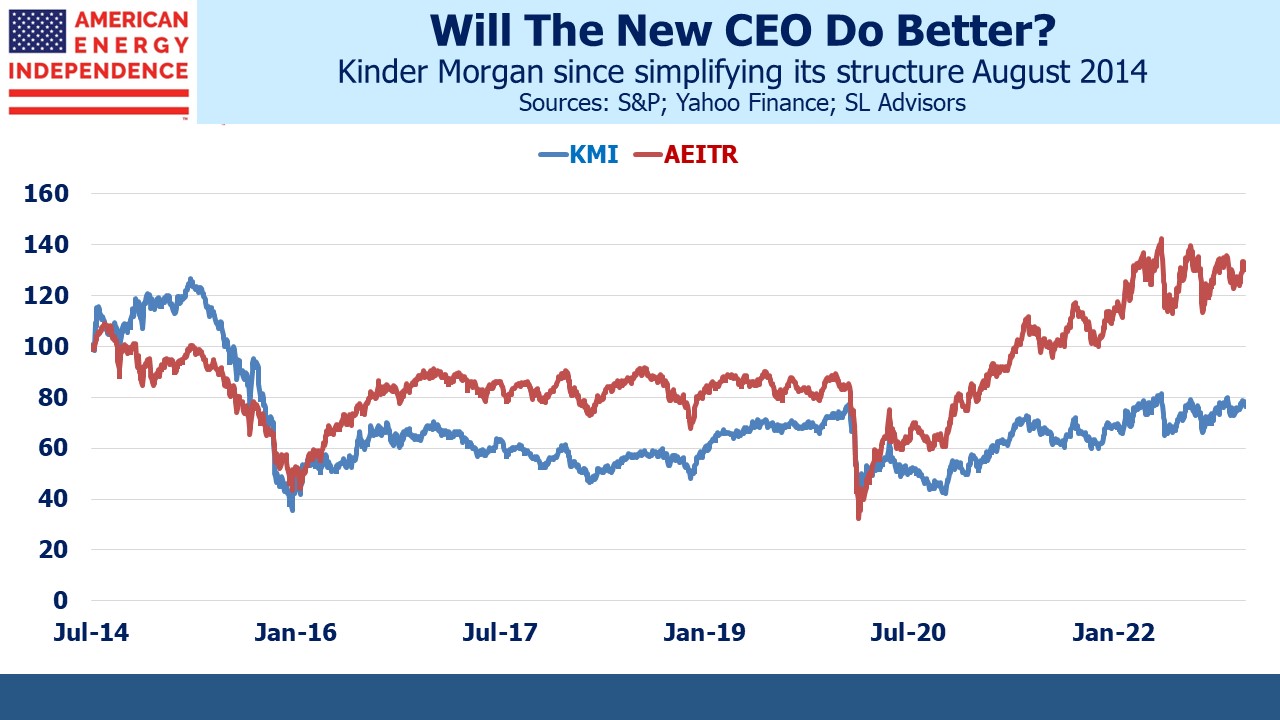

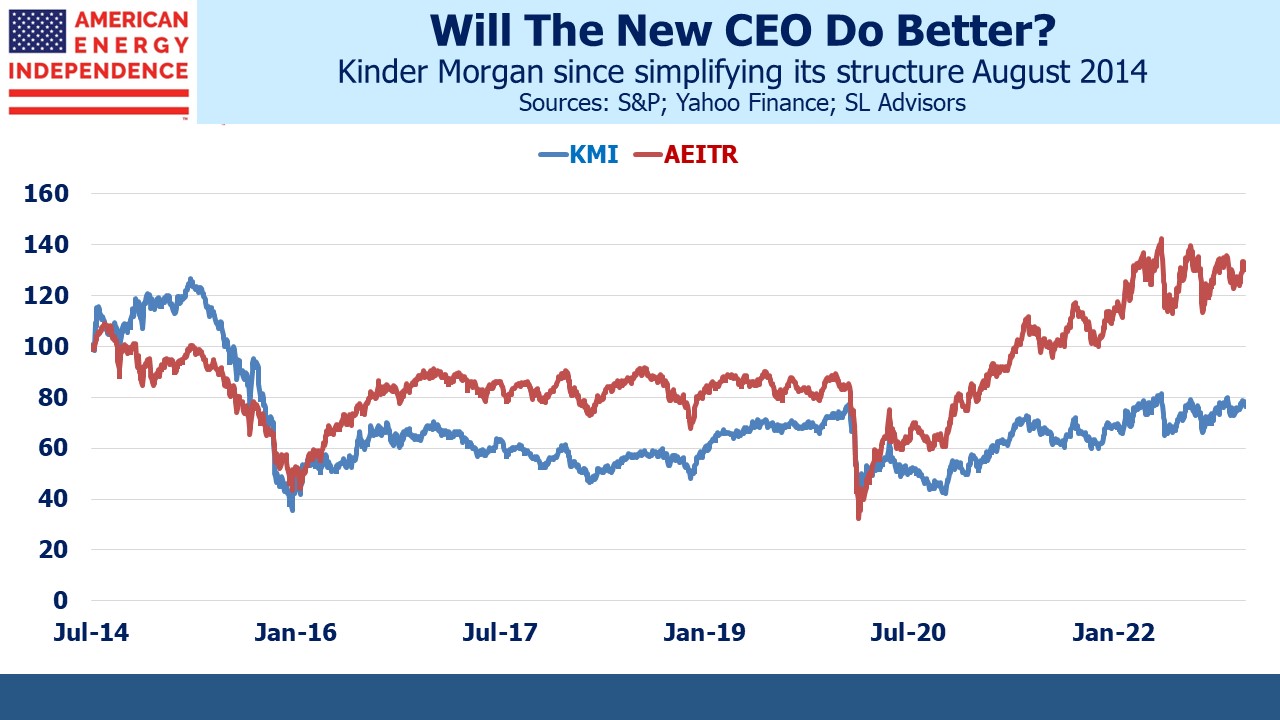

August 2014 was the peak in the energy sector for that cycle. Since then, KMI has generated a minus 2.9% annual return with dividends, lagging the sector, defined as the American Energy Independence Index (AEITR), which has generated 3.3% pa. KMI’s dividend is $1.11, still a long way from the $2 promised nine years ago.

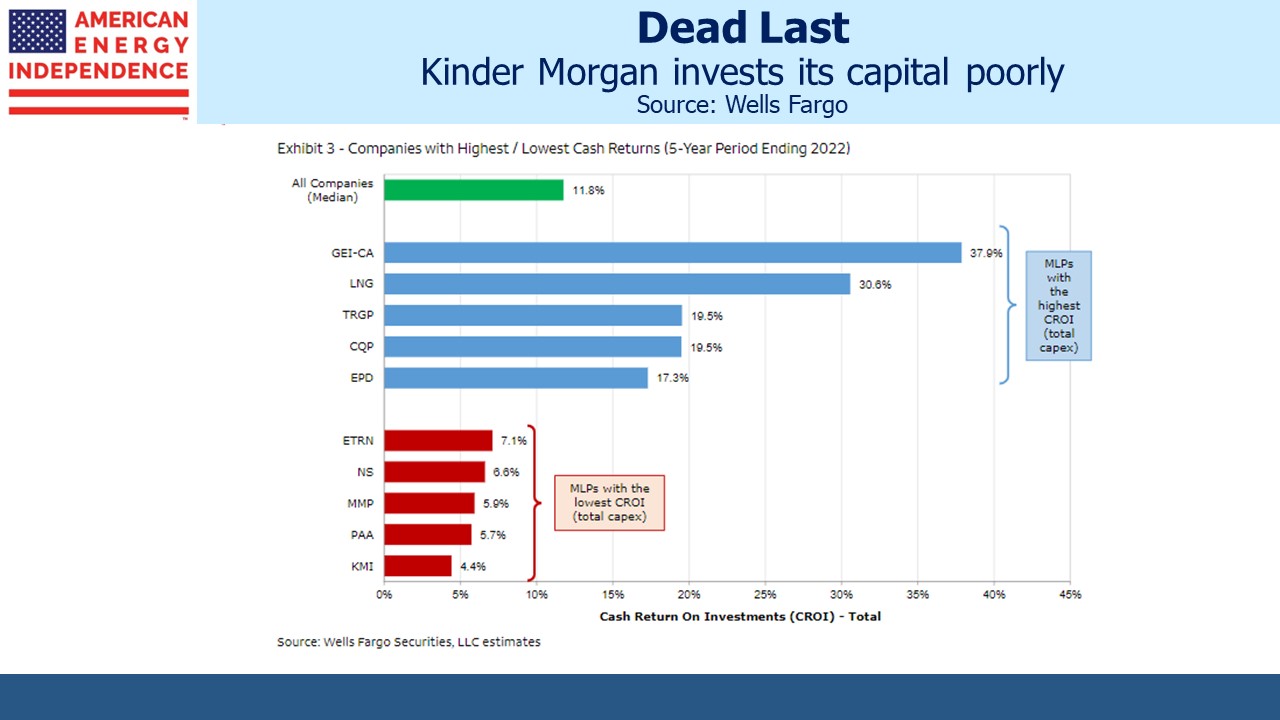

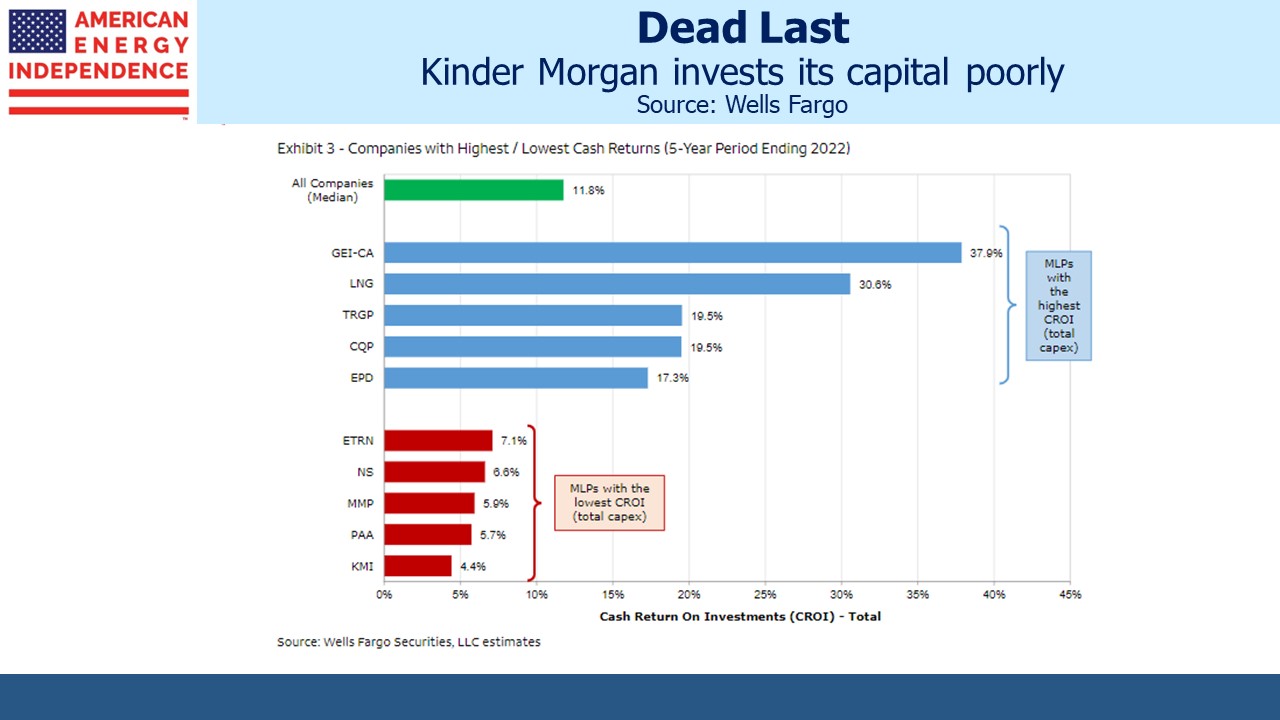

KMI has a track record of investing in low return projects. Wells Fargo calculates that over the past five years, KMI has earned a Cash Return On Investment (CROI) of only 4.4%, the lowest of any big company. Since 1999, they’ve earned 5.6% versus an industry median of 10.7%. KMI’s stock has lagged because they keep investing in projects that earn less than their cost of capital.

Rich Kinder ran the company during most of this period, and he’s misallocated his own capital as well as his investors’ because he’s still the biggest individual owner of KMI shares, with around 11% of the company. His personal fortune is from understanding how to exploit the GP/MLP structure that used to exist, but he must think it’s from making good investments.

Which brings us to the new CEO Kim Dang. She became CFO in 2011 and has been part of the management team ever since. The low CROI projects substantially occurred on her watch. Did she internally oppose misdirected capital, or did she misestimate returns as much as Kinder? Neither explanation is good, and KMI’s pliant board of directors doesn’t seem too concerned about the company’s investment track record.

On KMI’s Q4'22 earnings call, Dang commented that, “A large part of my job is going to be about continuity.” Long-time investors may feel a twinge of nervousness at this prospect. An improvement on past performance is needed.

Encouragingly, KMI added $1 billion to their buyback program. Given the stock’s poor performance for many years, this might be one of their best uses for excess capital. We continue to own KMI, but at a reduced size relative to its percentage of the sector’s market cap.

More By This Author:

US Oil And Gas Production GrowingDon’t Bet On A Return To 2% InflationLooking Back On 2022

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their ...

more

Disclosure: The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and charts depicted herein should not solely be used to make investment decisions. Please refer to our full disclosure here.

less

How did you like this article? Let us know so we can better customize your reading experience.