Why Quality Strategies Are Drifting To Value Valuations

An interesting dynamic is developing in the factor world.

First, momentum strategies have gained a lot of media attention. They had garnered a reputation for being growth strategies since growth was working for so long. Recently, value has taken over.

Twitter has caught on to the declining price-to-earnings (P/E) ratio of the MSCI World Momentum Index as evidence.

For instance:

Another interesting dynamic taking hold is that quality strategies—which select growth and quality companies—are showing valuations that rival traditional value indexes but with a different composition and sector mix.

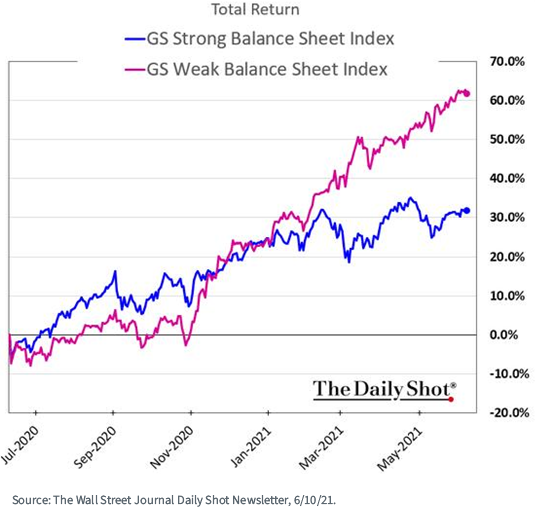

One chart that explains some of what is going on is the divergent returns among strong-versus-weak balance sheet stocks, exemplified by this Daily Shot graphic depicting returns based on balance sheet sorts of the market.

Strong balance sheet stocks are associated with higher-quality companies, and weak balance sheet companies are associated with low-quality stocks—and this big return dispersion—30 percentage point differential returns over the last six months or so—are leading to valuation discrepancies in these baskets.

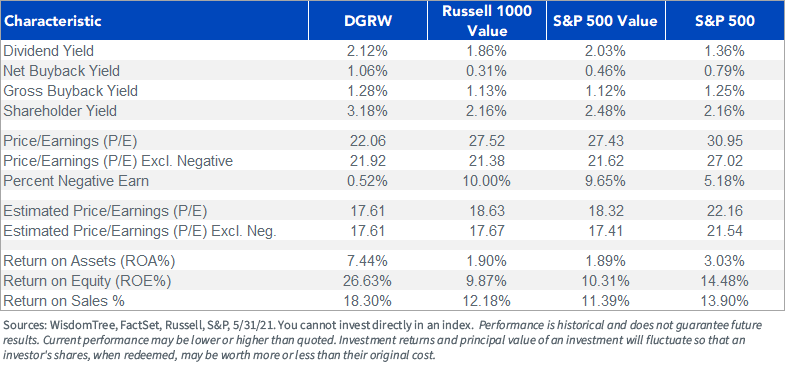

While traditional value strategies select companies that earn lower returns on capital (measured by return on equity (ROE) or even return on assets (ROA)), the WisdomTree Quality Dividend Growth Fund (DGRW) is showing valuation multiples as compelling as the value benchmarks but with a process that focuses on high return on capital and strong balance sheet stocks.

DGRW has even lower forward P/E multiples than either the Russell 1000 Value Index or the S&P 500 Value Index, despite having an ROE upgrade and improvement relative to the S&P 500.

Click here to view the 30-Day SEC yield and standardized performance.

For definitions of terms in the table, please visit the glossary.

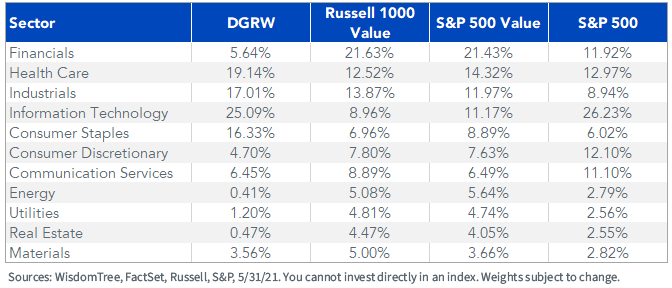

The sector compositions of the baskets that drive these valuations are also different.

While the S&P 500 Value and Russell 1000 Value are weighted highest in Financials—10% over-weight relative to the S&P 500—DGRW has half that Financials exposure, at under 6%.

Instead, DGRW has over-weight allocations to Health Care, meaningfully more weight in Information Technology stocks than value strategies, as well as over-weight allocations to Consumer Staples stocks.

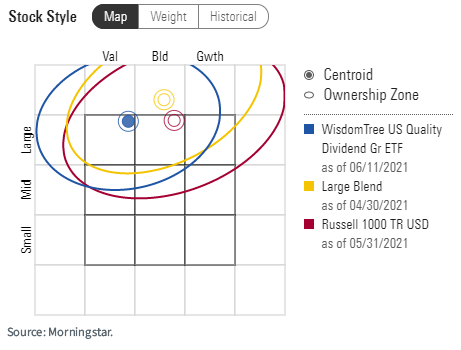

While in international markets this quality often results in a large-cap growth designation, in the U.S., DGRW is currently mapping in the value bucket as it did for much of 2020 as well.

The below chart shows how DGRW has historically been in the “US Fund Large Blend” category over the past five years, but over the last two years its style—which can deviate from year-to-year without triggering a category change—has been in Large Value.

Historical Style Map

Whether Morningstar will reclassify DGRW as a value strategy in time remains to be seen.

Value’s outperformance is being led by Financials and Energy and increasingly recent momentum strategy purchases. But if you believe this outperformance is apt to run out of steam, there is a way to get what we view to be compelling value-like valuations with an investment process that favors high-quality, dividend growth-oriented firms that are being neglected on a valuation basis today.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

There are risks of investing in value stocks such as the potential that a particular stock may not rise to its anticipated intrinsic value and could decline further in value.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more