Where's The Weakness In Discretionary?

Entering the final month of the first quarter, most S&P 500 sectors are sitting on year-to-date gains, although there are two notable exceptions. The Tech sector is currently down 5.29%, which has dragged on broader market performance, given it's by far the largest sector by market cap. Consumer Discretionary is down an even worse 5.65% year to date, and returns look even worse when compared to the December 17th high. Since then, the sector is down just under 12%. As shown below, using the sector ETF (XLY) as a proxy for the group, that latest correction leaves it in no-man's-land between the 50 and 200-day moving averages with the recent low finding some support around the November post-election low.

T

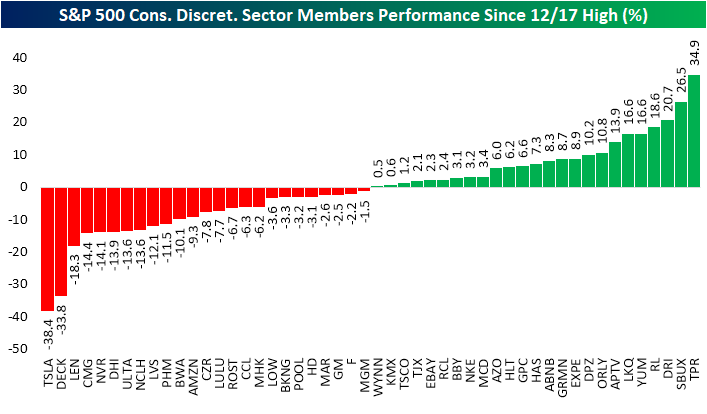

aking a look under the hood, breadth since that December high hasn't been that bad. Of the 50 stocks in the sector, half are higher, and half are lower since the high. However, there is a far larger weight in the losers than the winners. Among the decliners are the sector's largest names: Tesla (TSLA) and Amazon (AMZN). Given that the S&P 500 is weighted by market cap, those declines in the mega caps—namely the outsized 38.4% drop in TSLA shares—have acted as significant drags on broader index performance.

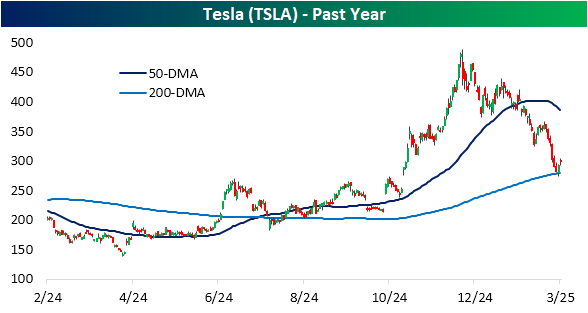

Zeroing in on Tesla (TSLA), the stock peaked a day after the Consumer Discretionary sector, closing at a 52-week high on December 18. Regardless, it's been a brutal period of selling since then. The stock's nearly 40% decline saw it crash through its 50-DMA, and in the past few days, it has found support at its longer term 200-DMA.

Again, the S&P 500 and its sectors use a market-cap-weighted methodology, meaning stocks with larger market caps (like Tesla) will have a greater impact on the index than smaller peers. That also makes equal-weight versions of the indices useful in canceling out some of that noise and providing a better look at breadth. As shown below, whereas the market-cap weighted sector ETF (XLY) is down 9.6% from a 52-week high, the equal weight version (RSPD) is down less than 3%. Furthermore, whereas XLY looks like a falling knife, RSPD has just been bouncing sideways along the 50-DMA. The latest lows for RSPD came right at the uptrend line off of last summer's lows. So all together, while the weakness in the Consumer Discretionary sector may cause some alarms to go off as a sign of stress for the consumer, the current situation is more looking like a lesson in index weighting methodologies and mega-cap volatility.

More By This Author:

Be Greedy When Others Are FearfulWhen The Weekend Was A Good Thing

Don't Sleep On Dividends

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more