Was It Just A Bounce From The August Mini-Crash?

Image Source: Pixabay

Two things we know. September is the worst month of the year from a seasonal perspective. And September to mid-October is seasonally weak in election years. Two weeks ago I mentioned that if the Nasdaq 100 and semiconductors were about to fail, it was going to get ugly in the short-term.

I think it’s safe to say that they have failed as you can see both charts below. With the two negative seasonal patterns and the failure, both the semis and Naz look like they are headed back towards, to or through the August 5th mini-crash bottom. At this point, I would say that a move down near those levels would be a strong buying opportunity.

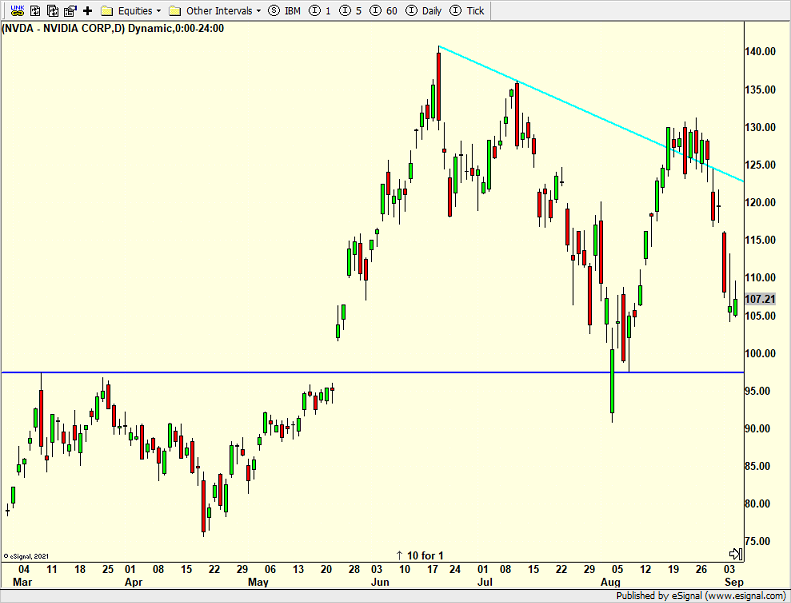

Isn’t it amazing that the world couldn’t stop falling over itself for the Artificial Intelligence (AI) trade? Nvidia (NVDA) could only go one way and people scoffed and laughed at me when I suggested just simply harvesting some acorns.

The stock is below and like my comment about the semis above, this one looks like it’s certainly going sub-$100 and possibly under $90. Look, I love the company and what they are doing and will do. But to suggest it’s a one-way street is patently absurd. Pruning profits is never a bad idea.

Let’s turn to what was being hailed as the “next Nvidia”, Super Micro (SMCI). This is another stock I hammered on even harder for those lucky enough to enjoy that epic rally above $1200. I thought the stock would “correct” 50% sooner than later. What’s going on now is an outright drawn out crash. $350 is next where we should see some stability. This one reminds me of a Dotcom stock.

With all negativity, you would think the bull market is over. It’s not. Sorry bears. Your day in the sun will have to wait until 2025. I think we have some turbulence for the next 4-6 weeks and then a rally to all-time highs in Q1 2025. If I am right, that rally will be uber important to gauge 2025.

For now, prune when possible. Make your buy list. And get ready for a good opportunity.

I am traveling early on Monday morning down to the Sunshine State. My chariot of choice, Avelo, doesn’t have WiFi. I will try to publish from the airport, but as most of you know, I am usually that guy who jogs on last as they announce, “Mr. Paul Schatz. Mr. Paul Schatz. Last call. Your flight is leaving.”

Unofficial fall in here. Cooler nights. Fire pit. Fall baseball for D. Three games each weekend. The 12 team, Schatz family fantasy football league has begun. I already hate my team and I had the number one pick. Travel ramps up through year-end, some business, some personal.

On Tuesday we sold EMB and SSO. On Wednesday we sold some FDX. On Thursday we bought PCY, EMB and levered S&P 500. We sold DRN and some IJJ.

More By This Author:

Friday Was All About Window Dressing & Month-End Mark UpNo Stock Market Crash From Nvidia

It’s All About Nvidia Today – Be Careful

Please see HC's full disclosure here.