Waiting For The Worst

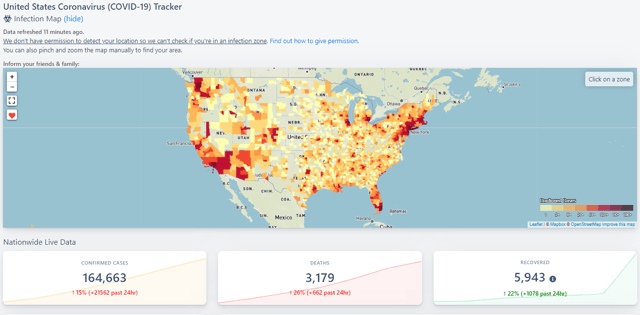

The U.S. COVID-19 Tracker as of Monday Night

Waiting For The Worst

I should be writing more. That's what I tell myself.

Instead, I keep refreshing that COVID-19 tracker, as I sit here in the contagion hot zone of Bergen County, NJ. I put on a surgical mask and gloves for occasional trips to buy food or medicine or whatever home exercise equipment is left, and then I go home and look at that site. The 24-hour increase in deaths dropped to 14% on Sunday, for the first time since I'd discovered the site about a week ago, and I was briefly encouraged. But as I write this, it's back up to 26%. If it stays at that level, and deaths peak in two weeks, by that time there could be more than 80,000 deaths in the U.S. Grim, but it could be a lot worse if so many of us weren't on lock down right now.

Looking Ahead

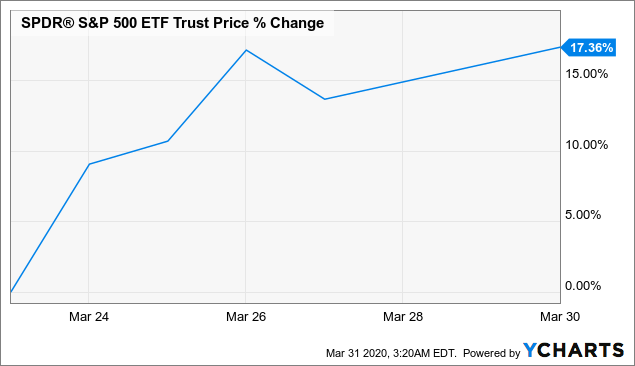

Markets are supposed to be forward-looking, so with the SPDR S&P 500 ETF (SPY) up more than 17%, as of Monday's close, from the bottom, one might assume the market is looking past the peak in COVID-19 deaths expected next month.

But as my Twitter correspondent James Miller, the Smith College economist, noted, markets weren't very forward looking in early February.

The biggest prediction failure was of the financial markets. A market crash in early Feb would have been a wake up call to the world. We pay $$$ to our best and brightest to work in finance, and prediction is a huge part of their job. They let us down.

— James Miller (@JimDMiller) March 22, 2020

What Now?

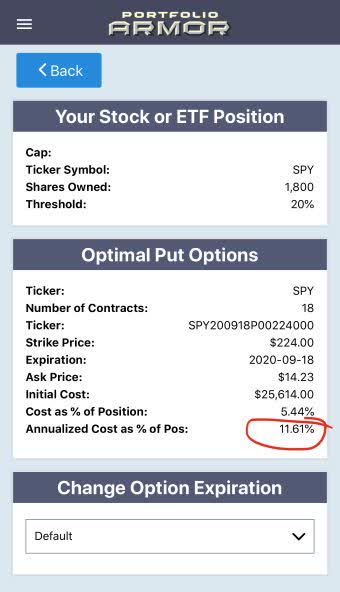

So what now? I wrote recently that it was too late to hedge market risk because it was too expensive, but it might get a little cheaper after a bounce. We've had a bounce and it's gotten a little cheaper, but it's still extremely expensive: 11.61% of position value annualized, to protect against a >20% decline in SPY over the next ~6 months.

By way of comparison, when I suggested hedging on February 13th, the annualized cost of similar protection was about 1.12% of position value.

Later, I wrote about going on offense, with a hedged bet on the ProShares UltraShort Oil & Gas ETF (DUG), but as of this writing, the hedging cost isn't as attractive so that's no longer one of Portfolio Armor's top names.

What about one of Portfolio Armor's current top names? The top ten names as of Monday's close are mostly short-duration government bond and currency ETFs, so not a lot of upside potential.

The bounce since the market bottom seems to have put Portfolio Armor's security selection in a conservative mode. Those top names are updated every day the market's open, so I would keep an eye on them, and when their potential returns go up - whether because it's picking stocks in a bullish scenario, or inverse ETFs in a bearish one - that's when I'd consider putting more money to work (while hedged, of course).