VIX-Leveraged ETPs And The 5% Contango Rule

On April 23, 2017 I informed readers, traders and investors alike as to the risks that lay before the global equity markets in an article titled Macro-Concerns Dominate The Trading Week As Volatility Takes Center Stage. Within the article I also articulated my steadfastness regarding maintaining a long-term, core short position in ProShares Ultra VIX Short-Term Futures ETF (UVXY) that I had been increasing, as the VIX had been rising.

For all the media’s fear mongering and traders hedging their proverbial bets against their long positions and just as was the case with Brexit, global equities rallied past the headline risks as the VIX precipitously dropped. On this latest French election, North Korean and looming government shutdown scare, the VIX rose beyond 16 before settling at 14.63 on Friday April 21, 2017. If you held onto your long VIX and/or VIX-leveraged ETF/ETN positions for fear of the French election, Monday morning those positions were significantly damaged. The VIX dropped all the way down to 10.84 on Monday, cratering VIX-leveraged instruments like UVXY, my favorite of all the VIX-leveraged ETFs. And it wasn’t even like UVXY gave longs/hedgers a chance to get out of it with minimal damage that day as it trended lower throughout the day, closing near the lows of the trading day. It’s for this and many other market exampled reasons I always offer to investors/traders not to go long designated short instruments. If your timing is not precisely perfect on the entry and the exit, the capital erosion can be demoralizing. But it’s a great lesson for a great many market participants to say the least.

Staying short leading up to and through this past week’s manufactured drama in the markets proved quite rewarding for the Golden Capital Portfolio. While I suffered through the significant 45% backwardation in the portfolio’s largest position in UVXY (Short shares); I understood this backwardation would be met with equal or greater share price decay in the near-term. And it is with that understanding that I continued to short through backwardation, layering in more and more positions as well as trading intraday. UVXY experienced a 45% share price spike from the low $15s to roughly $21.75 in a matter of 2-weeks. In less than 3 trading sessions, the share price dropped all the way back down to the low $15 range. This past trading week, UVXY found a new, all-time trading low and finished the trading week at $14.18 a share. Golden Capital Portfolio, as chronicled here on TalkMarkets.com and with various articles, maintains a long-term, core short UVXY position. It’s for this reason that the portfolio is now expressing a 67.5% ROIC year-to-date. The screen shot below of Golden Capital Portfolio performance YTD identifies the portfolio’s mirroring of UVXY’s backwardation, portfolio manager’s layering of additional short positions during backwardation and subsequent drop in UVXY share price.

Moreover, this article is not designated for the recognition of Golden Capital Portfolio’s strong returns; it’s not…wink wink. This article is an offering of what may have failed to find a discussion or evaluation in the past. I’ve been investing, yes investing short in VIX-leveraged instruments like UVXY since 2012 and despite the misnomer that these types of instruments can’t or shouldn’t be held over night. In doing so I’ve learned a few strategies for participating with them and doing so w/great efficacy, profits and confidence. I think my followers would all agree, that regardless of the state of the VIX and equity markets, I exhibit reasonable levels of confidence in shorting VIX-leveraged instruments…even during share price backwardation of 45% against the Golden Capital Portfolio holdings.

The aforementioned confidence comes firstly from understanding the construction of UVXY and its peer ETF/ETNs. These instruments are designed to decay in price over time and as such their performance is not left to chance, but rather human error if utilized inappropriately. In other words, it’s not UVXY’s fault if the investor/trader loses capital, UVXY can only do what it has been designed to do and over time it will do that very thing. Another reason for exuding confidence in shorting UVXY comes from experience. Experience is a great teacher, motivator and disciplinarian. Practice and learned lessons are garnered over years of experiencing hardships and rewards. With each passing year, my experience with VIX-leveraged instruments builds and generates identifiable trends, correlations, strategies/approaches and the all-too necessary “ice water in the veins” approach to handling adverse shocks to these investments and trading vehicles. These variables have all been a key to my understanding and participation with VIX-leveraged ETPs. More importantly, they have been to the greatest benefit of my clients’ invested capital.

One of my more commonly used strategies for investing and trading UVXY is what I call the 5% Contango Rule. This rule was created through dedicated charting and correlating of contango and VIX-leveraged ETP share price performance over the last 5+ years. The graphic below is of contango during that time period.

As one can identify from the graphic, positive contango is present in VIX-leveraged ETPs more than 80% of the time and is only inverted less than 15% of the time. I use the term inverted contango as I find the term backwardation inappropriate in definition and confusing to many in practice. Inverted contango is negative contango. While some believe contango pulls down the share price of VIX-leveraged ETPs, I believe it acts as a price suppressant in that it suppresses upward price movement. It doesn’t prevent it, just suppresses it. The greater the degree of contango, the greater price suppression in my humble understanding and as represented in the graphic above. It is with the evidenced graphic of contango since 2011 that I developed and implemented the 5% Contango Rule.

The 5% Contango Rule was built on the careful following and short participation of VIX-leveraged ETPs. It tracks the level of contango over a period of time and aids in forecasting the correlated price movement of VIX-leveraged ETPs during the tracked time period. The rule is applied as follows:

- Flat contango: Benign and bears no prognostication. It can become inverted just as easily as it can soar to 10% or greater.

- 5% contango: Represents an opportunity for an investor to prepare to start or add a short position near term. 5% contango suggests volatility is becoming complacent and equity markets are awaiting buyers or a catalyst for increasing equity valuations. 5% contango allows VIX-leveraged ETP participants to prepare to deploy capital by raising cash or maintaining a state of alertness.

- 5%-10% contango: The “daily chop zone”. It is within this range of contango that daily “scalps” are prevalent. VIX-leveraged ETPs tend to remain loosely correlated to the movement in the VIX.

- 10% contango: Offers investors/traders a greater degree of certainty with regards to the future price decay of VIX-leveraged ETPs. It is upon achieving 10% contango that additional short positions are taken as risk diminishes. VIX-leveraged ETPs become increasingly less and less correlated to equity markets and Spot VIX.

- 15% contango: Investors/traders continue to add more short positions at this level, as the correlation to equity markets and Spot VIX widens. Typically 15% or greater contango occurs in a state of market complacency and after consecutive VIX Futures monthly contract rolls have taken place with limited to non-existent contango percentage reversion. Long hedging using VIX-leveraged ETPs at this level or higher are found ineffective. VIX-leveraged ETPs enter death spiral zone at this level.

- 20% contango, death spiral: It is at this level or greater that several VIX Futures monthly rolls have occurred alongside sustained market complacency. Additional short positions are ideally taken at this level and/or higher with greatly diminished risk. VIX-leveraged ETPs are likely exhibiting low share price valuations at this level of contango, possibly forcing a reverse split in the instrument’s share price near-term. This level of contango is known as the death spiral zone, as a reverse split in VIX-leveraged ETPs’ share prices is imminent. Reversion in both contango and the share price are extremely unlikely absent an adverse market shock. Investors’/Traders’ greater considerations should focus on a desired number of shares or contracts to be held post a reverse split and position accordingly to achieve the desired outcome.

The 5% Contango Rule has never failed since implementation and as such has never found a short position without a profit. The rule, implemented as a strategy for shorting VIX-leveraged ETPs, highlights the importance of contango when positioning and/or deploying capital. As such, the 5% Contango Rule also serves as a risk assessment tool.

At the close of trading on Friday April 28, 2017, contango finished just under 7% and after modestly rising throughout the week. As identified above, contango is presently in the chop zone and with the next VIX Futures contracts expiration period on the horizon. The chop zone is ideal for day trader participation and as such I had been doing so as identified with various positions posted through my Twitter feed. For those who have followed my positioning in VIX-leveraged ETPs over the years and through the numerous risk/volatility events, you’ve likely done very well for your actively managed portfolio.

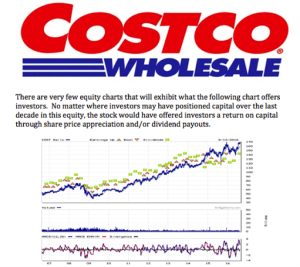

In the month of May, Golden Capital Portfolio will receive new client commitments totaling $8mm in new investor capital of which I plan to invest according to the rules and strategies outlined. Year-to-date, the Golden Capital Portfolio continues to show increasing levels of ROIC. Outside of VIX-leveraged ETF capital deployment, the Portfolio also holds shares of Costco (COST). Last week, Costco announced a significant and shareholder friendly, Special Cash Dividend worth $7 a share. As a research analyst, I broadly cover the retail and consumer goods sector and have for many years. On 9/15/16, I offered to my clients and through an exclusive report, why I was acquiring shares of COST and would continue to do so on any pullback in share price. The screen shot below identifies that very reporting. For readers who desire a copy of this report, feel free to contact me directly.

In the 4th quarter of 2016, I offered to the greater investor community a reiteration of this sentiment in an article titled Costco Shares Have Been Poorly Received By Investors. I’m pleased to see the performance in shares of COST in 2017. The recent announcement of a Special Cash Dividend worth $7 a share will aid in boosting the YTD performance of the Golden Capital Portfolio alongside other well-researched investments.

Disclosure: I am short VXX and UVXY, I am long COST

Any opinion on what you feel is the best broker to hold short UVXY?

In my experience, as I have used a plethora of brokerages/platforms since 2001, Scottrade is the only one that has never called in shares on mine or associates' accounts.

Thanks, appreciate the reply.

I have to assume a strategy like this performed well even in 2015, a year in which it has been said that EVERY volatility product declined in price, with UVXY down about 77% that year. I don't think we will see a year in which they all go up!

Would be very challenging to exhibit all like instruments having an annual gain, but should that be that case, it is always prudent to have ample cash to participate accordingly.

Okay but the phrase "like instruments" may be confusing to some. I wanted to be clear that even instruments appearing to be opposites, or at least on opposite sides such as $VXX and $XIV, $UVXY and $SVXY, $ZIV and $VXZ etc. all declined in 2015.

Excellent post. Specifies guidelines to any one new or pro. Will use this as a ready reckoner before opening new positions in VIX ETP/N. Any guidelines when in negative contango? What levels one should look for trim positions? what level to book losses?

Thank you! This article www.talkmarkets.com/.../uvxy-reverse-split-ahead-how-to-position-when-volatility-spikes offers my positioning when $UVXY or $VXX spike, usually during negative contango.