VanEck Rare Earth & Strategic Metals ETF – Elliott Wave Technical Analysis

VanEck Rare Earth & Strategic Metals ETF (REMX) – Elliott Wave Technical Analysis – Daily & 4H Charts

Daily Chart – Expanded Flat Correction Nearing Completion

Function: Counter trend

Mode: Corrective

Structure: Expanded Flat

Position: Wave [c] of 4

Direction: Bear market rally

Details:

Wave 4 is approaching its final subwave before the corrective phase concludes.

The current rally is expected to retrace 38.2% to 50% of the decline from wave 3.

A break above $51.10 will serve as strong confirmation of the expanded flat structure.

The termination of wave 4 is projected near the $57.12 level.

After the top of wave 4, a 5th wave decline is anticipated, targeting a level below the origin of wave 4.

Invalidation Level: $32.36

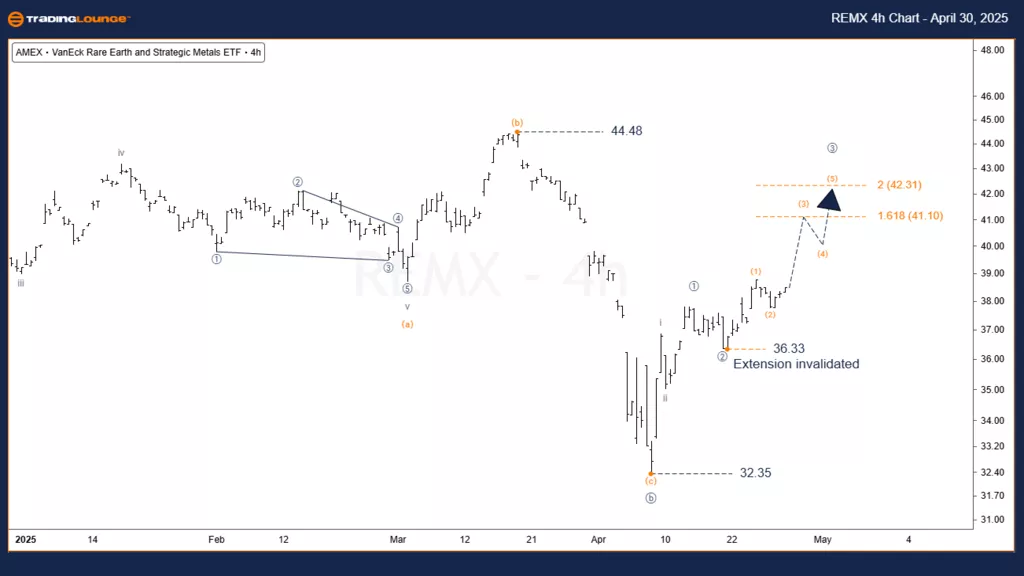

4-Hour Chart – Impulsive Rally Structure in Play

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave [3] of iii

Direction: Rally

Details:

The rally is expected to continue past the $44.48 high in a clear impulsive pattern.

Wave [3] is likely to terminate between $41.10 and $42.31.

The low of wave (2) is a key level to monitor for maintaining the bullish outlook.

$36.33 serves as critical support and the invalidation level for this view.

Invalidation Level: $36.33

Conclusion & Strategic Notes

REMX is expected to continue rising in the near term.

The market should surpass the end of wave [a] in this phase.

The primary target is $57.12, where wave [c] may equal wave [a].

This scenario presents a favorable opportunity for ETF-focused traders.

Following Elliott Wave guidelines and respecting invalidation levels are vital to managing risk effectively.

Technical Analyst: Simon Brooks

More By This Author:

Unlocking ASX Trading Success: Car Group Limited - Wednesday, April 30

Elliott Wave Technical Analysis: MicroStrategy Inc. - Wednesday, April 30

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Wednesday, April 30

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more