This Article Analyzes The AI Sector 10 Ways To The Middle

From what has been written about artificial intelligence (AI) there is not much information as to what companies are involved in the research and development of quantum computing qubits and the companies involved in the application of such revolutionary technology. This article does just that, slicing and dicing the sector in a multitude of ways and identifying artificial intelligence and related (AI&R) stocks and ETFs that an investor might wish to consider investing in.

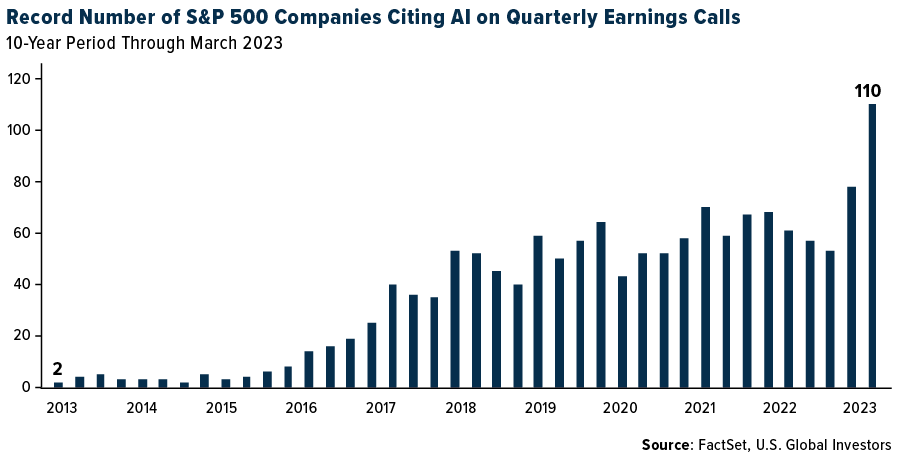

According to an analysis by FactSet of earnings conference calls for the first quarter of 2023 110 companies mentioned AI.

(Click on image to enlarge)

According to Grand View Research the AI industry is expected to surge from about $197 billion in 2023 to $1.8 trillion by 2030, representing a compound annual growth rate of 37% – but what is the best way to chose that growth?

- invest in individual AI&R stocks OR

- invest in the best ETFs in the broader tech sector that have some AI&R exposure OR

- invest in robotics and AI&R ETFs OR, better yet,

- invest in generative AI and/or semiconductor ETFs.

AI Companies by Sector

At the sector level, 75% of Communication Services companies (15) and 66% of Information Technology (38), 23% of Industrials (17), 22% of Consumer Discretionary (11), 19% of Financials (13) and 10% of Health Care sector companies (16) cited “AI” on Q1 earnings calls. Of the 110 companies, 46 cited the term “generative AI” on these calls referring to their application of AI that can create unique content from simple prompts submitted by users).

1. AI ETFs

There are 15 ETFs invested in baskets of stocks of companies involved the research and development of quantum computing capabilities (i.e. semiconductor stocks) and the application of such technology (i.e. generative AI stocks) so there is a broad selection to choose from and these ETFs do just that: SMH; SOXX; SHOC; SOXQ; AIQ; THNQ; PSI; FTXL; SEMI; LRNZ; XSD; WTAI; IQM; QTUM; and CHAT. They have expenses ranging from $0.19 to $0.75 (average of $0.51) and an average of 47 constituents ranging from 23 to 93 in number.

Of the 15 ETFs, Global X AI & Technology ETF (AIQ) provides the broadest selection of AI&R companies with 93 (and the fourth highest expenses at $0.68) and, as such, reflects the most accurate insight into the overall performance of the AI&R sector. A close second is Robo Global AI ETF (THNQ) with 72 constituents and expenses of $0.68. These two ETFs are UP 20.0% and 16.7%, respectively, since the AI&R bubble began to inflate at the end of April into early May and are UP 36.9% and 35.4%, respectively, YTD. Comparatively speaking, the Nasdaq is UP only 15.2% since the end of April and only UP 29.8% YTD.

On a more selective semiconductor basis, the iShares Semiconductor ETF (SOXX), with 35 constituents and $0.35 in expenses, is UP 21.1% since the AI&R bubble began to inflate at the end of April into early May and is UP 39.6% YTD while the Invesco PHLX Semiconductor ETF (SOXQ) of 33 constituents and expenses of $0.19 is UP 20.3% since the end of April and UP 38.2% YTD.

The latest article on AI ETFs is available on TalkMarkets here.

2. Quantum Computing Semiconductor Stocks

By comparison to the above, the munKNEE Quantum Computing Companies Portfolio of 12 companies (Alphabet (GOOGL); IBM (IBM); Amazon (AMZN); Microsoft (MSFT); Intel (INTC); Nvidia (NVDA); Taiwan Semiconductor (TSM); Alibaba (BABA); IonQ (IONQ); Baidu (BIDU); D-Wave Quantum (QBTS); and Rigetti Computing (RGTI)) is UP 29.9% since the end of April and UP 54.7% YTD.

The latest article on quantum computing semiconductor companies is available on TalkMarkets here.

3. AI&R "Bubble" Stocks

Of the 110 AI&R stocks mentioned at the outset, 46 with market capitalizations of at least $1B are in bubble mode (i.e. UP at least 20% since the AI&R bubble began to inflate at the end of April into early May) compared with the Nasdaq which is UP only 15.2% since the end of April. The AI&R stocks category has been divided into 5 sub-sections:

- 5 stocks are UP in excess of 85%: IONQ (+176.3%); SMCI (+140.9%); UPST (+115.0%); PLTR (+87.5%); RXRX (+87.1%)

- 6 stocks are UP by more than 50%: FRSH (+68.1%); NVDA (+65.8%); ZS (+64.1%); AI (+63.6%); ATEYY (+58.4%); ADBE (+ 56.6%)

- 6 stocks are UP by at least 40%: UBER (+48.6%); DDOG (+47.7%); TSLA (+45.2%); MRVL (+44.9%); HUBB (+40.3%); SYM (+40.3%)

- 10 stocks are UP more than 30%: AVGO (+39.1%); ENTG (+39.1%); META (+37.6%; ANET (+36.3%); DELL (+34.9%); SPLK (+34.4%); VMW (+33.4%); LRCX (+33.4%); AMAT (+30.9%); AMZN (+30.6%)

- 19 stocks are UP by at least 20%: TWLO (+29.5%); TEAM (+29.4%); ON (28.3%); CRWD (+28.1%); TTD (+27.9%); PANW (+26.5%); NFLX (+26.1%); INTU (+25.5%); AMD (+25.3%); KLAC (+24.6%); GOOGL (+24.1%); ORCL (+23.9%); NOW (+22.7%); VRSK (+22.2%); PCOR (+22.4%); NXPI (+21.7%); SNPS (+21.3%); ACN (+21.0%); IBM (+20.2%).

The latest article on AI&R "bubble" stocks is available on TalkMarkets here.

Interestingly, however, well known mega cap companies the likes of Microsoft (MFST), Intel (INTC), Taiwan Semiconductor (TSM), Alibaba (BABA), Apple (AAPL), ASML (ASML), Qualcomm (QCOM), Texas Instruments (TXN) and Honeywell (HON) are not included in the above 5 categories as their stocks have appreciated by less than 20% or, as in the case with HON, actually gone down in price since the AI&R bubble began to inflate at the end of April into early May.

4. Small Cap AI&R Stocks

In addition, munKNEE.com tracks the performance of 15 small cap AI stocks (i.e. those with market caps of between $100M and $999M) which, as of last Friday, were Up 62.8% since the end of April. The 15 stocks are: Applied Optoelectronics (AAOI); Innodata (INOD); Applied Digital ((APLD); Rigetti Computing (RGTI); Verses AI (VRSSF); Rekor Systems (REKR); SoundHound AI (SOUN); Presto Automation (PRST); Exscientia ((EXAI); D-Wave Quantum (QBTS); Butterfly Network (BFLY); Innoviz Technologies (INVZ) Applied Digital (AAOI); Lemonade (LMND); and BigBear.ai (BBAI).

The latest article on AI small cap stocks is available on TalkMarkets here.

5. AI "Penny" Stocks

13 small cap stocks (with market caps between $80M and $999M) trade for less than $5/share (i.e. "penny" stocks) and they are UP 20.2% since the end of April. They are: Rigetti Computing (RGTI); Verses AI (VRSSF); Rekor Systems (REKR); GSI Technology (GSIT); Presto Automation (PRST); SoundHound AI (SOUN); D-Wave Quantum (QBTS); Knightscope (KSCP); Quantum Computing (QUBT); Butterfly Network (BFLY); Innoviz Technology (INVZ); Veritone (VERI). and BigBear.ai (BBAI).

The latest article on AI penny stocks is available on TalkMarkets here.

I hope the above breakdown of the major AI&R stock categories provide a deeper understanding of the opportunities that exist for the enlightened investor. Follow-up articles on each of the 5 categories will be be provided at the end of this week in the August summary.

More By This Author:

The 7 ETFs In The Fringe Portfolio Were, On Average, Up Last Week

Conservative "Cannabis" Stock Index Remained Stable Last Week

7 Largest American Cannabis MSOs Moved Up 3% This Week

Disclosure: None

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more