The Short-Term Downtrend Continues Despite The Nasdaq Rallying

Image Source: Unsplash

The short-term downtrend looks set to continue, although the market has seen a few attempted rallies and the Nasdaq index has been showing strength. However, even though the Nasdaq index is rallying, the majority of stocks have still been weak which is why the trend is marked as down.

The short-term downtrend has been a period where the market's major indexes have moved sideways since early April, as shown by the SPX. However, as you have probably heard many times over the past few weeks, market participation and breadth have been poor. The indexes have held up well because a concentrated number of large-caps have done quite well while the majority of stocks have pulled back in price.

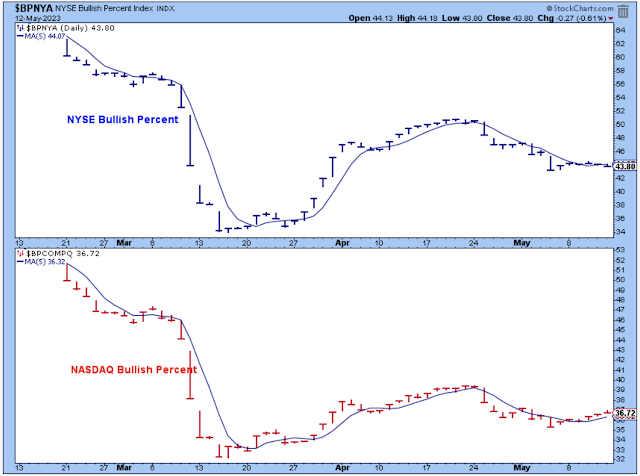

The bullish percents have moved sideways along with the indexes, but at low levels, which is another way of showing that the majority of stocks remain on sell signals.

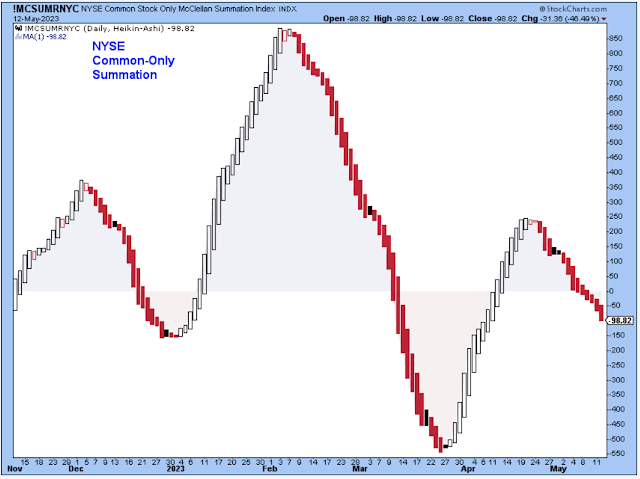

The NYSE common-stock-only Summation index is pointing decisively lower, confirming the general market's downtrend.

There are elevated levels of 52-week new lows on both exchanges. This chart should be considered today's headline for market followers. The major indexes may be doing well, but the foundation of the market looks to be getting weaker based on these new lows.

Bottom Line: I am a stock market bear, and I am currently comfortable owning Treasuries, bear-market ETFs, and a few small long positions in my favorite stocks while also having un-invested cash.

I continue to believe that the market moves in short-term trends often provide about five or six good buying opportunities and five or six profit-taking opportunities every year regardless of whether it is a bull or bear market.

At the moment, the market is in a short-term downtrend, as indicated by the PMO index (first chart). However, this PMO index is near the bottom of its range which means that it is late to be selling and the market will be oversold in a few weeks. It also indicates that it may be time to start looking to close out short positions and perhaps deploy cash into long positions to take advantage of the next short-term uptrend.

Initial unemployment claims are rising, adding to the bear case.

Weak oil prices only add to the bear case, as well.

The US dollar looks like it is breaking out above a downtrend. This isn't going to help oil prices, and it will probably hurt gold as well. Generally, I think of a strong dollar as representing a demand for US Treasuries.

The gold miners have already turned down slightly. I wouldn't make much of it though, at least not until it decisively breaks below this short-term support level. I tend to think that the best time to buy gold miners is when the silver/gold ratio is rising. The ratio has recently turned lower, so I am a seller of the miners, and I would sell more if GDX were to break down.

I've been watching TLT for a while. I expected it to break out above resistance the last time it tested in April. I was wrong then, but I'm still watching. I'll add to my Treasury positions on a break out.

Another chart I'm watching is the one below of the Europe ETF. Prices are currently just under long-term resistance (not shown), and with the dollar showing strength, I'm expecting this ETF to break down below the uptrend line.

Outlook Summary

- The short-term trend is down for stock prices as of April 25.

- The economy is at risk of recession as of March 2022.

- The medium-term trend is uncertain for Treasury bond prices as of Feb. 4.

More By This Author:

The Short-Term Downtrend Continues Despite Sideways MovementReviewing The Charts For Week Thru April 29

The Not-So-Strong Short-Term Uptrend Continues

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more