The Next 10% Move (Here’s How To Prepare)

What were your thoughts as you read the title of today’s issue? Were you assuming the next 10% is up or down? Were you thinking that an argument was going to be provided in which you’ll agree or disagree?

The S&P 500 has fallen 10% from its high, which is one of the most difficult positions to be in. There are many signals that are good for finding a market bottom as you head toward a 5% move lower. If you enter between that level and the 10% correction territory, you may be a little early, but if you scaled in over several days, you’re likely mostly unscathed.

The issue comes when you commit on the way down from 5% to 10% and then you’re in the position of watching the market drop another 10% into bear market territory - down more than 20%. It helps if you look to take profits and hedge into strength, but is there anything that can help identify major bottoms?

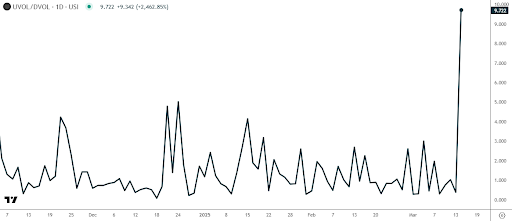

I’ve addressed a couple of indicators that can signal more significant bottoms in the market. Namely, the SKEW Index falling to the 115 to 120 range and seeing a highly correlated selling day (90% down day), but we haven’t achieved that yet. In fact, we had a 90% volume up day on Friday!

If you were looking for capitulation, you have one-half of a 90% day, but it was a bearish signal.

The Orderly Bear

So far, people have largely described the current sell-off as “orderly.” We’re searching around for indications that the market is about to move back to all-time highs. One problem with that notion is that it appears that institutions are comfortable with the market falling under its own weight but would not be opposed to a rally.

I call this “delta-comfortable.” We saw the high degree of hedging heading into the recent all-time highs. We watched as the VIX moved toward 30 a week ago. What we didn’t see on Friday, (and haven’t seen today - so far) is a major rally in the market. What we’re seeing, rather, are hopes for one.

Treasury Secretary Bessent over the weekend seemed to be comfortable with a further market decline. The idea of a “Trump Put” doesn’t seem to exist as they aim to quickly see the market realize the many issues of past policy, en route to a recovery based on the policy changes being instituted right now.

I’m sharing this because the move lower probably has much further to go. While we can try to find a silver lining, there just isn’t an easy way to remain bullish from an allocation perspective. Look to take shots and buy deep discounts, but any rally from last week’s low should be thought of as an opportunity to increase cash levels.

If you didn’t do it before the 10% sell-off as I had discussed on February 18, 2025, consider doing it now.

The harsh reality of a bear market is that you can’t hedge it. You can apply hedges intermittently, but markets don’t move in a straight line downward. At some point, it’s the allocation strategy that quarantines much of the systematic risk in the market.

First Mover Option Pulse

We’re looking for a first-mover advantage by identifying option pulses or prints that could impact the stock price. Here are several from the Chinese market that I thought were significant today:

- Xtrackers Hvst CSI 300 China A Shsres ETF (ASHR)—28 MAR 25 29/33 calls vertical bought

- Baidu Inc (BIDU)—28 MAR 25 100/105 call vertical bought

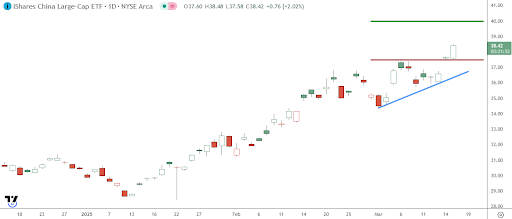

- iShares China Large-Cap ETF (FXI)—21 MAR 25 $38.50 calls mostly bought

- iShares China Large-Cap ETF (FXI)—31MAR 25 $38.50 calls mostly bought

- PDD Holdings Inc (PDD)—25 APR 25 $155 calls mostly bought

- KraneShares CSI China Internet ETF (KWEB)—28 MAR 25 $38 calls mostly bought

What is lifting the Chinese markets and seeing a flood of significant prints in the options market for many of these stocks? In a word, “stimulus”. This is exactly what Secretary Bessent was warning was the issue in U.S. markets in recent years.

The other side of stimulus is a weaker currency, but that hasn’t come to fruition yet. The Chinese yuan to U.S. dollar has remained stable and even seen the currency appreciate today on the news.

My fears over the yuan devaluation against the dollar haven’t materialized, but will at some point. However, it looks like the Chinese markets are prepared to continue their pump this week.

How to Play the Move

The hard thing about equity positions in these stocks is the volatility is expanding into the advance. That can mean sharp reversals, which makes it difficult to control risk. However, the call buying has created some degree of positive skew in the options. That means the call implied volatility is rising as you move OTM on the calls for many of these stocks.

For example, a slightly in-the-money (ITM) long call vertical on FXI can be bought pretty cheaply.

- Buy FXI 17 APR 25 $38 call

- Sell FXI 17 APR 25 $40 call

The implied volatility for the $38 call is lower than the $40 call, which makes the debt cheaper at around $0.85. With the vertical nearly $0.35 ITM with a share price of $38.34, it is one way to play positive movement in FXI this week with a target to close the vertical around a 55% gain or a limit of $1.32.

More By This Author:

The Smart Way To Play China’s Big Week

Get Ready For The “Great Reflation” This Week

Fade The Rip: The Market Says There’s More Trouble Coming

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more