The Market 'Could' Get Worse, But Signs Of Recovery Are Here: HDV And QQQ

Perspective

In one week, between March 4 and March 11, "2020", the S&P 500 index dropped by 12 percent, descending into correction mode. On March 12, 2020, the S&P 500 plunged 9.5 percent, its steepest one-day fall since 1987.

That was a continuation of the market malaise (caused by the COVID malaise) that began on Feb. 12, 2020. Using the most common benchmark, the S&P 500, from February 12, closing at 3370, to March 18, "just 5 weeks later", the S&P closed at 2447, a decline of more than 27%.

This year has been a disappointment thus far, but it still does not come close to the 2020 decline - and, by the way, March 2020 marked the beginning of this current bull, which extended almost uninterrupted until the last day of 2021, when it closed at 4793, a gain of 2743 points (a 96% increase!).

Thus far in 2022, the S&P is down from 4793 to 4329, 464 points, or a little less than 10%. Could it get worse? Sure. But it could also get better.

When was the last time you saw a banner headline on the front page about COVID? As long as COVID was defying our attempts to prevent it from killing our friends and family, it was front-page news.

Next came the fears of "runaway inflation." Even though we have known for months that a combination of supply bottlenecks and demand aided and abetted by government helicopter money raining down upon us just might be inflationary, it suddenly seemed shocking to some people that demand-inflation is thing.

What if?

But what if?

What if COVID really does come under some semblance of control globally, like the flu?

What if that means workers in manufacturing all over the world can return to work, earn a living wage and produce the goods, currently in such short supply, that we will see demand-caused inflation begin to subside?

What if the Fed is signaling only a quarter-point increase for March and fewer than originally thought during the year? (Which is now likely to happen.)

What if Russia accomplishes its goals in Ukraine only partially and is bogged down as it was in "its" Afghanistan fiasco? Even if Vladimir Putin "succeeds" in establishing a puppet government, winning the war does not mean winning over the populace nor does it relieve him of the massive, draining expense of an occupation force. Putin's war is already creating resistance at home.

Speaking as the geopolitical analyst I once was when covering Russia, occupation is an expense Russia cannot afford. This invasion will fail to do anything Mr. Putin had hoped to achieve geopolitically or politically at home.

How much should the world's greatest fear today - that the Ukraine/Russia war spreads and engulfs Europe or the world - influence your personal investing?

This cowardly bullying by Mr. Putin is a travesty. I personally will do, and want my government to do, everything it can to provide aid to Ukraine yesterday and today. But, speaking only about your investments for the moment, it's unlikely that this war will alter the earnings of most American companies.

Yes, some US energy companies and financial companies are likely to lose some revenue from their involvement in Russia. But in an index fund or any well-diversified portfolio like ours, materials and defense holdings will more than make up for that with their earnings. And the companies that are harmed will find it a short-term harm and may be a blessing in disguise - take the pain now before getting even more deeply involved with dictatorships.

The latest scare headline is that Russia is recruiting experienced Syrian urban combat mercenaries. Putin kept Bashar al-Assad's regime propped up, so it's time for payback. Those who fear this have simply not thought it through. While there are Syrian refugees in Ukraine, they're learning the language, have appropriate identification papers, and are not carrying AK-47s. These may simply become targets of opportunity.

(For my geopolitical analysis of Russia/Ukraine written just prior to the invasion: Russia Attacks.)

On to what may prove to be some news in the current panic:

Could This Be Where the Market Bottoms?

Everyone has an opinion. But no one knows.

There are some healthy signs, however. For one thing the S&P 500 was down 13% on Feb. 23. Since then, up, down, up, down, it has not been that low. Could this have been the low for this correction and we are now started to zig-zag our way forward?

Before the indiscriminate and violent invasion of Ukraine, when COVID and inflation were on the front page, it would have been fabulous news if more Americans (and global citizens) returned to work. We would know this if the number of new jobs filled exceeded our expectations.

That's exactly what happened but it seems to have been overshadowed by the more compelling events in Ukraine. The US new jobs report for February was highly positive. A total of 678,000 new jobs were filled vs. a consensus of only 440.000. If we compare our real fears with real good news I think we might see things in a more balanced light.

Next bit of good news: Fed Chair Powell has all but vetoed a 1/2 point interest rate rise this month. A 25 basis point (1/4 of 1%) rise is already well baked in at the current market levels. And analysts are back-peddling their predictions of seven more raises.

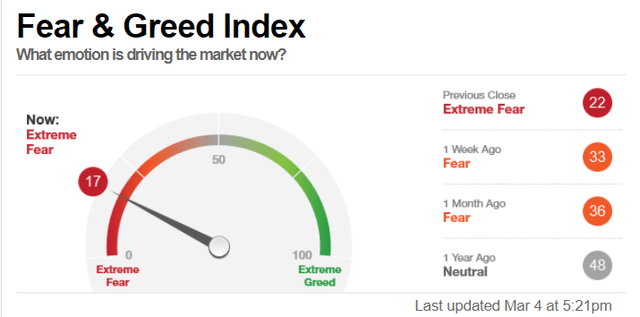

Finally, CNN provides a Fear & Greed Index every market day. What makes this a metric worth checking occasionally (or just seeing it here at week's end!) is that it tries to directly address the two emotions that drive investors at the extreme: Fear and greed. An excess of fear will always send stocks well below their "normal market" valuation. An excess of greed will always bid stock prices up beyond their "normal market" valuation.

Neither extreme tends to last for long. In fact, these tend to signal good times to lighten up or place trailing stops (at the Extreme Greed end of the pendulum) or, conversely, to begin positioning for a rise (at the Extreme Fear end of the pendulum's swing.) This makes sense. If most everyone is at the extreme of their fears, they have probably already been selling, selling, selling. At the other end, if greed is ruling common sense, their portfolios are already stuffed full and the momentum for the market continuing to rise (new cash coming in) is already in. Where are we now?

CNN Money

I'm much more comfortable establishing positions when fear is the primary emotion in the markets. We are now in the "extreme fear" range. I think the lowest I ever saw this gauge was in the fall of 2008 at 12, just a few weeks before I wrote an article March 3 titled "Can You Hear The Bell Signaling A Bottom?" (Can You Hear the Bell Signaling a Bottom? (NYSE: USB))

Last week this gauge declined to just "17", definitely in the "excessive fear" category.

If you're interested in the factors that comprise the Fear & Greed Index, here are the indicators directly from the CNN Business site.

We look at seven indicators:

•Stock Price Momentum: The S&P 500 (SPX) vs. its 125-day moving average

•Stock Price Strength: The number of stocks hitting 52-week highs and lows on the New York Stock Exchange

•Stock Price Breadth: The volume of shares trading in stocks on the rise versus those declining.

•Put and Call Options: The put/call ratio, which compares the trading volume of bullish call options relative to the trading volume of bearish put options

•Junk Bond Demand: The spread between yields on investment grade bonds and junk bonds

•Market Volatility: The VIX (VIX), which measures volatility

•Safe Haven Demand: The difference in returns for stocks versus Treasuries

For each indicator, we look at how far they've veered from their average relative to how far they normally veer. We look at each on a scale from 0 - 100. The higher the reading, the greedier investors are being, and 50 is neutral.

Then we put all the indicators together - equally weighted - for a final index reading."

No one knows where the US markets will go from there, not even The Shadow.

The only real negative beyond the possibility of a serious expansion of the Russian attack on Ukraine is that we should see inflation continue in the 7%-8% range for a couple more months. Yes, inflation is high. But a demand-based inflation needs only one thing - increased supply -- to bring it back down. Increased supply is coming - except to Russia.

I'm pleased that we have a large cash position in the Investors Edge® Growth & Value Portfolio. I'm also now doing some rebalancing to strengthen the sectors I view most highly, with quality companies sold way down as well as a couple of changes to make the portfolio easier to read.

The specific changes to our model portfolio followed my original article from this weekend. For my SA readers, might I suggest for your due diligence...

Two Great ETFs For This Market Environment

Every portfolio needs some ballast so that wild swings in the markets do not equal wild swings in your net worth. One of my friends is an avid balloonist. He carries enough ballast in the gondola of his balloon to enhance its stability and control. It's the same with my portfolio and our model portfolio.

But when the time is right (like, for instance, when the Fear & Greed Index is plunging into the deep red) you also want to think about nibbling on the long side. I like to select the quality companies that are down the most. Here are two simple ways to gain each.

The iShares Core High Dividend ETF ETF (HDV) will definitely not light the fire of anyone on Reddit. It is solid, it's strong, it's steady. Which, to some people, means borrrring. To me it means, to quote the famous stock market guru Aaron Rodgers, R-E-L-A-X. Over the ugly last week, it remained above water (barely, but still up a hair!) Over the past ugly year to date, it has fallen risen 4.25%. That's great ballast.

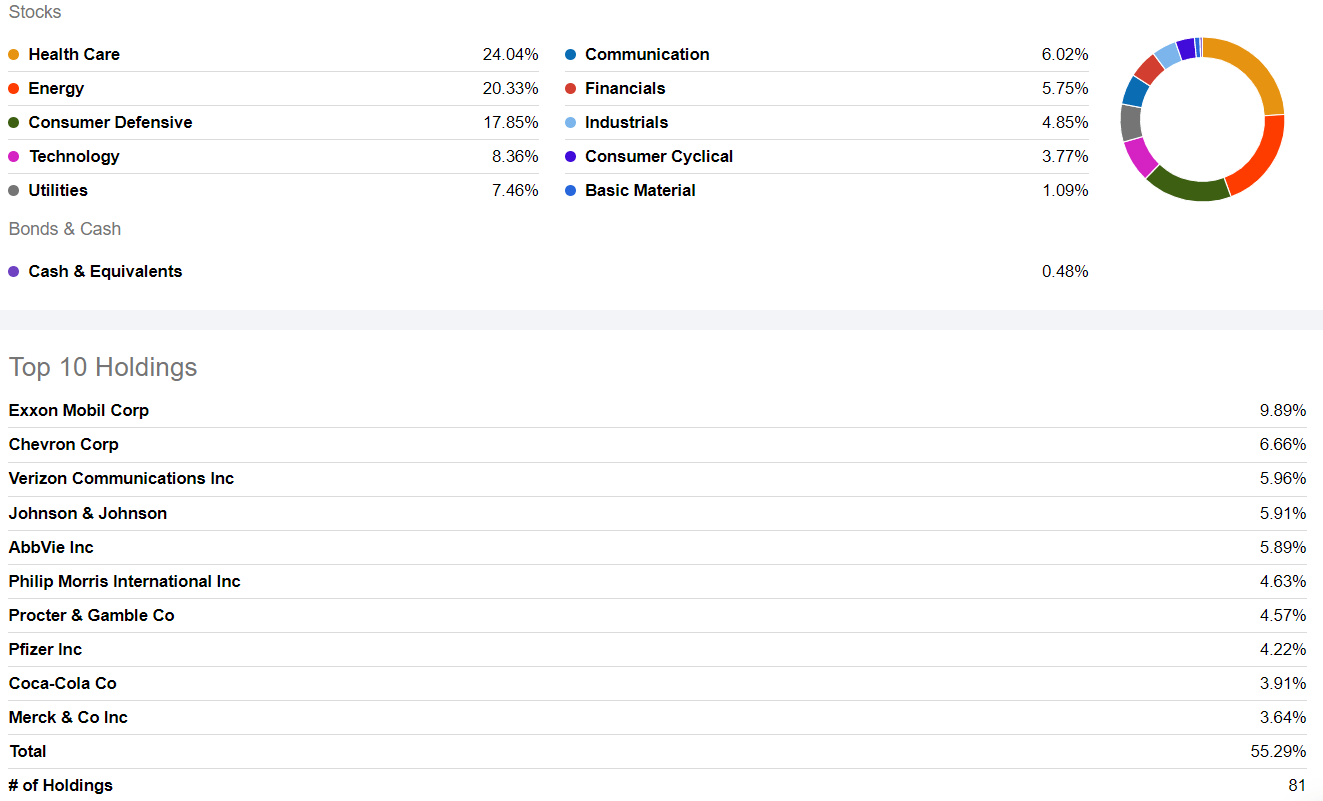

HDV's top holdings benefit from its diversification. It has positions in every sector but real estate. Healthcare, Consumer Staples (also called Consumer Defensive), and Utilities are considered defensive investments in times of market turmoil. HDV has ~ 50% of its assets in these three sectors. All of its holdings are large cap value companies regardless of sector:

(Click on image to enlarge)

Seeking Alpha

By diversifying across this many sectors, HDV ensures that "something" is always providing good ballast and good dividend income (currently 3.3%.) In addition, "some" things might do very well - like energy has been doing.

What do you give up by placing some HDV into your portfolio? The possibility of wildly increasing share price - but also the probability of decline due solely to market action rather than your choice of individual shares.

For instance, I'm personally very long basic materials. Market up or market down, I see a recovery around the world as COVID is brought under better control, which leads me to infrastructure buildout which leads me to the boring stuff infrastructure depends upon: Timber, iron, copper, nickel, lithium, etc. Because this sector can be sensitive to significant ups and downs, you won't find much in HDV. No problem. I use HDV and others like it for ballast, not my entire portfolio!

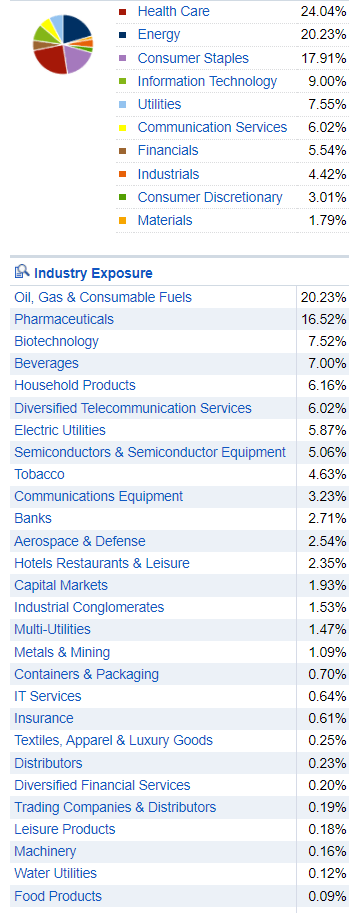

For those who like to get a bit more into the weeds, here's a more granular view of the industries within the above sectors that comprise 99% of HDV's portfolio:

Fidelity.com

Most investors know all about the Invesco QQQ ETF (QQQ) or believe they do. That's the risky high technology ETF, right?

No. It's true that QQQ is market-cap weighted to shares traded (but not exclusively traded) on the Nasdaq exchange. As a result, its top 10 holdings are all tech. Indeed, 51% of its holdings are in tech, partly because the "Naz" is the youngest of the major exchanges and came into being along about the time tech was in ascendancy. Some of the older exchanges moved like sloths to embrace this "new techie stuff" and the Nasdaq blossomed in this area.

However, the QQQ is not the same as the Nasdaq Composite Index. QQQ shows only the 100 largest companies by market cap on the exchange. This includes "the other" 49% of its holdings. Did you know that Costco (COST) is part of QQQ? How about American Electric Power (AEP)? Or steady old Kraft Heinz (KHC)? Dollar Tree? Fastenal? T-Mobile? Starbucks, Pepsi, Marriott, and many, many more.

You're not buying tech alone when you opt to buy QQQ. I use it as a way to buy a recovery. Tech has been devastated the most these first 11 weeks of 2022, but that is because tech also got ahead of itself with all the new SPAC offerings and IPOs from companies with little revenue (or none) and even less earnings (or none).

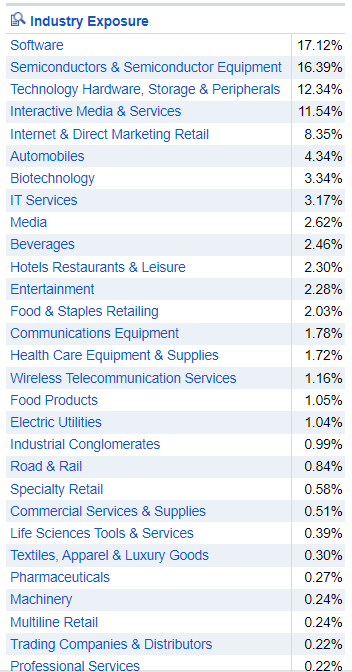

However, buying the largest of the large cap techs via QQQ makes sense to me. And I'm getting other large cap US companies with 49% of my QQQ investment as well. Heck, I'm even getting some large cap value in the mix, like KHC and AEP. Here are the industries you will own if you purchase QQQ:

Fidelity.com

I believe every investor needs to create a portfolio that they feel most comfortable holding. For me and my firm's clients, we are all on the same wave length. We own some holdings for ballast, some because we believe we are at the cusp of a major trend as yet unrecognized by most, and some to simply give us the pleasure of having purchased at an eminently fair price even if they may take a while to fully break out.

For us, HDV or others like it provides the ballast. And right now, QQQ at this point and this price give us the benefits of what we believe will be the resumption of the tech trend at what looks like a very fair price.

This article was sent to our Investor's Edge Marketplace community as part of an end-of-week wrap-up I provide to our subscribers. It's only fair to subscribers that I have truncated the article at the point of telling them which specific securities we were buying for our model portfolio. In its stead, I discuss two fine ETFs for my SA readers (which I also own!).

Disclosure: I/we have a beneficial long position in the shares of QQQ, HDV either through stock ownership, options, or other derivatives.

Disclaimer: I do not know your personal financial ...

more