The Importance Of Not Taking Beta At Face Value

Beta is a very commonly used measure of systematic risk, which tells us how sensitive a security/ portfolio is to changes in the overall market. A security with a beta of less than 1 (relative to the market benchmark) is considered less price- sensitive to market changes, whereas a security with a beta higher than 1 is considered more sensitive. Investors often also incorporate beta into investment strategies, where in a bull market they seek to increase exposure to high-beta securities to improve their chances of outperforming the market, and in a bear market they look to increase their exposure to low-beta stocks instead in order to minimize systematic risk. Beta values for various securities are easily found through market data providers. However, investors should beware of naively using the Beta value provided at face value when building investment strategies and measuring systematic risk-adjusted performance.

The traditional beta’s flaw

While there are several limitations posed by the use of beta as a measure of systematic risk, it is essential to address a particular flaw regarding its theoretical perception as representing symmetric upside and downside risk. For example, theoretically it is perceived that a security with a beta of 1.5 (relative to the S&P 500) will deliver a return of -1.5% when the S&P 500 return is -1%, and will offer a return of 1.5% when the benchmark rises by 1%. However, this may certainly not be the case in practical reality. A security may obtain a beta of 1.5 (based on historical performance) during a bull market due to a mix of factors, including support from specific secular growth trends, strong sales revenue and profit margin growth, robust fundamentals and appealing valuation multiples. Now if the S&P 500 is expected to fall by 10% over the next year, that does not necessarily mean that the particular security will decline by 15% over the same period of time simply based on its beta value of 1.5. Contrarily, its strong fundamentals and secular growth trends could allow the security to outperform the market by only declining by 5% (for example) over the next year, or potentially even deliver a positive return despite negative market performance. Hence in this case, amid expectations of a correction in the S&P 500, it would turn out to be a big mistake for investors to screen out this particular security based solely on a high beta, and could potentially end up missing out on a lucrative investment opportunity to outperform the underlying benchmark. Similarly, a security with a low beta may also mislead investors into believing that it will help minimize systematic risk during market downturns due to being less sensitive to market changes. In reality the security may have developed a low beta value during bullish market conditions due to weak fundamentals and unappealing sales revenue/ profit growth trends. As a result, even though the security may have a beta value of 0.5, it may still fall by 15% (for example) when the market has only declined by 10%. Take a real example, the Consumer Staples Select Sector SPDR ETF (XLP), which is considered a defensive security with a 2018 beta value of 0.56, delivered a return of -8.02% in 2018, a larger loss than the -6.20% return of the S&P 500 benchmark over the same period. Therefore, the traditional beta value can not be expected to represent both upside and downside risk for a security, as it can lead to underestimating/overestimating downside risk during bearish conditions, and underestimating/overestimating upside potential during bullish market conditions.

The importance of splitting beta into downside and upside risk

One common method of calculating the beta for a security, relative to its benchmark, is by first obtaining the covariance between the security’s daily returns and benchmark’s daily returns over a specific period of time, and then dividing this by the variance of the benchmark’s daily returns. This approach incorporates both positive and negative daily returns together to arrive at a single beta value.

However, having acknowledged the failure of beta to provide a symmetric representation of both upside and downside risk, we should calculate the betas for downside risk and upside risk separately. More specifically, if we want to explicitly calculate the sensitivity of a particular security to downturns in the overall market, we can filter for just the days when the S&P 500 delivered a negative daily return, and then calculate the covariance between the negative daily returns for the S&P 500 and the respective daily returns for a particular security, and then divide this by the variance of the negative daily returns for the S&P 500. The same process can be carried out for positive daily returns for the market benchmark to determine a security’s beta specifically for upside risk. This approach helps us obtain more accurate beta values to represent downside risk and upside risk individually. Furthermore, it helps overcome the issue of underestimating/overestimating a security’s potential return during various expected market conditions, as its sensitivity is not determined by one single beta value.

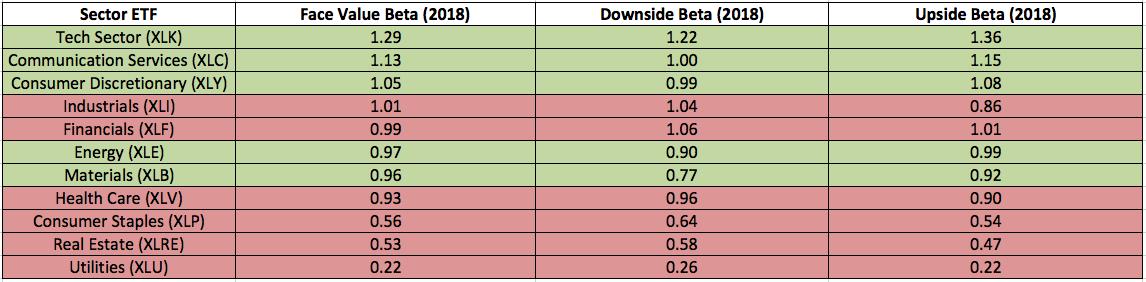

To further demonstrate the significance of separating systematic risk measurement in this way and the useful insights it uncovers, the betas for the 11 different sector ETFs (SPDR ETFs issued by State Street Global Advisors) have been calculated and analysed using this approach (relative to the S&P 500). The betas have been calculated based on their performances during 2018; the year volatility returned in financial markets, making it a more insightful time period to assess the systematic risks posed by the different sectors (ETFs), as it will help investors better manage their investment portfolios/systematic risks in the event that volatility is expected to return. The results can be found in the table below.

Data Sources: The beta values have been calculated using security/benchmark price data from Yahoo Finance

The results highlighted in green reflect those sector ETFs that have a higher upside beta than downside beta, while the results highlighted in red reflect the sector ETFs that have a larger downside beta than upside beta.

Splitting the betas into a downside beta and upside beta for each sector ETF has allowed for several interesting revelations. All five sectors that have a higher upside beta (than downside beta) happen to be of cyclical nature. Let’s take the Technology sector ETF (XLK), which holds the highest beta out of all sectors, and holds a face value (traditional) beta of 1.29. However, this masks the fact that it holds a higher upside beta than downside beta. This means that the ‘1.29’ beta value underestimates its upside potential during bullish market moves, as it actually holds an upside beta of 1.36. Moreover, the ‘1.29’ beta value also overestimates the downside risk it poses during downward market trends, as it holds downside beta of 1.22. While this value is not significantly lower than the face value beta, it certainly makes a difference when assessing the downside risk potential of the tech sector ETF, and when investors are making portfolio allocation decisions while striving to achieve a particular beta level amid changing expectations for market performance.

The Communication Services ETF (XLC) and Consumer Discretionary ETF (XLY) also offer more upside reward (during bull markets) than downside risk (during bear markets). The Communication Services sector in particular is a newly created sector in 2018, which combines the telecommunications industry with some former tech and consumer discretionary stocks. In fact, it is worth noting that it contains three high-growth FAANG stocks, Facebook (FB), Netflix (NFLX) and Google (GOOG) (GOOGL). Hence, it combines the defensive telecom industry with some riskier stocks, which has resulted in the sector ETF offering higher upside reward during bullish market moves, with an upside beta of 1.15, while the downside beta stands at 1, which means it performs in line with the market during downside market moves. Therefore from this perspective, the Communication Services sector ETF holds an attractive risk-reward attribute. The ETF’s traditional beta of 1.13 masked this attractive feature of the investment vehicle, which could mislead investors into believing that the sector ETF (XLC) holds higher downside systematic risk than it actually does, and may wrongly encourage investors to avoid exposure to the security when seeking to minimize systematic risk, which consequently could result in missing out on potentially higher gains.

The betas for the Industrials sector ETF (XLI) also revealed some interesting risk-reward aspects. During 2018, it held a face value beta of 1.01, which may appear as an attractive security to hold from the perspective of posing limited downside systematic risk while offering healthy upside potential in line with market performance. However, splitting the beta into downside and upside betas actually reveals that its performance during upward market moves notably lags the broader market compared to other cyclical sectors, with an upside beta of just 0.86. Moreover, in comparison to the upside beta, it has a rather high downside beta at 1.06. Therefore, if investors were to expect volatility to return to the equity markets the way we had seen in 2018, then the Industrials sector ETF is a rather unattractive security to hold exposure to in an investment portfolio, as it offers a lot more downside risk than upside potential.

Furthermore, all three defensive sectors, Consumer Staples (XLP), Utilities (XLU) and Health Care (XLV) pose more downside risk than upside potential, with their downside betas higher than their upside betas. This is rather disappointing for investors that look to play more defensively when increased market volatility is expected. Ideally we would want these defensive sector ETFs to offer more protection through a lower downside beta instead. Nevertheless, if investors expect volatility to return to equity markets similar to levels seen in 2018, then they should certainly take into consideration the unattractive downside beta/upside beta characteristic of these defensive sectors. Conversely, riskier securities such as the Communication Services sector ETF (XLC) and Consumer Discretionary sector ETF (XLY) offer higher attractive upside rewards, while offering relatively limited downside risks, with downside betas at 1 and 0.99 respectively. In fact, the latter downside beta of 0.99 certainly does not appear systematically risky in comparison to the Health Care sector ETF’s (XLV’s) downside beta of 0.96. Hence from the perspective of systematic risk, the XLY ETF may be more attractive to hold exposure to than the XLV ETF, even amid expectations of increasing volatility ahead, as the Consumer Discretionary sector allows investors to enjoy more attractive upside with similar downside risks to the Health Care sector.

Evidently, calculating separate betas for upside and downside risk helps uncover more valuable characteristics of various securities, allowing for more enhanced risk management and portfolio allocation strategies.

Bottom Line

The use of beta for measuring systematic risk is quite common, though investors should not ingenuously use the single beta values provided by market data providers as symmetric representations of both upside and downside risk. Instead, it is more advisable to always separately calculate the beta values for upside and downside risk, as this provides better reflections for how securities perform during both bullish and bearish market conditions, and helps avoid underestimating/overestimating both upside and downside risks.

While cyclical sectors are expected to pose more downside risks (than defensive sectors) during market downturns, this approach of separating downside and upside beta actually helps reveal the underlying reality of the true systematic risk profiles of cyclical/ defensive securities. For instance, we found that the Consumer Discretionary sector ETF (XLY) and Health Care sector ETF (XLV) had around the same 2018 downside betas, 0.99 and 0.96, respectively. Hence from this perspective, the defensive Health Care sector wouldn’t provide any significant downside protection in comparison to the more cyclical Consumer Discretionary sector in the event that 2018-type volatility were to return to equity markets.

Though keep in mind that this research solely assesses the different sector ETFs from the perspective of beta/systematic risk analysis, and that other metrics such as sector valuations, sales/earnings growth rates and other fundamentals should be taken into consideration when making portfolio allocation decisions. Investors should also acknowledge that past performance is not always a reliable indicator of future performance, and thus the 2018 beta values calculated should simply be used as a reference as to how sector ETFs tend to perform during volatile years.

Nevertheless, the findings from this research emphasize the importance of splitting beta values into separate upside and downside beta values to conduct more accurate market sensitivity analysis, and thereby make better portfolio allocation decisions.

Disclosure: None.

Interesting, thanks.