The Halo Effect Drives Demand For Sustainable And Impact Investments

The halo effect in investing is a cognitive bias that leads investors to make decisions based on their overall impression of a product/company/investment, rather than on a careful analysis of its fundamentals.

While sustainable and impact investments allow investors to express their attitude to social investment criteria, research (for example, about socially responsible mutual funds and sustainability) has found that the demand for sustainable and impact investments is driven by both financial and nonfinancial motives. What does economic theory have to say about these different motives: Are they aligned or in conflict?

Economic theory suggests that if a large enough proportion of investors choose to favor companies with high sustainability ratings and avoid those with low sustainability ratings (sin businesses), the favored company’s share prices will be elevated and the sin stock shares will be depressed. In equilibrium, the screening out of certain assets based on investors’ taste should lead to a return premium on the screened assets.

In our book, “Your Essential Guide to Sustainable Investing,” Sam Adams and I presented the evidence from about 60 studies that were entirely consistent with economic theory—sustainable investors should expect lower returns, though their investments also entail less risk because companies with high sustainability scores have better risk management and compliance standards. Their more robust controls lead to fewer extreme events such as environmental disasters, fraud, corruption, and litigation (and their negative consequences). The result is a reduction in tail risk in high-scoring firms relative to the lowest-scoring firms. The greater tail risk creates the “sin” premium.

Recent Research

Christina Bannier, Yannik Bofinger, and Björn Rock, authors of the study “The Risk-Return Tradeoff: Are Sustainable Investors Compensated Adequately?,” published in the May 2023 issue of the Journal of Asset Management, found that the preference for sustainable investment has been so strong that higher returns to less sustainable firms are sufficient to “overcompensate” investors for the risk they bear—the lowest-scoring firms produced the highest risk-adjusted returns. Thus, from a purely economic perspective, the optimal return-to-risk ratio is achieved for a portfolio that invests in the lowest CSR-rated firms.

Summarizing, sustainable and impact investors should expect lower returns from their investments. However, it’s possible that some investors have a difficult time aligning their social and investment preferences. The result could be that the “halo effect” could lead sustainable and impact investors to believe that these investments have superior returns. And that could lead to a loss of value creation.

Preferences Affect Return Expectations

Kremena Bachmann, Julia Meyer, and Annette Krauss, authors of the 2023 study “Investment Motives and Performance Expectations of Impact Investors,” used a unique sample of 721 retail impact investors in a Swiss microfinance development (a form of impact investing) fund in or to test how investors deal with the challenge of aligning their financial and their nonfinancial goals. Impact investments explicitly pursue both financial and social goals. Their main dependent variables were the expected return and expected risk of sustainable investments, stocks, and bonds.

Following is a summary of their key findings:

- Motivated-reasoning and wishful-thinking affect the judgement behavior of impact investors—they are prone to arrive at conclusions and to form beliefs that they find desirable or comforting. The result is that investors form financial expectations that fit with the investment decisions that are motivated by their nonfinancial preferences.

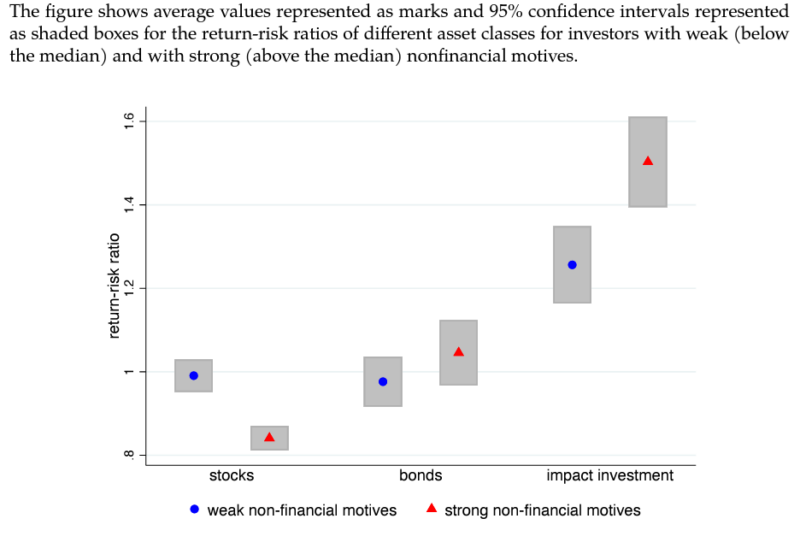

- Investors with stronger nonfinancial motives perceive stocks and bonds as riskier than impact investments—the average risk-adjusted return assessment for stocks was 0.99 and 0.92 bonds versus 1.4 for impact investments. The perceived attractiveness of impact investments was mainly driven by a perception of lower investment risks.

- Investors with stronger nonfinancial motives are more likely to be optimistic regarding the financial potential of impact investments—financial expectations motivated by nonfinancial preferences sustain feedback in the form of experience of losses (explaining research findings that investors tend to postpone selling sustainable investments after experiencing losses).

- There was no significant relationship between the strength of nonfinancial motives and the perceived risk-adjusted return assessment for bonds.

- Investors with broader investment experience are less likely to be optimistic with respect to the risk-adjusted return potential of impact investments.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Their findings led the authors to conclude:

“The halo effect dominates the liability characteristic of the impact investment. In particular, we find that impact investors with stronger nonfinancial motives are more likely to perceive the impact investment as an attractive investment opportunity. We also observe that investors with stronger nonfinancial motives view investments that they are less likely to make, such as investments in traditional equities, as less attractive from a financial point of view.”

Investor Takeaways

Empirical research findings align with economic theory in that the higher risk associated with less sustainable firms leads to higher returns to less sustainable firms. The research has also found that the preference for sustainable investments has led to investors in less sustainable firms being “overcompensated” for the risks they bear—the lowest-scoring firms have produced the highest risk-adjusted returns. Thus, from a purely economic perspective, the optimal return-to-risk ratio is achieved for a portfolio that invests in the lowest rated firms. With that said, some investors do not make portfolio decisions purely based on seeking to achieve the highest possible outperformance. Instead, they invest to contribute to a sustainable transformation of firms and economies. The takeaway for those investors is that when investing in accordance with their sustainability preferences they should recognize that they are accepting not only lower expected returns, but lower risk-adjusted expected returns.

Both investment motives and investment experience are important determinants for investors’ ability to assess (impact) investment opportunities. While investor preference can justify accepting a lower return as the cost of expressing their values, the halo effect should not play a role in making that assessment—both economic theory and empirical evidence should lead investors to expect lower returns on sustainable investments.

More By This Author:

Momentum Everywhere, Even Cross-Country Factor Momentum

Valuing Artificial Intelligence Stocks

Tracking Error Is A Feature, Not A Bug

Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past performance is not ...

more