The Everything Rally In 2025 Rolls On

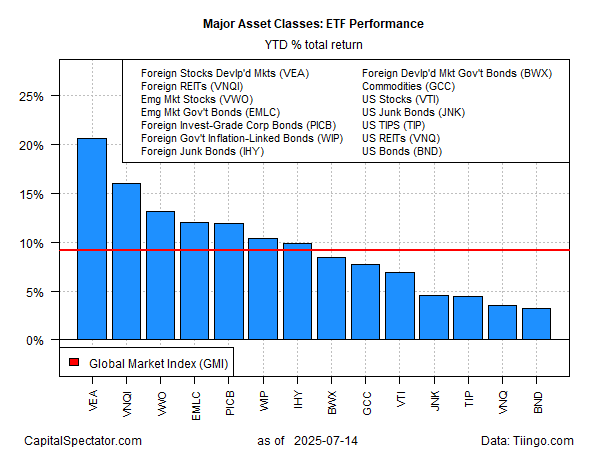

Judging by the headlines, there’s a lot to worry about. But if markets are anxious it’s not obvious in the year-to-date results for the major asset classes, which are posting across-the-board gains in 2025 via a set of ETFs through Monday’s close (Jan. 14).

Leading the bull run: stocks in developed markets ex-US (VEA). This slice of global equities tops the field with a 20.1% total return so far this year. That’s well ahead of the second-best performer: global real estate ex-US (VNQI), which is up 16.1% year to date.

US assets are relative laggards: American shares (VTI) are ahead by 6.9%. US junk bonds (JNK), real estate investment trusts (VNQ), and investment-grade US bonds (BND) are posting even softer gains.

Although returns vary widely for 2025, it’s striking that there are no losers. Optimism, in short, is widespread.

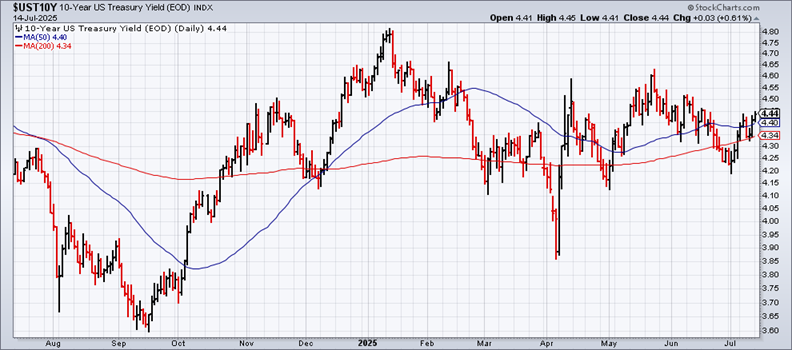

One reason is that interest rates remain steady. Despite worries about tariff-related inflation, the benchmark 10-year Treasury yield continues to trade in a range. This yield settled at 4.44% yesterday, a middling level for the year so far.

(Click on image to enlarge)

A break above the recent high – roughly 4.60% for the 10-year — could change the calculus and persuade the crowd to rethink its relatively upbeat assumptions about the near term.

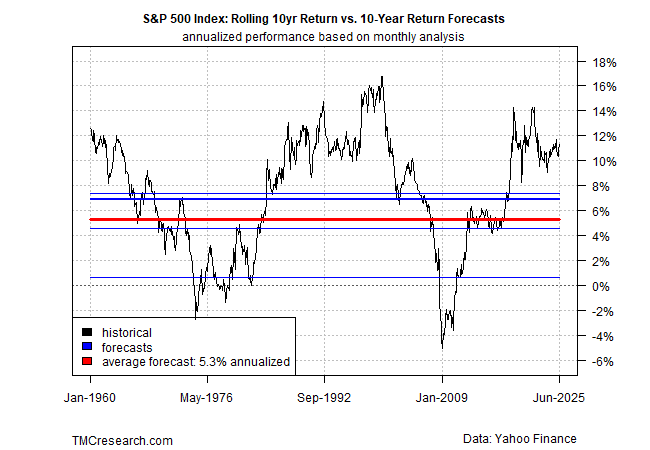

Meanwhile, a recent survey of 7,000 investors by Natixis Investment Management finds that expectations for long-term returns are sky high. As Morningstar reports: US investors responding to the survey said they expect stocks to generate long-term returns of 12.6% per year above inflation.

That looks far too rosy to this observer. As I wrote a few weeks ago, a model I run for TMC Research, a unit of The Milwaukee Company, estimates US equity performance will be in the low-5% range for the decade ahead, or roughly half of the 10%-12% range for annualized ten-year performance for US stocks since 2024, based on the on the average of five models.

It seems that investors in the Natixis survey are using recent history as a guide to manage expectations. That’s usually a mistake. But perhaps this time is different. Maybe, but put me down as skeptical.

More By This Author:

Will Tariffs Derail The Bull Run In Global Equities Ex-US?

Macro Briefing - Friday, July 11

Macro Briefing - Thursday, July 10

Disclosure: None.