The ETF Portfolio Strategist - Sunday, May 9

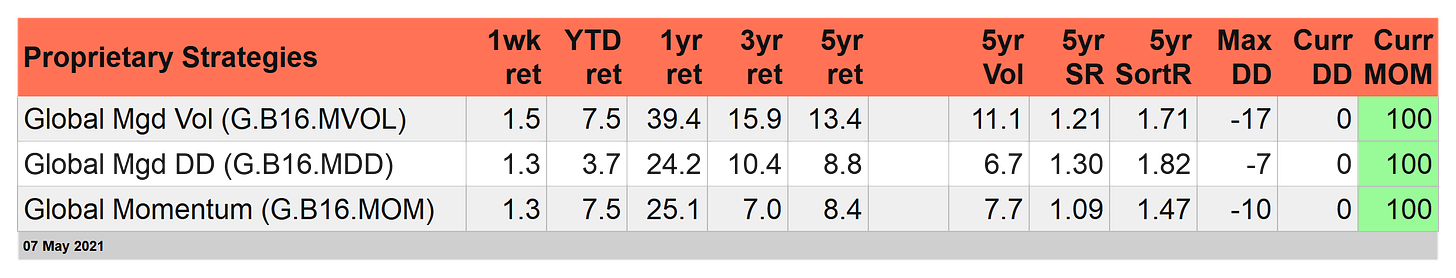

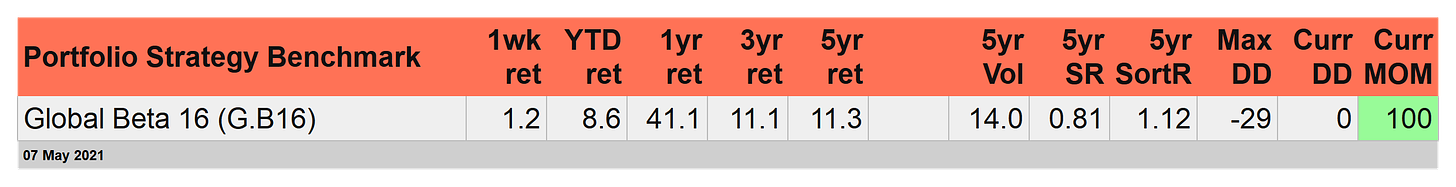

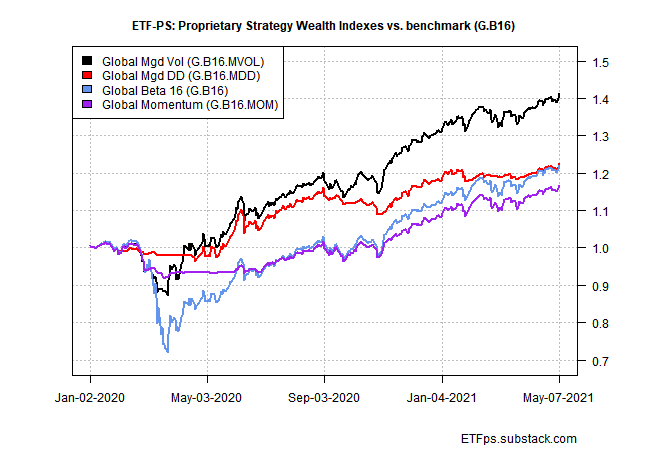

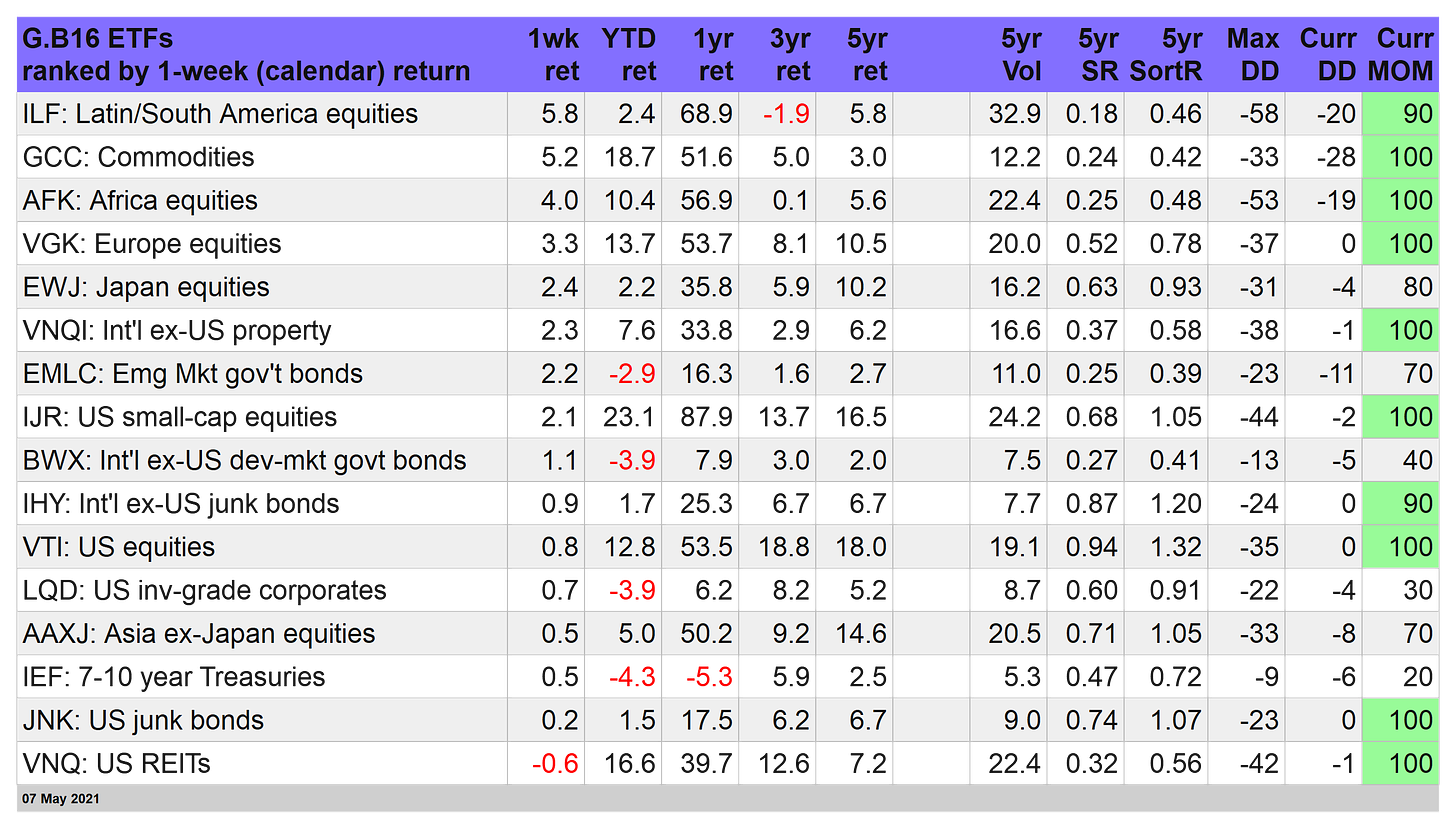

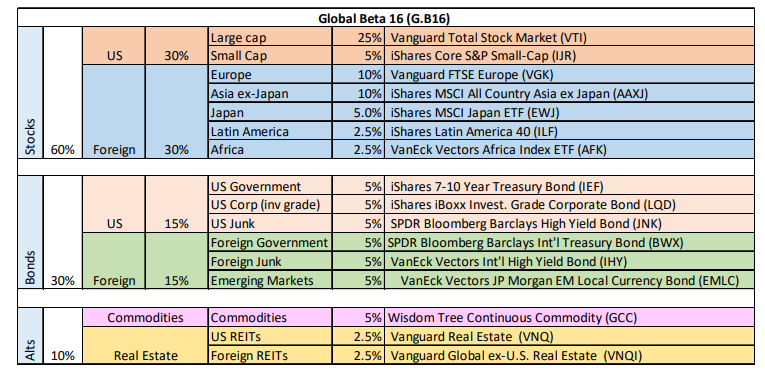

Markets were fired up last week and so were our three proprietary strategies. The top performer: Global Managed Volatility (G.B16.MVOL), which jumped 1.5%. That was enough to beat the benchmark, Global Beta 16 (G.B16), which rose 1.2% for the trading week through Friday, May 7.

Our other two active strategies also topped the G.B16 benchmark, which passively holds 16 funds (rebalanced annually) that represent the opportunity set for all three prop portfolios. Year-to-date, however, G.B16 is still comfortably in the lead, posting an 8.6% return — well ahead of the trio of strategies intent on adding alpha to the benchmark’s beta. On a risk-adjusted basis, however, each of the proprietary strategies continue to deliver superior results over G.B16.

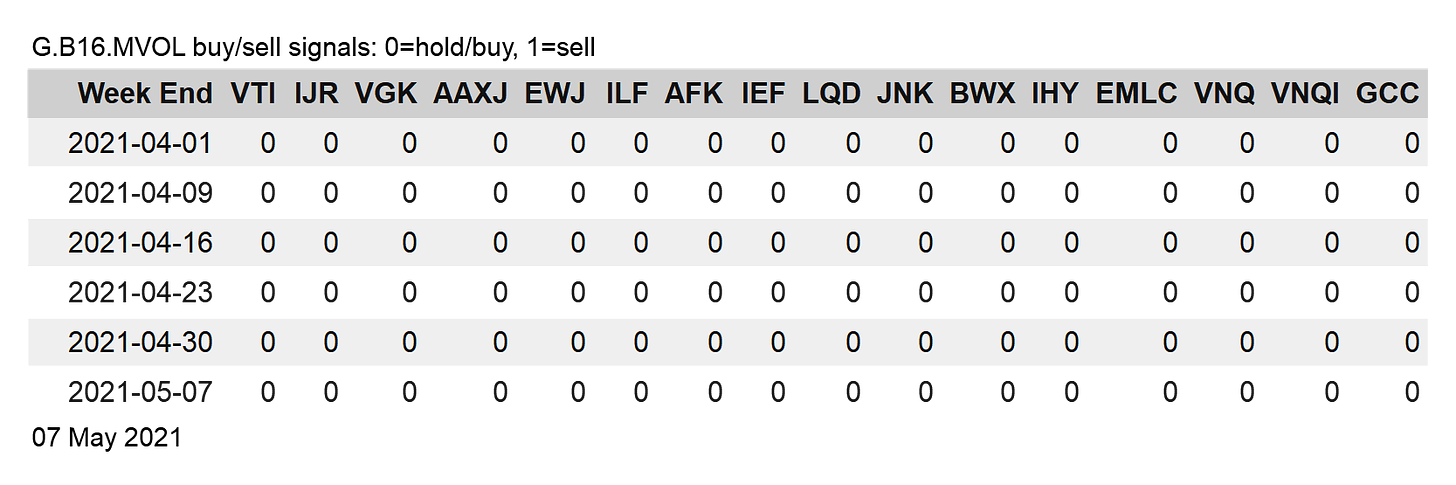

There was no rebalancing activity last week for G.B16.MVOL, which remains risk-on for all 16 funds in the opportunity set.

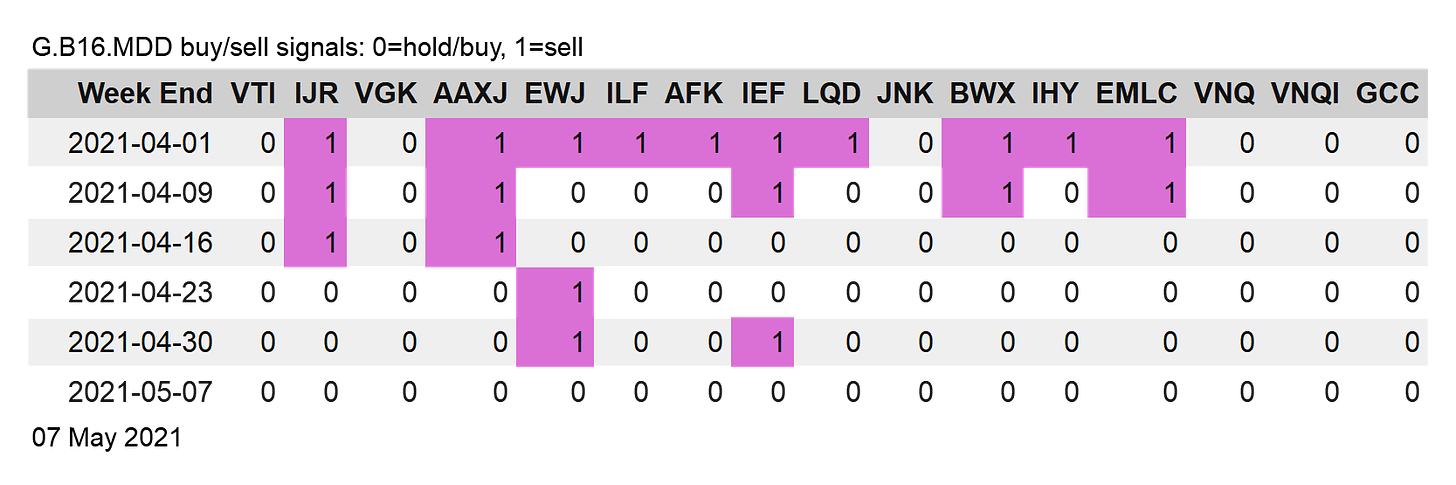

Meanwhile, G.B16.MDD joined the bulls by going all-in on risk-on after shifting to a buy position at last week’s close for the two previous risk-off positions: stocks in Japan (EWJ) and Treasuries (IEF).

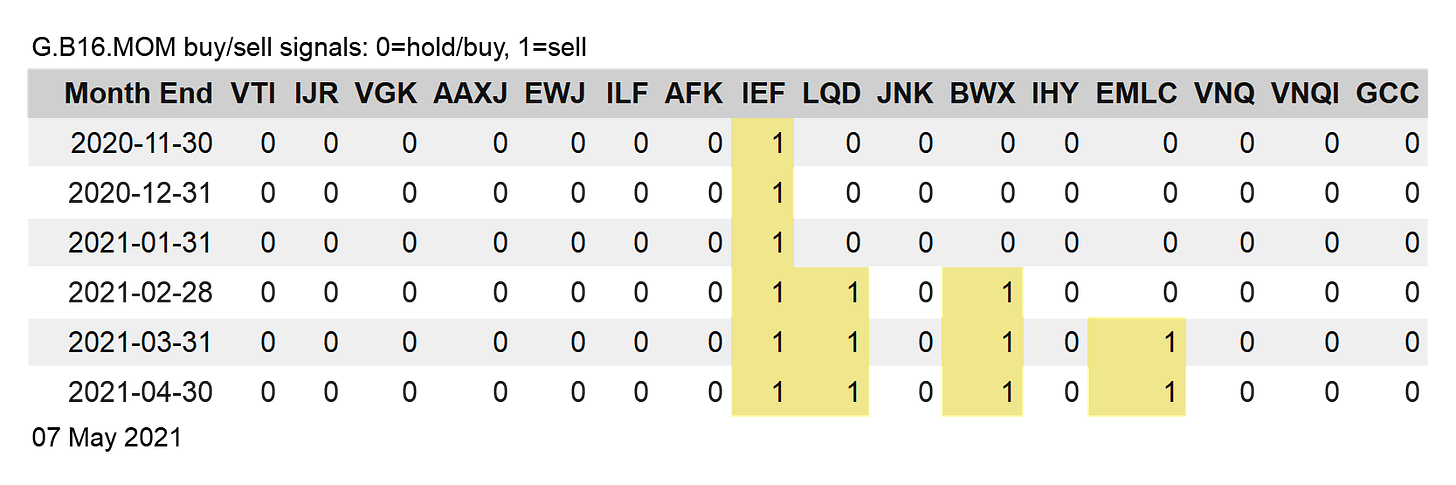

G.B16.MOM’s rebalancing frequency is month-end and so it continues to hold the end-of-April positions, which is risk-on for 12 of the 16 funds in the opportunity set.